- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

This looks okay..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

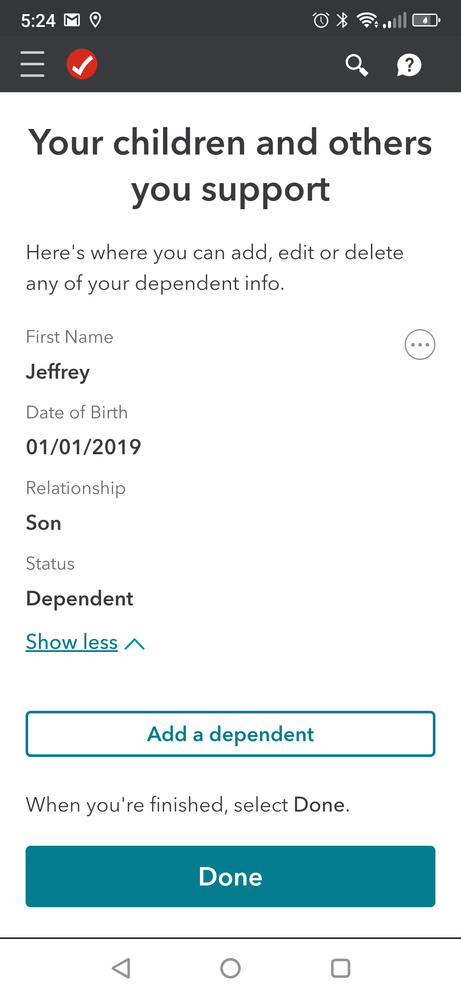

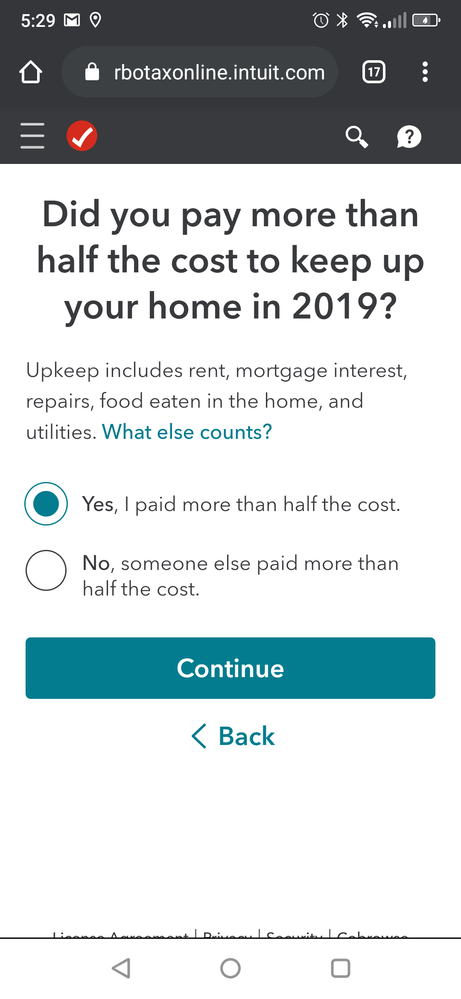

Okay. So I've deleted him and added him back as my dependent, that went good but here's where I think I messed up? Not to quite fasure... But I live with my grandmother for right now. She DOES NOT take care of him. I DO!!!! I pay for everything that includes anything for him. I give my grandmother any extra money I get to help with bills.. I filed SINGLE originally.. but when I click YES to this question it now puts me as HEAD OF HOUSEHOLD instead of single .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Yes---when you file Single and claim a dependent and enter the dependent's information, it gives you the filing status of head of household. You get a higher standard deduction that makes less of your income taxable.

Now---Look at your 2019 Form 1040 to see the child-related credits you received

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Child Tax Credit line 13a

Credit for Other Dependents line 13a

Earned Income Credit line 18a

Additional Child Tax Credit line 18b

Child and Dependent Care Credit line 18d

https://ttlc.intuit.com/questions/1900923-what-is-the-child-tax-credit

https://ttlc.intuit.com/questions/1900643-what-is-the-child-and-dependent-care-credit

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

But my grandmother files taxes & uses the same address and claims HEAD OF HOUSEHOLD ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Your grandmother cannot claim to be head of household unless she is claiming a dependent. Who is she claiming as her dependent? Did she claim YOU? Or is there someone else in the household?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

https://www.irs.gov/help/ita/what-is-my-filing-status

Am I Head of Household?

https://ttlc.intuit.com/questions/1894553-do-i-qualify-for-head-of-household

https://ttlc.intuit.com/questions/2900097-what-is-a-qualifying-person-for-head-of-household

