- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

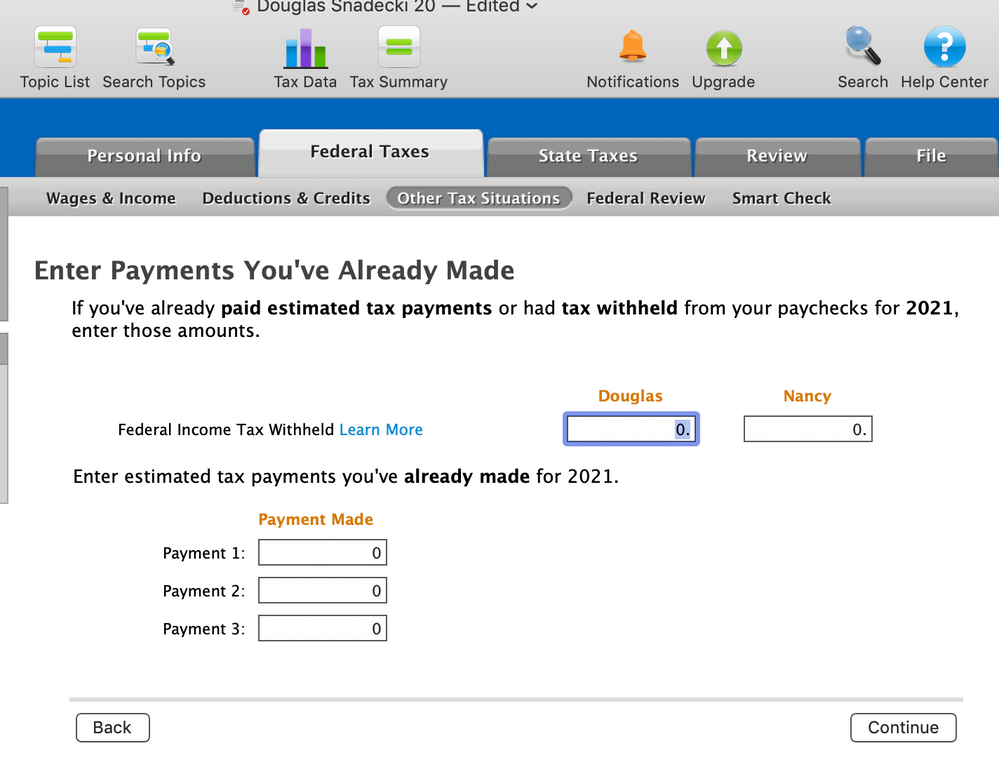

Hi, I am trying to estimate my W-4 withholding for 2021 in the TT 2020 Mac version. It is working fine until I hit this screen, and although it asks for the Federal Income Taxes Withheld, there is a 0 there, but when I try to enter the number, it doesn't allow any data entry in this field for either me or my wife. Is this a bug in this desktop version? Thanks for your help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

