- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

Thats hilarious 😂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

Please clarify @rbr6596 by telling us what state you are filing. State forms are all laid out differently so it's possible the information may be on another part of the form, such as the signature line.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

Missouri

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

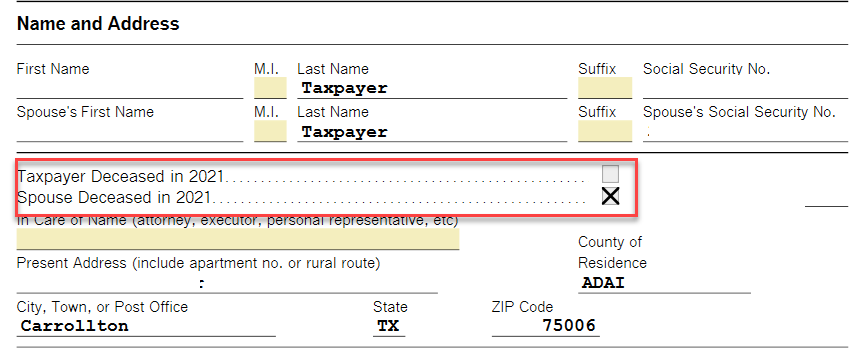

Form MO-1040 includes a box to show one of the filers is deceased. It's right above the address line.

Missouri requires additional information as well:

In order to claim a refund for a decedent, the following documents are required:

- Refund check payable to decedent;

- Completed Federal Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer;

- Death Certificate; and

- If requestor is a personal representative, verification of appointment.

Send all required documentation to Missouri Department of Revenue, P.O. Box 2200, Jefferson City, Missouri 65105-2200.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

Do I need to amend if I don't owe or get a refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to amend my return? I selected my spouse died. It said sorry for your loss and asked what year. The state returns does not show my spouse as deceased.

Please see this Turbo Tax FAQ on when to amend.

https://ttlc.intuit.com/community/amending/help/do-i-need-to-amend/00/27607

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ellenbergerta

New Member

jgmmrn44

New Member

uk05

Level 3

marvincarr1

New Member

abigailr2005

New Member