- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

Businesses that are owned by a married couple can be treated as a qualified joint venture. Qualified joint ventures will file one schedule C for each spouse owner, and report each spouses' portion of income and expenses.

Here are the requirements to file your business tax information as a qualified joint venture.

Partnerships (or LLCs in community property states) with husband and wife owners can file schedule Cs for each of their portions of the partnership’s income instead of filing a Form 1065 partnership return by electing to be treated as a qualified joint venture. The requirements are as follows:

- The business is unincorporated or not organized as a limited liability company (unless the husband and wife live in a community property state).

- The only owners of the business are the husband and wife.

- Both spouses materially participate in the business operations.

- Both spouses agree and elect not to file their tax return as a partnership.

- Each spouse reports their full share of income and expenses on separate schedule Cs.

You will need to divide the income and each expense by your respective ownership share. If you live in a community property state, the ownership will be 50%. If the ownership shares are 50/50, you will enter the exact same income and expense items on each schedule C. If there is business mileage, you will divide the mileage between each schedule C as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

Businesses that are owned by a married couple can be treated as a qualified joint venture. Qualified joint ventures will file one schedule C for each spouse owner, and report each spouses' portion of income and expenses.

Here are the requirements to file your business tax information as a qualified joint venture.

Partnerships (or LLCs in community property states) with husband and wife owners can file schedule Cs for each of their portions of the partnership’s income instead of filing a Form 1065 partnership return by electing to be treated as a qualified joint venture. The requirements are as follows:

- The business is unincorporated or not organized as a limited liability company (unless the husband and wife live in a community property state).

- The only owners of the business are the husband and wife.

- Both spouses materially participate in the business operations.

- Both spouses agree and elect not to file their tax return as a partnership.

- Each spouse reports their full share of income and expenses on separate schedule Cs.

You will need to divide the income and each expense by your respective ownership share. If you live in a community property state, the ownership will be 50%. If the ownership shares are 50/50, you will enter the exact same income and expense items on each schedule C. If there is business mileage, you will divide the mileage between each schedule C as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

In Business Summary, how do I set up one business (joint venture) owned by a married couple so each of us can report our own Schedule C and claim 50% of the income and expenses? There is only one EIN for the business and one name for the business, so do I list it was two separate businesses with the same name but add something like (business1, business 2 or businesshusband, businesswife) to delineate, list the same EIN for both and then add half of the info in each Schedule C? Do I record our home office square footage in half for each of us at some point so we each get half the deductions? And how do whole house expenses like utilities factor in....there doesn't seem to be a way to enter those in halves. I AM SO CONFUSED!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

You are a partnership but may qualify to file 2 schedule C's if you meet the qualifications in IRS: Election for Married Couples Unincorporated Businesses.

- If you file a partnership return, you need TurboTax Business for corps.

- If you are filing 2 schedule C forms, you split every income and expense in half. The forms will be identical except for your names. Grab a calculator and start dividing by two.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

We are qualified to fie with 2 Schedule Cs and I understand that I need to divide the income and expenses in half. What I don't understand is how to set up TurboTax to generate two Schedule Cs for the same business. If I enter our business name, it asks me who owns this business, and when I add "both of us" it only generates one Schedule C. I need to know how to list the business so it will generate two Schedule Cs for the same business with the same EIN. Someone told me to first click one of our names when asked whose business it is, but if I do that, I can't back up and change the business ownership to enter the other 50% of the numbers. Someone else told me to list the one business with two separate names, but then Turbo Tax wants me to enter an EIN for the second business, which is the same EIN. I can't figure out a way to get started so that both of us are sharing equally--important for both of us regarding social security.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

that question about ownership is really irrelevant. it never shows up on the actual schedule C but what is does do is splitting the income for self employment tax pouposes. i suggest you use taxpayer for the first. now to create and enter the second schedule C . go to the federal taxes tab. then wages and income. select I'll choose what to work on. scroll down to business Items. select update for business income schedule 2. then click on add another business. for this you will check owned by spouse.

by the way, EIN is not required unless you have employees.

remember that income and expenses must be manually split and entered on each schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