@macuser_22 Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

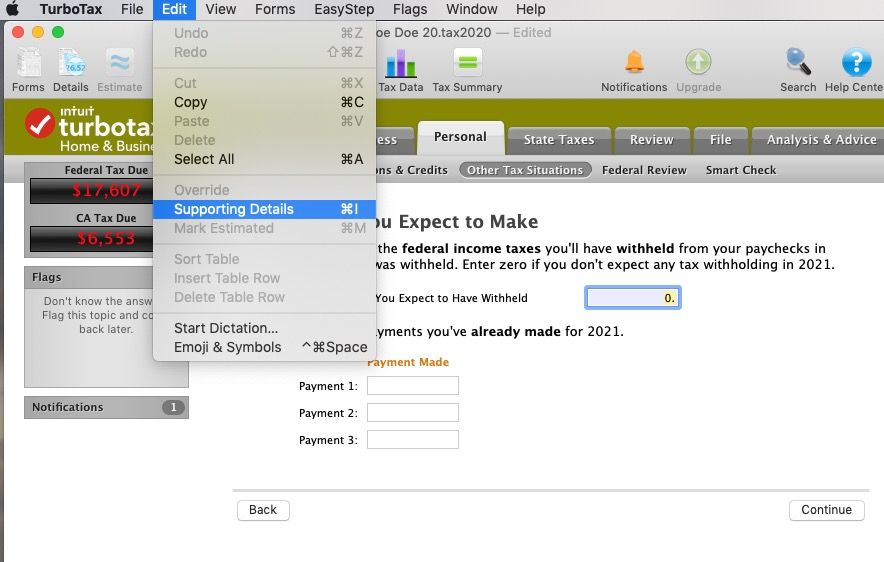

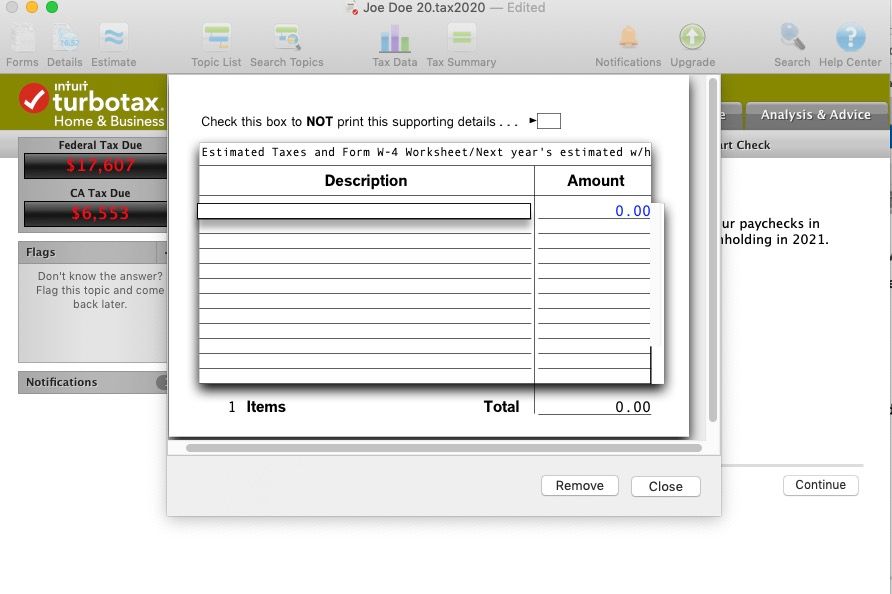

That means that you either added supporting details to that filed by double clicking on it or using Top menu bar -> File -> Supporting details. Double click on it to open the details window and then remove it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

Hi thanks for your reply and help. I have already filed these taxes for 2020, now I am going back into the software to figure out how much more to withhold from my income to not have a big bill next April. I clicked File, on the top menu, but there isn't a supporting details on the options. Can you please walk me through what you are recommending, I really appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

Never be afraid to click on all the buttons in the program to find all the bells and whistles ... you won't break anything.

This is my mini version of a tutorial that should be in the downloaded program:

What is Forms Mode?

Forms Mode lets you view and make changes to your tax forms "behind the scenes."

If you're adventurous, you can even prepare your return in Forms Mode, but we don't recommend it. You may miss obscure credits and deductions you qualify for, and you may forget to report things that will come back and haunt you later.

Forms Mode is exclusively available in the TurboTax CD/Download software. It is not available in TurboTax Online.

Related Information:

- Why would I use Forms Mode?

- How do I switch to Forms Mode in the TurboTax for Windows software?

- How do I switch to Forms Mode in the TurboTax for Mac software?

If you want to play around with different figures and tax scenarios without affecting your original return you can ….

- >>>In the TurboTax CD/Download software by creating a test copy:

- 1. Open your return in TurboTax.

- 2. From the File menu, choose Save As.

- 3. Give the copy a new name to distinguish it from the original (for example, by adding "Test" or "Example" to the file name).

- 4. Click Save. You are now safely working in the test copy and anything you do here will not affect the original.

- https://ttlc.intuit.com/questions/1900642-how-to-make-a-test-copy-of-your-return

- >> use the WHAT IF tool:

- - Click Forms Icon (upper right of screen) or Ctrl 2 (forms view)

- - Click on the Open Form Icon

- - In the “Type a form name.” area type What-If (with the dash), click on the name of the worksheet - click on Open Form

- - You will see the worksheet on the right side of the screen; enter the information right into the form

- - To get back to interview mode - click on the Step-by-Step Icon (upper right of screen) or Ctrl 1

It's always a good idea to make a backup copy of your tax data file, in case your original gets lost or corrupted. Here's how:

- From the File menu in the upper-left corner of TurboTax, choose Save As (Windows) or Save (Mac).

- Browse to where you want to save your backup.

- Tip: If you're saving to a portable device, save it to your computer first to prevent data corruption. Then, after completing Step 4, copy or move the backup file to your device.

