- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I completed my 1040 and it was reviewed for any errors by turbotax. The review reported my 1040 had no were no problems and was ready for e filing. I was receiving a refund of $1180 because I overpaid my 2018 tax

After e filing my 1040 , I received an email from the IRS with the message

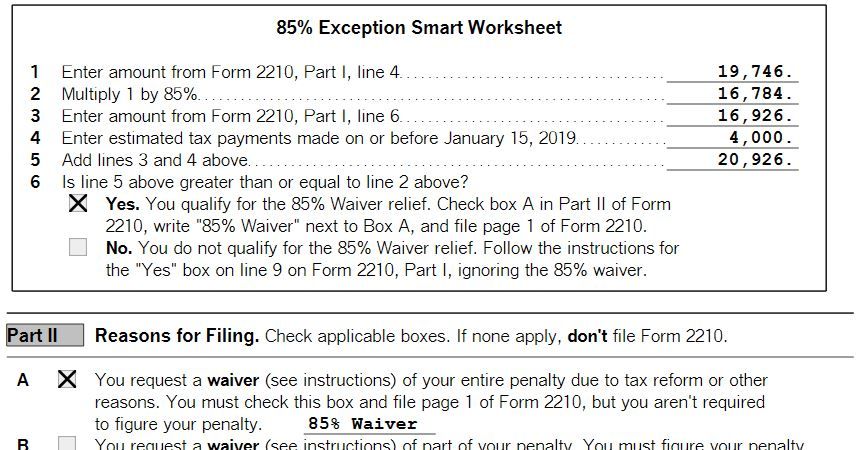

“Your return was rejected because line A of form 2210 was checked and you must file page 1 of form 2210 but aren’t required to pay a penalty” Please see below jpg image

Can some knowledgeable forum member please explain what the problem may be and how I can correct it so I can e file it again

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I’m having the same exact issues using TurboTax online - others are as well. Reading some other community posts it seems this may be fixed in the downloaded version of the software but nothing works online. Tried using Tax Tools to just delete the form but it won’t stay deleted and always shows back up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

Thanks for your reply, This is obviously a Turbotax problem that Im sure is affecting more than you and I

Lets hope others who had the same problem chime in with a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I’m having the same problem. Does anyone know when this glitch will be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I have had the same problem and talked to 3 tax specialists from TurboTax with no success so that I can file my return electronically. It is so frustrating and I have one more discussion on Wednesday. I am not very happy with TurboTax right now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I have the same issue. After got ejected, I followed their instruction and added the explanation statement under box B then resubmit. No luck. My return was rejected again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

Same issue for me. I have a refund, but the program creates a 2210 with an 85% waiver for a non-existent penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I was able to solve the 2210 rejection problem thanks to research on another TT forum.

The below solution applies to TT software I purchased (DVD)

USING THE STEP BY STEP METHOD

personal>other tax situations>additional tax payments>underpayment penalty

If there was an under payment for your 2017 filing delete the figure and enter 0

Doing this will solve the TT glitch problem and your efiling will be accepted by the IRS

Hope this help others with this frustrating TT software problem!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

i talked to them today and they claim this is a known bug which will be fixed in the on line version on march 8 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

Thanks for your message. This problem as been discussed extensively with confusing responses about updates on both the dvd and online versions. I was able to solve it by advice from a user in another forum.

If you used TT last year you must go back and insure to see if there was any tax liability and enter 0 to indicate that it was paid by changing the tax owed to 0.. When I did that the 2210 disappeared an the efile was accepted.

This years version had several glitches in it with promises they would be addressed in a future update.

I would suggest using this method which instantly correct the problem

Use google to search the 2210 problem

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

They say that, but I still can't seem to get this form to do what i need it to do (which is delete the 85% wavier box being checked.) I'd rather pay the $8 penalty it originally assessed. But I can't get that to come back.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

delwinfiddler32

New Member

staceywalkovak00

New Member

eva

New Member

patrickeric502

New Member

redbullcaddy

New Member