- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Cycle Code 20210805 No DDD as of 03/03/2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

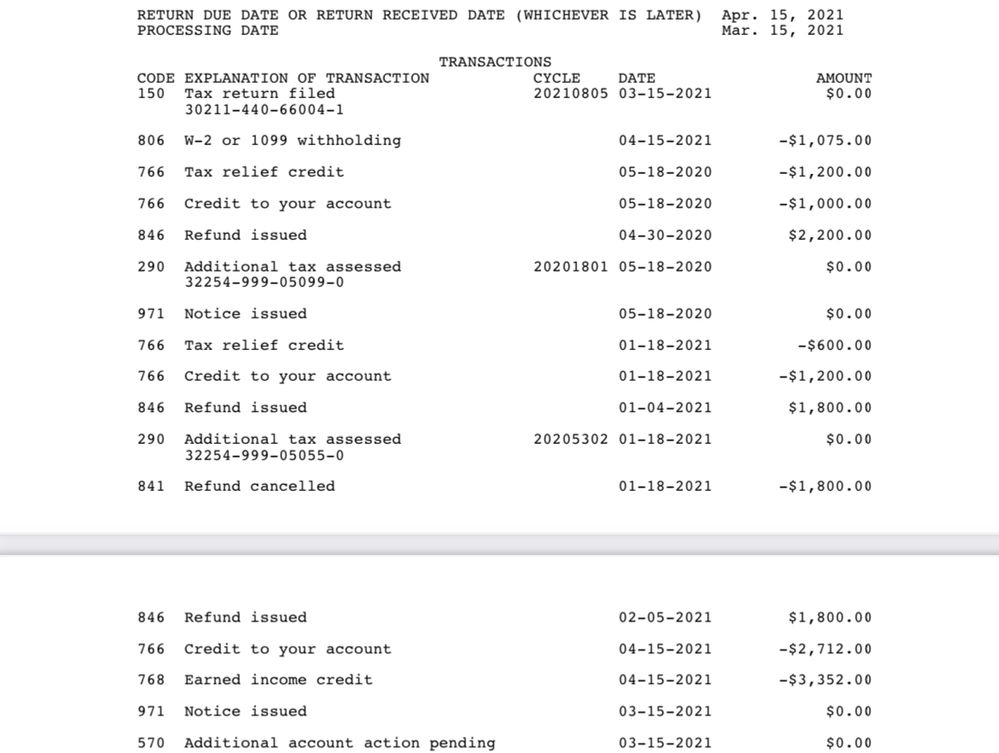

Cycle Code 20210805 No DDD as of 03/03/2021

I early filed 1/9/2021 through TurboTax and paid fees up front. I was accepted on 2/9/2021. I was able to access transcripts on Friday 2/26/2021. I have not gotten an approval nor a deposit and nothing has changed on transcripts. No bars on WMR just a still processing note. Can anyone help? I have reached out to IRS twice but they won’t tell me anything.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cycle Code 20210805 No DDD as of 03/03/2021

I am having this same issue!!! Hopefully it comes like it states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cycle Code 20210805 No DDD as of 03/03/2021

@irreplaceablewom You would need to contact the IRS for further assistance regarding this matter as they are the only ones that can look into your account. Their phone number is 800-829-1040. When calling, be sure to have the following:

- Your Social Security Number or Individual Taxpayer Identification Number

- Your filing status (Single, Head of Household, Married Filing Joint, or Married Filing Separate)

- Your prior-year tax return (they may ask you questions from it to verify your identity)

- A copy of the tax return you’re calling about

- Any letters they may have sent you

- Paper and pen to take notes—make sure to write down the day you called and the name and ID number of the agent you spoke to, as well as any instructions or deadlines you were given.

Please note: You may experience a delay, long hold times, or a busy signal when trying to contact them as the IRS lines are extremely busy at this time of year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jawckey

Level 4

mariajcs

Level 1

billnorthraleigh

Level 2

magicmaidsstaff

New Member

potatopotato

Returning Member