If you qualify as Head of Household, when you enter your filing status (single or married filing separately) into MyInfo, and then enter your qualifying dependent, TurboTax will offer HOH as your filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Okay I had to talk to grandmother. She said she didn't file a return so I'm clear to file head of household .. I'm about to correct that now then I'll be right back . Lol . I appreciate you so much you don't even know .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

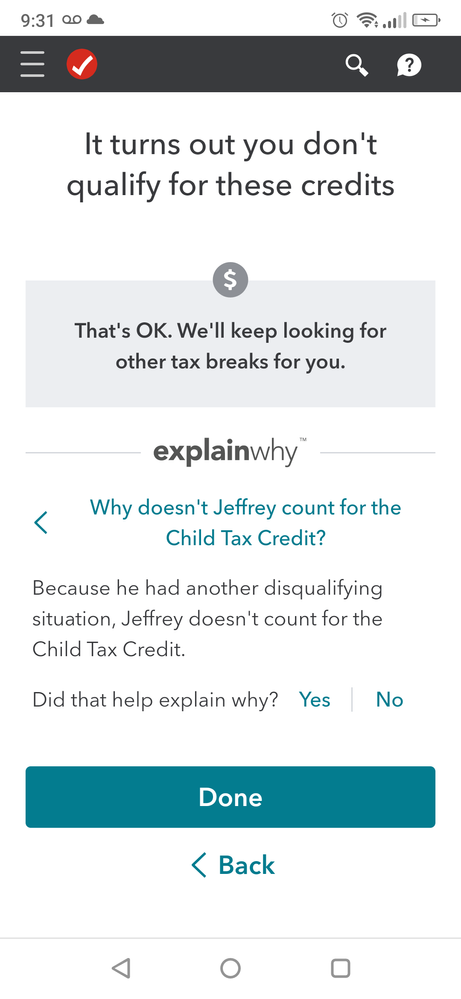

Hey, I put HEAD OF HOUSEHOLD . but it's still saying Jeffrey doesn't qualify for the child tax credit .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

I don't know what the disqualifying situation is ? I've deleted him as a dependent and put him back snd i still don't understand

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

Did the child physically live with you more than 1/2 of 2019?

Was the child no older then 16 at the end for 2019?

For the child tax credit of $2,000 per child.

The child must have been no older than 16 at the end of 2019.

The amount of child tax credit you can receive is limited by your taxable income (1040 line 11a)

If your taxable income is zero, then you are not eligible for any child tax credit.

However, if you do not qualify for the Child Tax Credit, and if your earned income is greater than $2,500, you might be eligible for the Additional Child Tax credit. That amount is 15% of earned income greater then $2,500 up to a maximum of $1,400.

Too high of an income will reduce or eliminate the CTC also.

Married Filing Joint - $400,000

Single, Head of Household, or Married Filing Separate-- $200,000

The child tax credit will be reported on lone 13a on the 1040 form. Additional Child tax credit on line 18b on the 1040 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

He has lived with me the whole year. He's only 1 and a half . Born January 1st 2019 .. I'm eligible the IRS sent me a letter saying I qualify for an additional Child Tax Credit and could get a refund . So now I'm trying to Amend but don't know how to fix the problem .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

I got a stimulus check for 1,200 and it was supposed to be 1,700 . They said I didn't get my 500 for my dependent because it goes off the CHILD TAX CREDIT . The IRS said they see where I have him in as my son but it's under OTHER DEPENDENT as if he's older than 16 instead of CHILD TAX CREDIT . which is why I didn't get the 500 for my son . They said when I file taxes next year that's when I could receive that money . and that I need to Amend my return to put him for the Child Tax Credit . They owe me a refund .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

read the questions aloud as you answer them. Does it ask if the Child provided more then half his own support?

Make sure you answer NO.

If the child was born in 2019 you should answer that they lived with you all year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

I've already did that ... I've even deleted him just to re enter his info ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to amend my 2019 tax return the IRS said I need to update the 1040x form. Instead of putting other dependent I need to put child tax credit.... HELP ?????!!!!

@jmoney_beep Did you use a paid version of the tax software? If so, you need a call with customer support so someone can have a live conversation with you and go step by step with you to figure out what you did incorrectly. We have tried everything we know in the forum but there is something you are still doing incorrectly or we are missing some information from you about what you have entered or done.

To call TurboTax customer support

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

They are available from 5 a.m. to 5 p.m. Pacific time Monday-Friday

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

193172360c2d

New Member

Mgentile65

New Member

fanfare

Level 15

akaqwp

New Member

63d72ddbda95

New Member