- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filed my 1040 and it was rejected for a form 2210 mistake. I received a $1200 refund but am being asked to figure my underpayment penalty???

I completed my 1040 and it was reviewed for any errors by turbotax. The review reported my 1040 had no were no problems and was ready for e filing. I was receiving a refund of $1180 because I overpaid my 2018 tax

After e filing my 1040 , I received an email from the IRS with the message

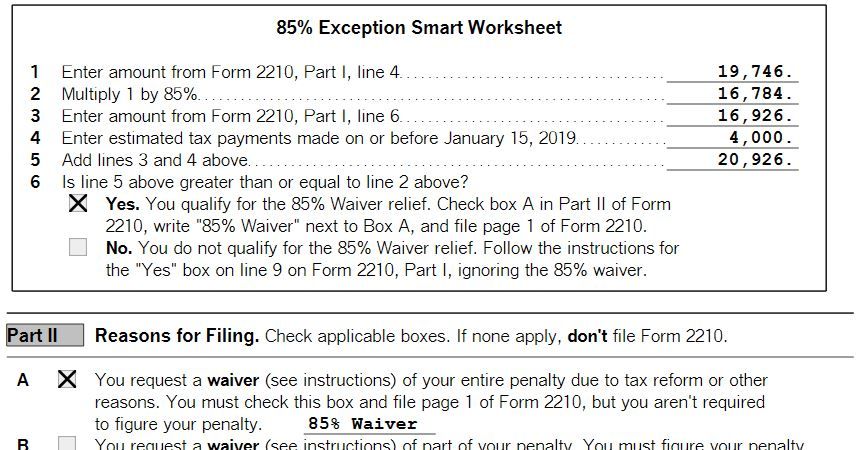

“Your return was rejected because line A of form 2210 was checked and you must file page 1 of form 2210 but aren’t required to pay a penalty” Please see below jpg image

Can some knowledgeable forum member please explain what the problem may be and how I can correct it so I can e file it again

Topics:

February 17, 2019

8:44 AM