- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

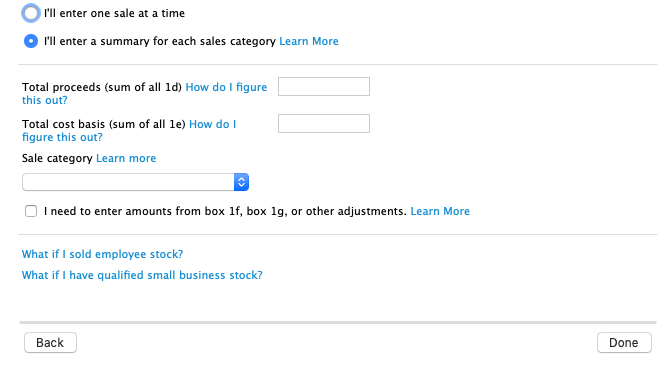

You should not need to manually complete the Form 8949. You likely selected the "Summary Total" method of reporting your transactions. With this method, you really just need to mail your Form 1099-B statements along with Form 8453 to the IRS. You do not need to do manual calculations for Form 8949 (the TurboTax instructions reference sending a Form 8949, but with this method of reporting, your 1099B forms substitute for this Form). You could amend your return to include the individual transactions instead of the summary totals, but you will still need to then mail your amended return along with the forms to the IRS. So, its likely easiest to just leave the return as is and mail the statements to the IRS.

Here is a more in-depth answer to similar questions relating to this topic -

The answer below is going to assume that you choose to use the summary transaction method of reporting your 1099B transactions instead of entering individual sales.

- Description

- Date acquired,

- Date sold,

- Sales price,

- Cost basis,

- Gain or loss for each sale,

- Sale category based on how the sale was reported to you and the IRS, and

- In some cases, there will be an adjustment code and adjustment amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

I selected the "summary total" option and TurboTax had me upload the broker statement with individual transactions. My understanding is that this would be included with my filing so I don't have to mail anything. Is this correct or do I really need to mail it in? The software really should notify people of this when making the selection.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

If your stock sales show that they are covered sales (the basis is reported to the IRS), you can include summary information in your tax return and not mail the 1099-B to the IRS.

If you have stock sales where the basis is not reported to the IRS then you need to mail the IRS your 1099-B, or list those sales separately in your tax return, so they appear on from 8949. If those sales are listed separately in your return, you do not need to mail your 1099-B to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

HUGE FAILURE on the part of Intuit / TurboTax for not having a blaring warning on this page that by entering a summary you will need to mail in your STATEMENT (with our account information on it?) or manually write out each transaction and mail it separately from a tax payment to the IRS.

Why did TurboTax think this was a good idea?

Why would anyone choose to enter a summary if they knew that they had to subsequently mail this?

Why isn't there a warning before finalizing taxes saying "are you SURE you don't want to enter your gains and losses here because you'll have to mail it in separately." There is a warning after filing...the whole thing is such a big failure.

Because of this investment in time and effort and the accompanying annoyance, I may not use TurboTax last year. (They wouldn't let me edit my review so this is serving as an addendum to my review.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

Totally agree that Turbo Tax should generate the warning. I also faced the same dilemma. I chose to enter summary since I did not know I would need to mail the transactions later.

Also, in these times of Covid, I am not sure of mailing is a good idea.

Any clue what happens if somehow IRS do not receive my mail or they receive but somehow miss to add it to the return on their side?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

You can add the form but only if you have not already mailed your return. If you already mailed your return, e-filing will cause longer delays.

How do I change from mail to e-file in TurboTax Online?

You can use Where's My Refund even if you filed by mail.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

I have e-filed my return using Turbo Tax Deluxe. Now I have to mail Form 8949 with Form-8453. I am worried what if something goes wrong and IRS sends me notice to get it all together. In such times of COVID, when IRS does not have full employees presence, the chances of this happening are high

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

If you have successfully e-filed your return and it has been accepted, they have it and won't ask for it again.

For added peace of mind, you can buy a Certificate of Mailing at the Post Office. A Certificate of Mailing is a proof of mailing receipt that proves you mailed your tax return (or Forms 8949 and 8453) on a certain date.

After you send your taxes, keep your receipt in a safe place. The Postal Service® does not keep copies of receipts. If your return is delayed or lost, the postmark will not be available, but your Certificate of Mailing receipt will prove that you mailed your return on time.

Certificate of Mailing Service

The Treasury Department and the IRS are providing special relief to all taxpayers and businesses in response to the COVID-19 Outbreak: Tax Day has been moved from April 15 to July 15, 2020. All taxpayers and businesses will have this additional time to file and make payments without interest or penalties.

See full details about the filing and payment deadline on the IRS website.

Mailing Tips

- Send to the Correct Address

Check the IRS website for where to mail your tax return. Write both the destination and return addresses clearly or print your mailing label and postage.

Where to Send Paper Tax Returns - Use Correct Postage

Weigh your envelope and apply the right amount of postage. Most tax returns are several pages long and weigh more than 1 oz. Tax returns sent without enough postage will be returned. - Meet the Postmark Deadline

If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS blue collection box or at a Postal location that has a pickup time before the deadline. Some Post Office™ locations offer extended hours and late postmarking for tax filers. Call a Post Office near you to find out if it will be open late on tax day. - Find USPS Locations

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

Is that possible to amend 8949 and related 1099b electronically? It seems IRS is taking electronic amendment after 2019. I don't want to mail the forms if that is not necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my taxes but did not realize I would have to file a Form 8949 manually. Can I amend my return to list all sales in TurboTax and refile?

See About Form 8949, Sales and other Dispositions of Capital Assets should have been a part of your tax return. If you used consolidated statements, then you need to mail the 1099-B forms with the 8453 to the IRS.

Please review the form instructions and your return to see what is needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

trostlechet

New Member

rajamj

New Member

HollyP

Employee Tax Expert

user17628882651

New Member

CZed

New Member