- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Foreign Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

I have accumulated Foreign Tax Credit (Form 1116) for last many years. I want to use it as a deduction.

Is there a way to deduct the accumulated Foreign Tax Credit in Turbo Tax

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

no. you can't do that because you elected to take a credit in prior years. in any one year all of it must be taken as a credit or as a deduction - no splitting. after 10years the c/f expires. This happens to many taxpayers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

Hi Mike9241,

You say that I can't take the accumulated foreign tax credit as I elected to take a credit in prior years. If that is the case; what is the purpose of "Foreign Tax Carryover Reconciliation Schedule" also known as Schedule B (Form 1116)?

Is there anywhere else on IRS forms I can take this credit to lower my tax bill?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

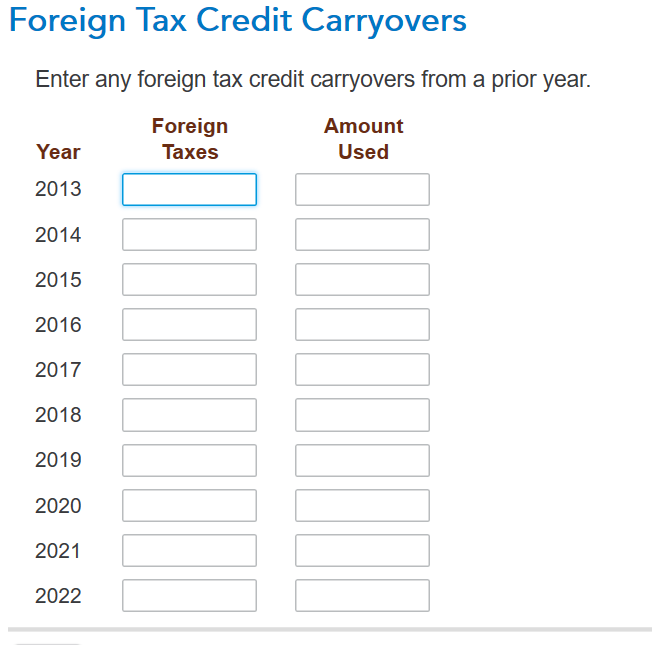

You may be able to carryover your unused foreign tax credits from previous years to the current year. You will see an option for this in the Estimates and Other Tax Paid section, then Foreign Taxes, which are in the Deductions and Credits section of TurboTax. When you work through that section, indicate that you want the foreign tax credit as opposed to the foreign tax deduction. After you enter your foreign income received in the current year and answer other questions, you will come to a screen where you can enter your foreign tax credit carryovers. You can only receive a foreign tax credit to the extent you have income tax on foreign income in the current year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Andy R

New Member

lionessdiva2002

New Member

in Education

murphybrian636

New Member

pblancatojd

New Member

elliottvail04

New Member

in Education