- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Amended return and stimulus check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

I mistakenly marked the box I can be claimed as a dependent on my 2019 return, so I mailed my amended return more than a month ago. But my federal amended return has not even been received as of today ( but my state amended return has been processed) and I found out the reason for such delay was IRS isn’t processing paper returns during COVID and it could take 3-6 months for my amended return to be processed.

I am wondering if I am still be able to receive the stimulus check when IRS starts to work on paper returns since IRS doesn’t specify about this on their website..

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Yes, the stimulus payments are being processed throughout the year. You should be able to receive it after your mailed amended return has been processed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Yes, the stimulus payments are being processed throughout the year. You should be able to receive it after your mailed amended return has been processed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

I'm in a very similar boat. My state amendment was processed and there is no info on the federal amendment, which was mailed in 10 weeks ago. I had filed an amendment, because neither my boyfriend nor I claimed my son. Since there was no dependent on the 2019 tax return, and the amendment hasn't gone through yet, I did not receive the extra $500 dependent stimulus payment. I can't find any info about what to do on the IRS website and no one is available for phone calls-which doesn't really make a lot of sense to me. Is there any chance I will get the $500 payment, or do I have to wait until I file for 2020 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Miss spell last name on my stimulus check refund how do I correct that

the miss spell name was Aruther and should be spell Arthur

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Did you try to deposit the check at your bank? Did they refuse it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Hi my name is Linda and I did same thing that the person did I checked the box dependant and now they won't let me have stimulus check. I was told to do the amended return. But its December 18th, do I have time to get this turned in on time. Could I do a certified check and send it off that way. I really need this stimulus check. Please help me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Please somebody help me!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

@01Linda10 wrote:

Please somebody help me!!!

Don't bother amending the 2019 tax return. If you are not a dependent on your 2020 tax return you will be able to get the stimulus payment included on your 2020 tax return.

It is entered on federal Form 1040 Line 30.

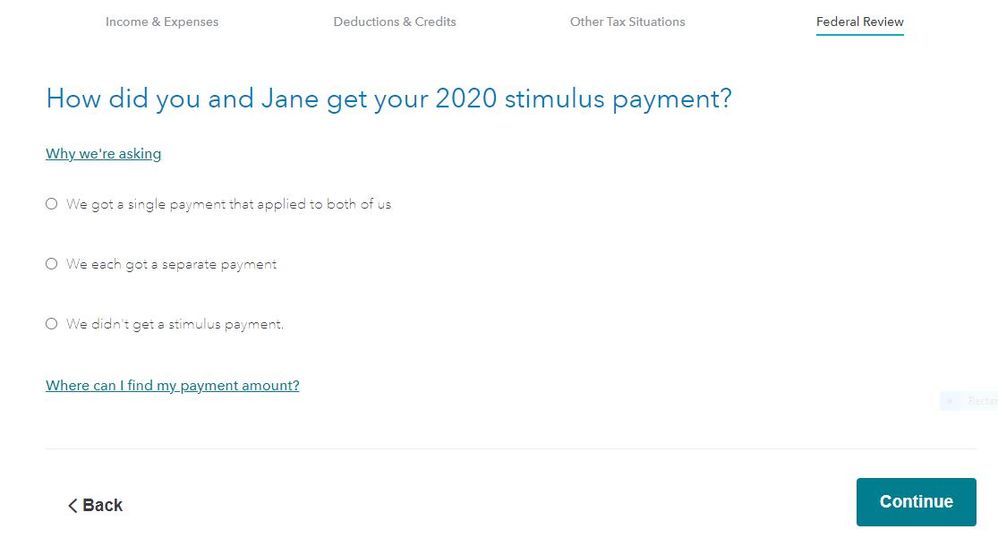

When using the TurboTax program you will be asked about any stimulus payment in the Federal Review section.