- In the File name field, enter a name that will distinguish it from the original tax file (for example, add "Backup" or "Copy" to the file name)

- Click Save and then close TurboTax.

- Restart TurboTax and open the backup copy to make sure it's not corrupted. If you get an error, delete the backup and repeat these steps.

If you make changes to your original tax return file, repeat these steps to ensure your original and backup copies are in-synch.

Related Information:

- Retrieve a Tax File from a Portable Device

- What's the difference between the tax data file and the PDF file?

AND save it as a PDF so you have access to a copy even if you don’t have the program still installed and operational :

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

AND protect the files :

Always remember to shut off the auto update function once you have filed your returns and do not do any updates unless you have safeguarded the PDF & .taxfiles to a removable storage unit for safekeeping. Click on ONLINE then Update Preferences.... don't be afraid to click on all the menu headings to find all the goodies that are hiding.

What's the meaning of all the different colors in Forms Mode?

When you look at an onscreen tax form using Forms Mode, you might wonder why one figure is blue and the one next to it is red or black.

These colors indicate the source of that data.

Color | Meaning |

Blue | You entered this data, either in the interview or Forms Mode. |

Black | The program entered this data or calculated this amount. |

Red | This data has either been overridden or is invalid (for example, a ZIP code that doesn't exist). |

Red italics | You marked this amount as estimated. |

Black italics | The program calculated this amount from an amount you marked as estimated. |

Purple | This information has supporting details. |

Aquamarine | This data was transferred over from last year. |

Green | This data was imported from Quicken or QuickBooks. |

Yellow fields (Windows) | Yellow fields allow user input. Anything you enter here shows up in blue. |

https://ttlc.intuit.com/replies/3302127

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

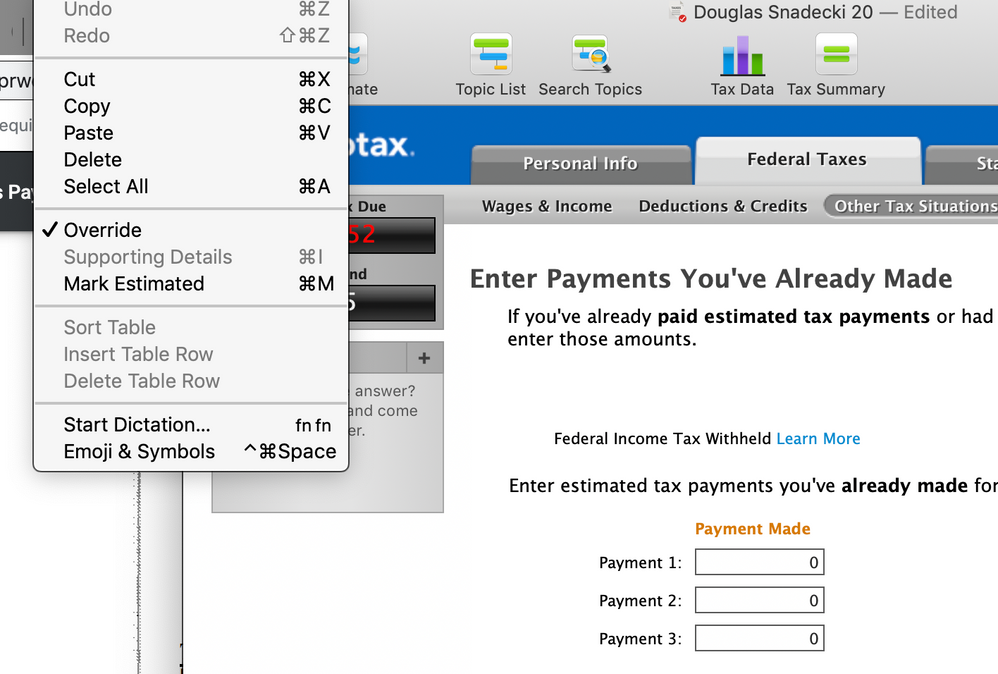

Thanks very much, that got me thinking. The field wasn't available on the Edit menu, but there was one called Override. I checked that one and was able to enter the tax withheld to date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimating 2021 taxes and W-4 not working in Turbotax 2020 for Mac

Beware of the OVERRIDE option when completing a real return as that option will void the accuracy guarantee and may stop you from efiling.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mark1110

Level 2

jottaviani

New Member

SusanL9516

Level 1

edgelser2

Level 3

JWAmpsOnly

Level 2