- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Is anyone finding that TurboTax is rounding up to the nearest dollar when entering the amount received from the Advance Child Tax credit (form 6419)? Is this ok?

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone finding that TurboTax is rounding up to the nearest dollar when entering the amount received from the Advance Child Tax credit (form 6419)? Is this ok?

I am entering $x,xxx.50 for myself and $x,xxx.50 for my wife, but then it rounds the dollar amount up. This seems like it would cause an issue with not matching what the IRS has.

Topics:

posted

January 22, 2022

3:11 PM

last updated

January 22, 2022

3:11 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone finding that TurboTax is rounding up to the nearest dollar when entering the amount received from the Advance Child Tax credit (form 6419)? Is this ok?

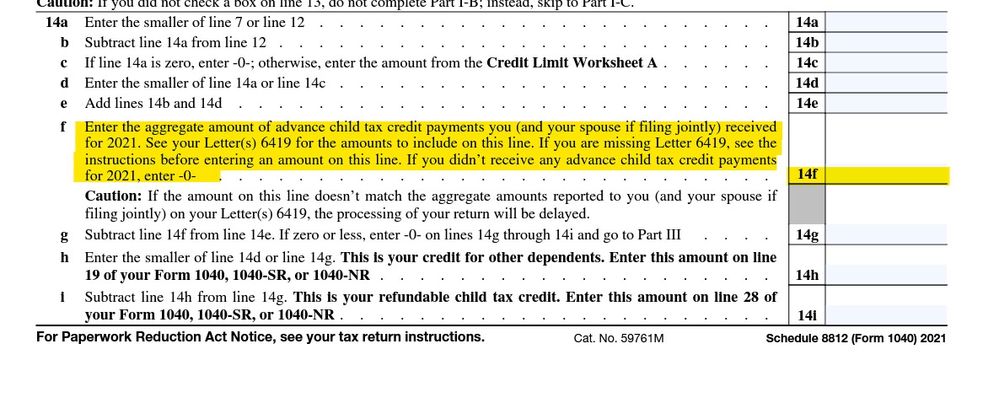

Ok ... this is an issue with the auto rounding program ... so here is the work around. You can either add the 2 amounts together and enter it all under ONE parent and put a zero on the other OR if the amount is say 300.50 on both letters then enter 300 on one parent and 301 on the other.

601 + 0 = 601

300.50 + 300.50 = 601 and 300 + 301 = 601

LOOK at the form line instructions :

January 22, 2022

3:16 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SeaLady321

Level 3

gw1948

New Member

chrisdeteresa

New Member

Jonson702ER

New Member

emircengiz1925

New Member