See screenshot -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

@01Linda10 wrote:

Hi my name is Linda and I did same thing that the person did I checked the box dependant and now they won't let me have stimulus check. I was told to do the amended return. But its December 18th, do I have time to get this turned in on time. Could I do a certified check and send it off that way. I really need this stimulus check. Please help me

Amending will do no good because amended returns currently are taking 6 months of longer to process and since the stimulus is actually based on your 2020 tax return (2019 was just used for an advance payment). You will have filed your 2020 return long before a 2019 amend is processed. Just file your 2020 return before April 15, 2021 and the IRS will use that to issue the stimulus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

I didn't file a tax return in 2019 or 2020. I've been on social security disability since 2004.

Therefore I never received any of the 3 stimulus checks. I've been on the IRS.gov site for 3 days and didn't get any help. That's why I contacted you. Please help me file The Amended Tax Return for my $ 3,200.00 or more if possible. I just reached $1,24.00 a month when Trump was elected. Before him, I never received One Penny raise for 9 years. If anybody should qualify for stimulus checks, it's me. Please help me to file the proper online work that is needed. If you need to call me , my phone number is [phone number removed].

Thank You Joseph M

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

You will need to file a tax return for 2020 even though you aren't required to in order the claim the Recovery Rebate Credit.

The stimulus payment amounts issued in 2019 or in January 2020 were based upon your 2018 or 2019 income tax returns filed.

The amount of the Rebate Recovery Credit is based upon your actual 2020 income tax return you file. Therefore, if you meet the criteria for the credit, you will receive it when you prepare your 2020 income tax return. The credit is intended to give those who should have received a stimulus payment but never did a tax credit on their tax returns. Any excess credit is then refunded to you if there is an overpayment on your tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

When you prepare your 2020 income tax return, be sure to do the following to ensure the credit is calculated correctly on your income tax return.

- In the Federal section, select the Federal Review interview section at the top of the screen.

- This will take you to the input section for the Recovery Rebate credit.

- Be sure to indicate the actual amount of each stimulus payment you received on the page that asks if you received a stimulus payment. Since you did not receive either of the payments, you will need to select No to indicate you did not receive either payment.

The best thing you can do to prepare your tax return is go to TurboTax.com and start answering the questions.

Enter your information from your tax forms as prompted.

TurboTax will take your entries and calculate any credits, including the Recovery Rebate Credit, you might be entitled to.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

Please send me a amendment to submit for my 2020 2021 stimulus I did not ever receive it

please send it to [PII Removed by filter]

[phone number removed]

[phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return and stimulus check

This TurboTax Community website is an open forum for TurboTax users to ask and answer questions.

The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit. The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021. The credit is available to those who did not receive the Economic Impact Payments or who received less than the full amount that they were eligible for.

- The payments that were sent out were called Economic Impact Payments (also called stimulus payments) and went out as an advance payment of the 2020 tax credit.

- The government sent out an amount thought to be what you would be eligible for based mostly on your prior year tax return or your eligibility for certain benefits such as Social Security.

- The goal was to get money into the hands of taxpayers as fast as possible without having to wait for them to file their 2020 tax returns.

If you did not receive the credit or not enough of the credit through the stimulus payments, the only way to claim the proper amount is on your 2020 tax return. You must file a 2020 tax return to claim any credit that you have not already received, even if you otherwise are not required to file a 2020 tax return.

If you have already received Economic Impact Payments for the full amounts that you're eligible for based on your 2020 tax return, you don't qualify for any additional credit.

In order to qualify for any of the credit on your 2020 tax return, you:

- Must be a U.S. citizen or U.S. resident alien in 2020

- Cannot have been a dependent of another taxpayer in 2020

- Must have a Social Security number that is valid for employment before the 2020 tax return due date

- Did not receive the full amount of the credit through an Economic Impact Payment

See this TurboTax tips article for more information.

See here if you need to purchase a TurboTax product to prepare a 2020 tax return or amend a previously filed 2020 tax return. The deadline is April 15, 2024.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

codykerr670

New Member

wujack-quanye

New Member

jocelyngonzalez18

New Member

undead2352

New Member

luiscarlos-marrero

New Member