- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I didn't double-dip AOTC and ESA, but when completing TT interview do I include just enough "books and course-related materials" to hit $4000 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't double-dip AOTC and ESA, but when completing TT interview do I include just enough "books and course-related materials" to hit $4000 ?

1. When completing the TurboTax interview, do I answer $400 for “books and course-related materials”, which is exactly the amount needed to hit $4000 of eligible expenses for the AOTC ($3600 $400), but less than total “books and course-related materials” expenses? Again, I am covering QEE beyond $400 with an ESA distribution, which I coordinated such that I will not be “double dipping” expenses, so really I’m just confused about whether to include just enough “books and course-related materials” expenses to maximize the AOTC at $4000 of expenses, or do I enter the full amount in TurboTax.

2. TurboTax interview covered the 1099-Q received by my daughter. I feel confident that there should be no tax liability for my daughter or me related to the ESA distribution, since the distribution corresponded to the exact amount of QEE beyond $4000. Do we just maintain records for these expenses paid from an ESA distribution or does the ESA distribution somehow show up on my tax return or my daughter’s tax return (she has no income and I don’t think she will need to file since there should be no tax consequence related to this ESA).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't double-dip AOTC and ESA, but when completing TT interview do I include just enough "books and course-related materials" to hit $4000 ?

Yes, you should enter the Total Amount of 'Other Education Expenses' you incurred in the Education Section. TurboTax will calculate the $400 needed to qualify for the American Opportunity Credit, and include the balance as Qualified Education Expenses.

You are correct that if your 1099-Q Distribution does not exceed Qualified Education Expenses, you don't have to include it in your return, but definitely keep records of your education expenses.

Click this link for more info on Reporting Form 1099-Q.

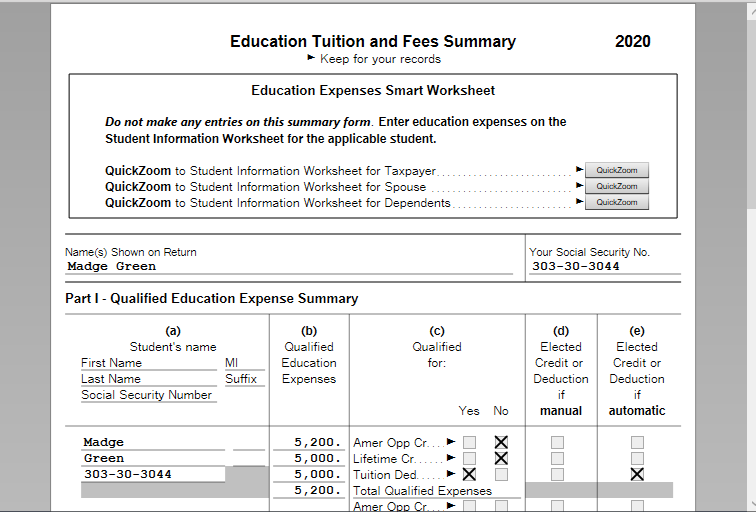

Your can review the Education Tuition and Fees Summary to see the calculations (screenshot).

Use FORMS mode in TurboTax Desktop, or the Print Center from the left-side menu in TurboTax Online.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noodles8843

New Member

dmitris70

New Member

bpinto1979

New Member

ekudamlev

New Member

TAMR917995

New Member