- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Amend return to claim Recovery Rebate credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

The issue is that the recovery rebate credit is not being applied to box 15 of form 1040X as a refundable credit (other box checked with RRC listed) when filing through TurboTax. However, it is still listing the updated refund amount on the generated 1040 form when reviewing files to send on amended returns.

I have attached a picture of the 1040X form below. This took a five minute google search and the information comes directly from the IRS released on 03/01/2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

The IRS posted recommendations on 03/01/2021 on this exact situation. The amended return was only available today within TurboTax. It needs to be updated to include the RRC under other credits which it is not currently doing. @ReneeM7122

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

EXACTLY! You are absolutely right @Noneyabusiness . TurboTax made us wait for so long, you'd think they would have come ready and prepared.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

any updates to this? i'm in the same situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

Okay so what I’m taking from this is that we can’t amend to get the recovery rebate credit currently on turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

The program DOES add the credit to the amended return, but it seems the entry is going on the incorrect line on the 1040X.

You might wait a few days as this is being repaired.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

They fixed it. You can do it now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

Turbox tax got it fixed now. You are able to amend the recovery rebate credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

How? I still do not see it when i try to amend. Under what category did you see the credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

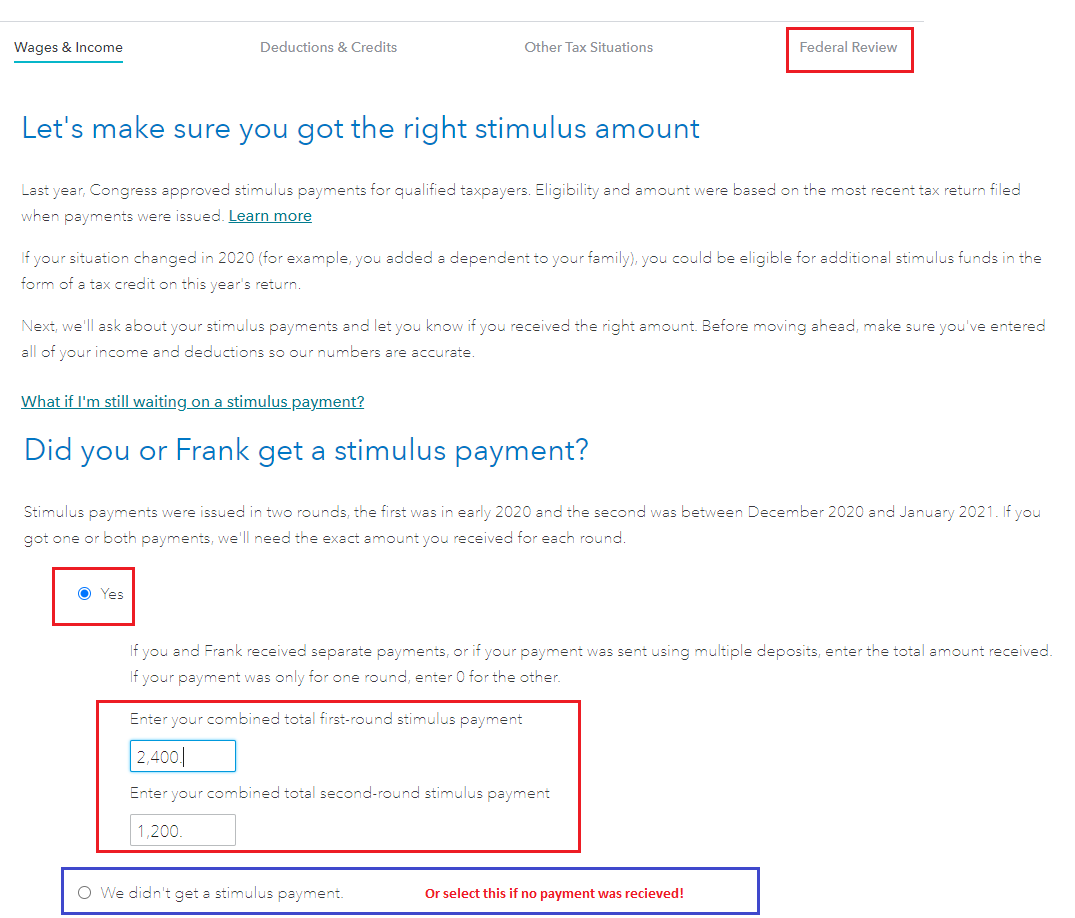

The Federal Review tab at the top will take you to the Recovery Rebate Credit (RRC) so that you can change the amounts you did or did not receive.

See the instructions below.

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview - review the amounts and make the necessary changes.

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040.

You may find these links useful, they are the FAQs for each round of stimulus:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

@DianeW777 This isn't on the amend return. We aren't claiming the credit on a regular return, we're trying to amend our returns and claim the credit in the amendment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

You're only able to amend if your return has already been accepted and released. If you had to change any mistakes, after the tax breaks wrap up, It will ask about stimulus amounts. Thats where you would change your amounts. Enter 0 if you didnt recieve 1st or 2nd. You are basically re-submitting return. Did mine and has already been accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

Okay, I finally found it. I was under the impression that the process was over once you gave a reason for amending, so I hadn't gone further. If you're having this problem, make sure you change yourself from can to can not be claimed as a dependent, click continue, give a reason for amending, click done, and you'll be able to claim the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

I was thinking this too. The instructions only help if you haven't amended; but I found it. Just proceed with continue after making sure you corrected all your info (example: Correcting if you could be claimed as a dependent) when you keep clicking continue it will prompt the question if you received the stimulus or not, and you can go from there. Not sure why its prompted at the end like that but I hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend return to claim Recovery Rebate credit

Is it though? When I went through the correction process my 1040x still doesn't show the correct amount. I see that line 30 on my 1040 is updated, though.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kidatheart

Level 1

user17581376415

Level 1

kac42

Level 2

Naren_Realtor

New Member

elliottulik

New Member