Hey Mike, I came right up to the Extension deadline a few days ago because nowhere could I find how to generate a second Schedule C for my wife's half of earnings - not on Turbo Tax website nor anywhere in the program. Also, since there's no easy way to track down a phone number for such assistance (even though the package for the "Home & Business" program states "Live Product Support via phone" - I found it by the way and it directed me back to the website!!! No live consultant), I was forced to file my Fed & State returns with only my half of income and expenditures. Now I'll have to go through the process of amending the returns - hopefully using your recommended solution. This is my first year using Turbo Tax and, taking into consideration my background in rewriting technical manuals for end-users, I would rate this program "Seriously LAME"!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

maybe i shouldn't have used "spouse"

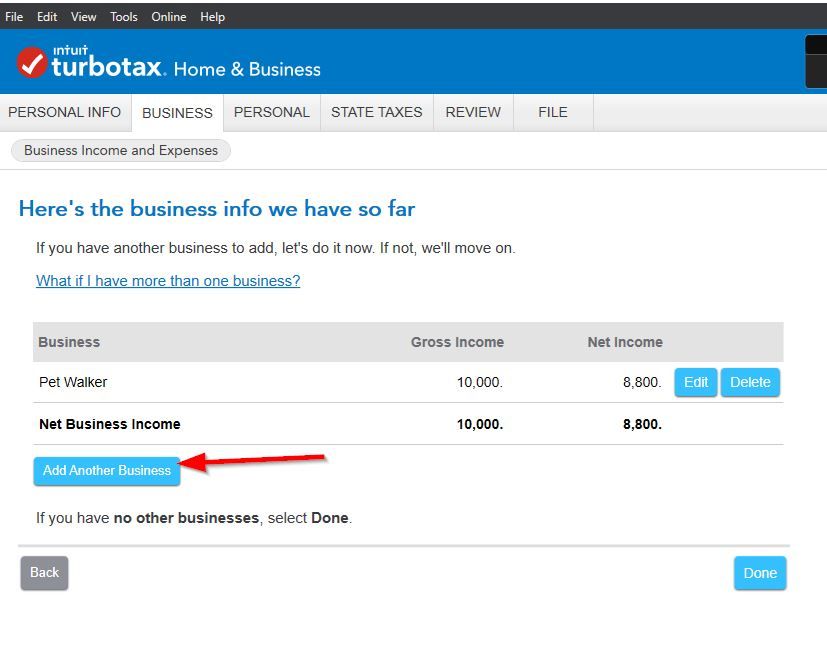

on the business summary page click on the blue icon "add another business".

enter a description that would be the same as you used for your portion.

Click on the blue icon "continue".

On the "tell us about your business" page

on the line that says "this business is owned by:" click on the name of your spouse.

Click on any boxes that apply.

Click on the blue icon "continue".

should have worked but perhaps you're using a different version. Also, I've noticed some bugs in TT that existed before 10/15 and have not yet been fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

What you needed to do was simply add another business for the other person. Enter it like 2 separate businesses. You need a schedule C for each person. I have the Home & Business Desktop program also. But if you already filed and it was accepted then now you have to amend. You need to wait until the first original return is done processing (which will take a long time) and you get the first refund. Then you can amend.

How to amend a 2020 return both online and desktop

https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-return/01/27439

You add another business here,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

The problem with TurboTax's handling of the income side is when you enter the 1099-NEC. If you are not going the partnership route, you have to assign it to one or the other taxpayer, and then you can't change it on the Schedule C.

What I did, and what I hope works, is to report TWO 1099-NECs for our community-property-state LLC, each for half the amount shown on the one we received from the Payer, and each of course with the same EIN for the Payer. I assigned one 1099 to myself and one to my wife, and now I can go in and manually split the expenses I had entered on the single Schedule C between the two of us. Fingers crossed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to do this step of "Business owned by Married Couple". I do not understand the steps.

Actually you don't even need to enter the actual 1099NEC. You can just enter it as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

But what you did should work out ok.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stelarson

Level 1

JazzAlternative

New Member

ranscoste

Level 2

bradsauve

New Member

vikingcat

Returning Member