in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Need to amend my 2024 income tax, have questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to amend my 2024 income tax, have questions.

I already filed my federal and state tax returns for 2024 and ended up owing some money both on my federal and state tax returns. Income tax was accepted and money I owed were successfully deducted from my checking account.

However, I later realized that I entered incorrect amount from my 1099-INT - less than I was supposed to (mistook 2023 1099-INT for 2024). So I need to amend my tax return and will have to pay some extra tax.

I would like to understand what to expect from TurboTax (I use online edition) when I file amended return. Does Turbo Tax know federal and state tax authorities already received some money I owed? I certainly don't want to pay more than I actually owe at this point.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to amend my 2024 income tax, have questions.

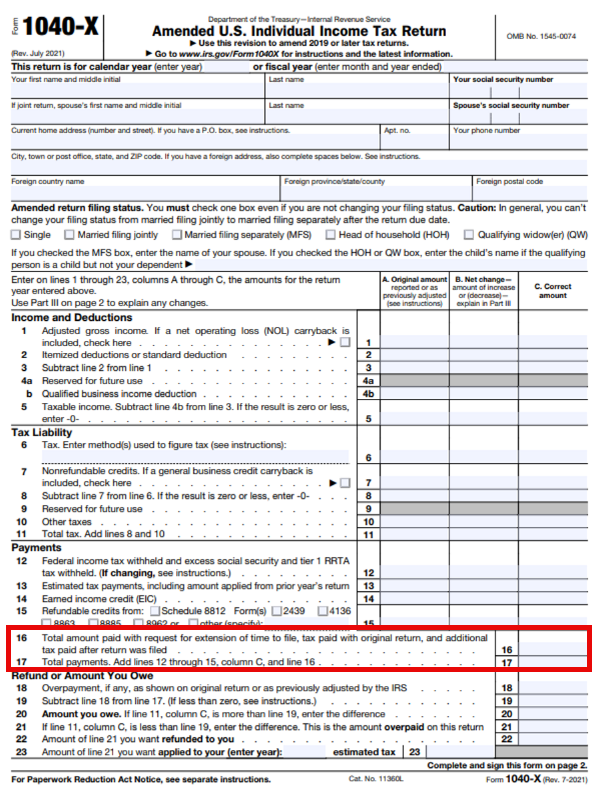

You have to fill in the amended forms with the reason why, the changes and enter the amounts already paid. Line 16 shows taxes already paid. Be sure to view your form and ensure it is accurate before filing.

TurboTax does not know if the IRS has changed things, you failed to pay, etc. You are filing the return and must ensure its accuracy.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Binoy1279

Level 2

ajm2281

Level 1

matto1

Level 2

sakilee0209

Level 2

bgoodreau01

Returning Member