- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Line 1 of Form 1040; 1099-R is combines with W2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

So I filed my taxes. I have W2 and my husband have 1099R for his disability pension. I notice that the amount on both form were combined in Line 1 of the Form 1040. For what I know, it should be on Line 5a/5b. Is there anybody here can explain it to me? Am I gonna be on trouble?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

If a code 3 in box 7 and he is under the minimum age that he could have retired had he not been disabled then it should be on line 7 as wages because it is a wage replacement.

That can be an advantage for many because it qualifies as earned income for the EIC credit and can be used for IRA contributions.

Once he reaches retirement age then it becomes a line 5a/b pension.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

He reached the minimum retirement age. I've been filing it since 2018 and this is the first time that it was combine with my wages. I checked my last year return and it was on line 4c. This time, it's with Line 1. I used H&R block for the previous year though

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

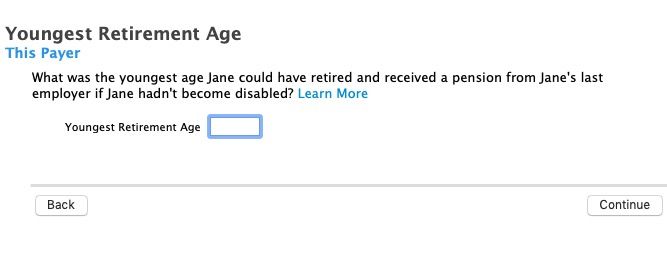

A box 7 code 3 asks the retirement age question.

Be sure that his DOB is entered correctly in the personal information section.

I suggest that you delete the 1099-R and re-enter.

You should get a screen that look like this for a code 3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

The thing is it's already filed. When I printed my tax return, that's when I found out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

If you filed, it is like dropping it into the mail - you cannot get it back if accepted by the IRS or state.

To amend your 2020 tax return:

-- First, *wait* to see if your return has been accepted or rejected by the IRS or state. DO NOT do anything until you receive the accept or reject e-mail.

-- If rejected, you can correct and re-send your return.

-- If accepted you should *wait* until your return has been processed and you receive your refund or conformation that any tax due has been paid. (If you file an amended return while you first return is being processed it can cause extended delays for both returns if two returns are in the system at the same time). In addition, if the IRS makes any change on your original return, you might end up having to amend the amendment – a sticky process that can take a year or more).

-- Then you can start the amend process.

It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it. That is the only proof of mailing that the IRS will accept.

-- Amended returns can be mailed or e-filed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing.

See this TurboTax FAQ for help with amending:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

You can check the status of your amended return here but allow 3 weeks after filing for it to show up:

https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

It just got accepted by IRS today.I don't really see that it will change anything in my taxes because the full amount is taxable anyways.. It will not change any numbers. It's just It's combined with my wages instead of being listed under "Pension which is in 5b"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 1 of Form 1040; 1099-R is combines with W2

The only different is the 1040 line that it is reported on. It will make no tax difference. If the IRS expects to find it on line 5 the their computers do not look at other lines to see it it was reported elsewhere, it simply generated a letter requesting that you pay tax on the missing line 5 income.

You can just wait for the letter (in a year so) and then answer the letter with your explanation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Drostrat

New Member

chrisdeteresa

New Member

CRAM5

Level 2

In Need of Help

Level 1

gamjatang

New Member