- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Question about Form 1098t

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1098t

Hello!

I filed w-2 and form 1098t together when I did the tax. The thing is I didn't pay for my school, but my dad paid for the tuition. So, my dad also filed my form 1098t that I used to file the tax when he filed his taxes.

Easy way to say: I think my 1098 t filed twice by different people.

Will it cause a further problem with it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1098t

Big question,

Did you select "Someone else can claim me" and "Someone else will claim me"?

In other words, did you file as a dependent?

If yes,

good, that means your father can claim you and enter the 1098-T for an education credit.

It could be a problem if he gets an education credit but there is also taxable income generated which you need to claim.

It might help if you can tell us the numbers form the 1098-T and if there are any other issues, such as 529 distributions, room and board, or other scholarships.

OR

If your father is using TurboTax and can claim you as his dependent, he will enter the 1098-T and any other documents relating to education. HIS TurboTax program will inform him if YOU need to claim any income relating to scholarships and/or distributions.

If you do, and it makes a difference in your tax liability, you'll need to file an amended return.

If you owe tax, you'll need to pay that before April 18th to avoid interest and possible penalties.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1098t

I don’t think I did as a dependent. I did it separately like I am a single person.

my dad didn’t use Turbo tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1098t

That would be a problem.

If you're a dependent, but you filed as a Single non-dependent, your father won't be able to claim you and e-file.

He can claim you and paper-file his return and you will need to file an amended return.

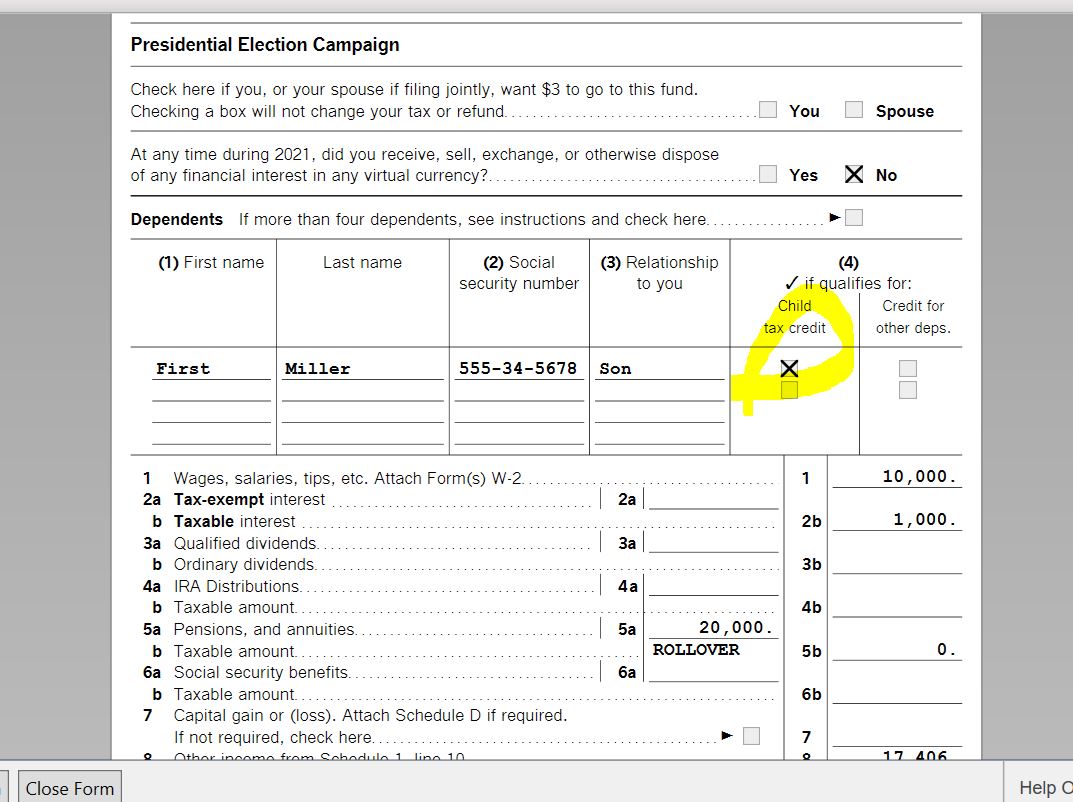

Please look at your 1040 to see if "You as a dependent" is checked.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RicN

Level 2

superlyc

Level 3

srobinet1

Returning Member

johntheretiree

Level 2

Dawnpm

Returning Member