- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

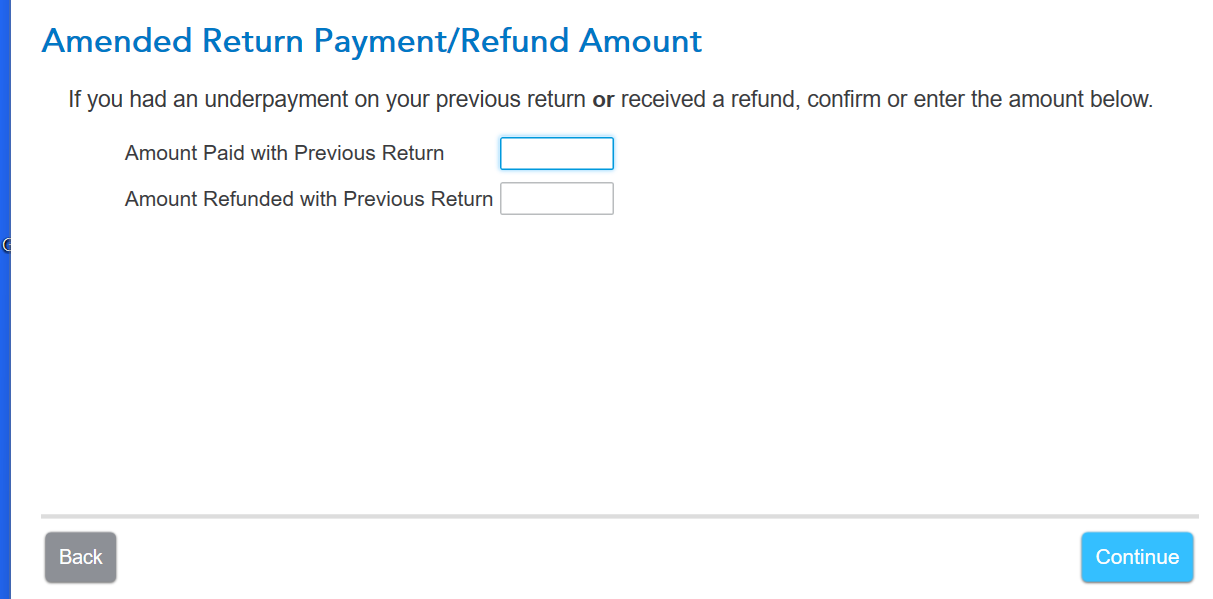

Be sure you are answering the questions for the amended state return in the interview section of the program. Your entries for the refund amount would go on this screen.

You should see a screen titled "Amended Return Payment/Refund Amount" If you had a $40 overpayment on your originally filed 2023 Kansas tax return, and you applied that to your 2024 return, that amount is still considered to be an overpayment. Per the instructions from Kansas, you would need to report this overpayment as an estimated payment on your 2024 tax return. When you amend the return, enter the $40 to the right of "amount refunded with previous return" to ensure the amended return populates accurately.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 8, 2025

8:06 PM