- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

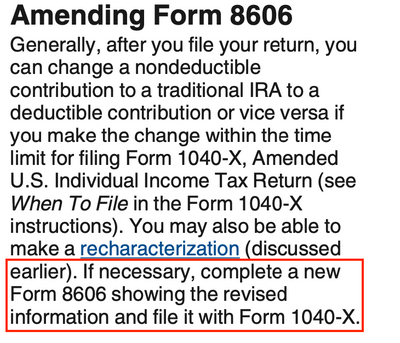

Thanks for your response @fanfare. As you suggested, I did check the instructions for Form 8606 and while not super clear, it seems filing Form 1040X along with the amended Form 8606 may be the way to go (refer to attached screenshot below). It just feels weird having to file Form 1040X when the amendment to Form 8606 has no impact to my previously filed 2021 Form 1040. Said in other words and to answer your question, I did have the correct amount on line 4b of my 2021 Form 1040. As such, do you still think I need to file Form 1040X?

@DanaB27 - Given The above contradicts what we previously discussed, do you think we are missing anything here?

Thank you both!

April 28, 2023

11:43 AM