- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Form 8606 (Line 2) Amendment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

Background:

- Step #1- In my 2021 return, TurboTax did not correctly keep track of my historical “non-deductible” Traditional IRA contributions. As such, Line 2 of Form 8606 showed the wrong historical basis. To keep this example simple, let’s assume Line 2 of Form 8606 in 2021 was supposed to show $6,000, but instead it showed $0. Also, for added context, my 2021 tax return was not impacted (in terms of refund / payment for this error), but it set the wrong precedent basis for my recently filed 2022 tax return.

- Step #2 - In my 2022 return, I did manually correct / calculate for the historical “non-deductible” Traditional IRA contributions in Line 2 of Form 8606 and filed the 2022 return based on the correct basis. The refund / payment on my 2022 return was dependent on Line 2 of Form 8606, so I made sure to use the correct amount in there. TurboTax added a statement at the end of my 2022 return in which I explained that my 2021 return missed $6,000 of Traditional IRA basis. However, I was not able to attach the amended Form 8606 for 2021 given that I e-filed my 2022 return.

Questions:

- Question #1 – Based on what I described on Steps #1 and #2, do I need to file an amended Form 8606 for year 2021 to show the correct amount in Line 2 (i.e., $6,000 vs. $0)? This would not have any impact on my 2021 Tax Return, but as I mentioned, it set the wrong basis for my recently filed 2022 tax return (for which I manually adjusted for the correct basis + statement attached, as described above).

- Question #2 – In case the answer to Question #1 above is “yes” - I am assuming I would only need to send my amended 2021 Form 8606 alone without a 1040X, correct?

- Question #3 – In case the answer to Question #1 above is “yes” - How do I find the exact IRS address to which I should mail the amendment?

- Question #4 – In case the answer to Question #1 above is “yes” – Do I attach a statement to my amended 2021 Form 8606 explaining why I am mailing it in?

- Question #5 – In case the answer to Question #1 above is “yes” – Is there a deadline by which I should mail-in the amended 2021 Form 8606?

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

Q1 and Q2 Yes, you will need to file the 2021 Form 8606. You can file it by itself. Technically you can be fined $50 for failing to file the form on time, but the penalty can be waived if you have reasonable cause. Please see Relief for Reasonable Cause for additional information.

Q3 "If you aren’t required to file an income tax return but are required to file Form 8606, sign Form 8606 and send it to the IRS at the same time and place you would otherwise file Form 1040, 1040-SR, or 1040-NR. Be sure to include your address on page 1 of the form and your signature and the date on page 2 of the form." (Form 8606 Instructions)

Please see IRS Where to File Addresses for Taxpayers and Tax Professionals Filing Form 1040 or Form 1040-SR.

Q4 Yes, you should add an explanation for the missed Form 8606 and a request to waive the penalty.

Q5 No, but I would file it as soon as possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

Q1 and Q2 Yes, you will need to file the 2021 Form 8606. You can file it by itself. Technically you can be fined $50 for failing to file the form on time, but the penalty can be waived if you have reasonable cause. Please see Relief for Reasonable Cause for additional information.

Q3 "If you aren’t required to file an income tax return but are required to file Form 8606, sign Form 8606 and send it to the IRS at the same time and place you would otherwise file Form 1040, 1040-SR, or 1040-NR. Be sure to include your address on page 1 of the form and your signature and the date on page 2 of the form." (Form 8606 Instructions)

Please see IRS Where to File Addresses for Taxpayers and Tax Professionals Filing Form 1040 or Form 1040-SR.

Q4 Yes, you should add an explanation for the missed Form 8606 and a request to waive the penalty.

Q5 No, but I would file it as soon as possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

Thank you very much @DanaB27, SUPER HELPFUL, as always! Just to clarify though, I did not “miss” filing the form on time. I just made an error to Line 2 of the Form 8606 when I filed it last year “on time”.

1- Does that change any of your answers?

2- Does the penalty / request to wave the penalty also apply in a case like mine where I just need to “update” an inaccurate amount?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

Yes, you will have to file the corrected 2021 Form 8606 with an explanation. Ignore the penalty and waiver part.

To confirm, the basis on line 2 on the 2021 Form 8606 (which should have been carried over from line 14 of your 2020 Form 8606/ last filed Form 8606) was still in the traditional IRA account by the end of 2021, correct?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

Thank you! And yes, to answer your question - The basis was still in the Traditional IRA account by the end of 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

@Polaris23

The proper way to file Form 8606 is attached to Form 1040-X.

Form 8606 can be mailed by itself only when you are otherwise not required to file a tax return. See Instructions for Form 8606 which state exactly that.

--

Do you have the correct taxable amount on Line 4b, and did not take a deduction?

After you e-File (you already filed)

get 2021 Form 1040-X from IRS website and mail it in with your 2021 Form 8606, which you can also get in fillable PDF.

Note: since you are not changing any dollar amounts on your amended tax return, you can leave all the lines 1-23 EMPTY.

--

Part III explanation: "didn't include Form 8606 with filed return".

In your case, "my filed Form 8606 was incorrect".

You will have to mail it so this does not use up your one 1040-X e-File. (- not relevant for 2021.)

Done this way, you sign 1040-X, not 8606

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

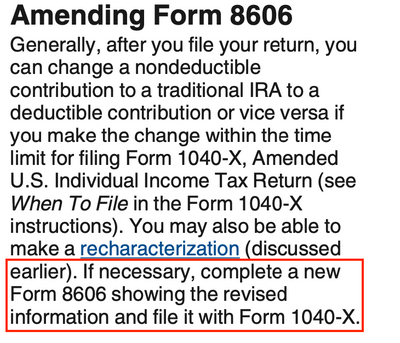

Thanks for your response @fanfare. As you suggested, I did check the instructions for Form 8606 and while not super clear, it seems filing Form 1040X along with the amended Form 8606 may be the way to go (refer to attached screenshot below). It just feels weird having to file Form 1040X when the amendment to Form 8606 has no impact to my previously filed 2021 Form 1040. Said in other words and to answer your question, I did have the correct amount on line 4b of my 2021 Form 1040. As such, do you still think I need to file Form 1040X?

@DanaB27 - Given The above contradicts what we previously discussed, do you think we are missing anything here?

Thank you both!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 (Line 2) Amendment?

as the instructions for Form 1040-X will tell you Form 1040-X is submitted for many reasons. not just one.

when you are not changing any dollar amounts, leave 1040-X lines 1-23 BLANK.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jaj2260

New Member

Mr-TSchimschal

New Member

legalto

New Member

74borabora

New Member

jccheng9

New Member