- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Kansas 2023 amended tax form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kansas 2023 amended tax form

I am filing an amendment to my Federal and Kansas 2023 returns. In doing my final review, I am getting two Kansas errors that are related. They appear on the Kansas Information Worksheet in Part VIII. I am being asked for the "previous Kansas payment made" and "previous Kansas refund received. I made my error on the Federal form 2023 by entering the same amount twice for a dividend payment. I don't get any problems with the Federal 1040 amended taxes forms but get the error in the Kansas worksheet which passes info to K-40. I did not have a payment due or sent in any $s with the Kansas original 2023 taxes and instead had refund due which I successfully applied to 2024 as a credit. So, I think that I had $0.00 Kansas payment made with K-40 last year and did not get a Kansas refund except as a credit to 2024 taxes due. Turbotax does not like my two entries. What would you suggest? Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kansas 2023 amended tax form

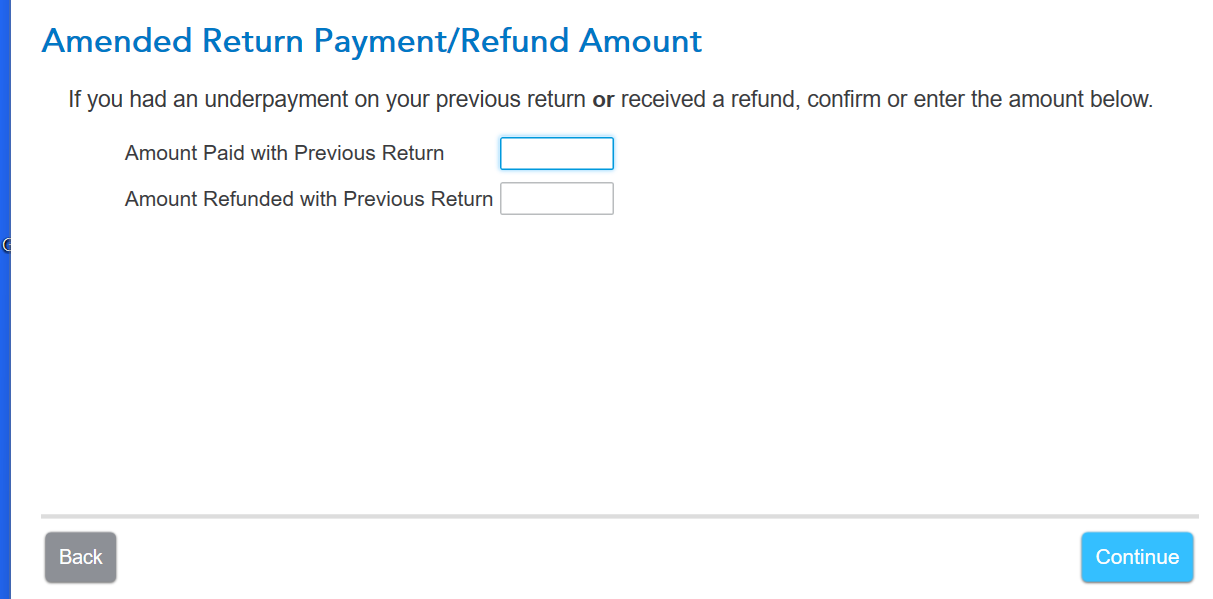

Be sure you are answering the questions for the amended state return in the interview section of the program. Your entries for the refund amount would go on this screen.

You should see a screen titled "Amended Return Payment/Refund Amount" If you had a $40 overpayment on your originally filed 2023 Kansas tax return, and you applied that to your 2024 return, that amount is still considered to be an overpayment. Per the instructions from Kansas, you would need to report this overpayment as an estimated payment on your 2024 tax return. When you amend the return, enter the $40 to the right of "amount refunded with previous return" to ensure the amended return populates accurately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tom_britton

New Member

march142005

New Member

balynn0223

Returning Member

Shakhnoza80

Returning Member

jliangsh

Level 2