- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I accidentally marked "someone can claim" me as a dependent but no one did.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@Chano1 - if you CAN be claimed, you will not get the stimulus, even if that person decided not to claim you.

this thread is quite long, what is the 'same boat' you are in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Has anyone got theirs yet please let me know I’m in the same boat

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Yes i know so even though I marked that box I will still get my stimulus check cuz I’m 19 and couldn’t of possibly been claimed cuz I’m independent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

- if you checked that box, no, you will not get the stimulus. There are plenty of 19 year olds that do get claimed by their parents. how would the IRS know you made a mistake?

if you marked yourself as 'can be claimed as a dependent' by accident, you have two choices to fix this

1) amend the 2019 return. that will take at least 16 weeks to settle and there is no guidance from the IRS that they are going to immediately pay out the stimulus after they process the amendment. Maybe they will and maybe they won't.

2) wait to get the stimulus on your 2020 tax return when you file next year.

- The stimulus payments are really based on your 2020 tax return (income, dependents, etc).

- The IRS is using either 2018 or 2019 – whatever is available - to ESTIMATE that payment

- When you file next year there will be a “settle up” section on the tax return.

- If you are due more stimulus (and this would include where you simply never received it), you will receive it through the 2020 tax filing as an additional refund

- If you received too much stimulus (not the issue here), by law , you are not required to return it

does that make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

I’m 18 and out on my takes that I could be claimed. Neither of my parents claimed me and it said they couldn’t, maybe because I made $4,200+? Anyways, I’m laid off and have tons of bills and don’t know whether I’m getting a stimulus check or not. I’ve tried the IRS get my payment but everytime it tells me it’s not available. Please help me I’m scared and don’t know what to do. Thanks so much in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@Maceyv20 - if you are not a full time student and made more than $4200, then you are correct, you parents CAN NOT claim you. You are eligible for the stimulus ($1200)

what to do: scroll up and see my prior posting on amending or waiting until your 2020 tax return is filed next year to receive the stimulus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

I am a high school student who goes to school for 4 hours but I live at home. But I made like $8,000. They could claim me but didn’t. So will I get a stimulus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@Maceyv20 - since you are a full time student and under the age of 24, you are NOT eligible for the stimulus.

It doesn't matter whether you parents claimed you or not.

your parents have the option to claim you - there is no rule that says they have to.

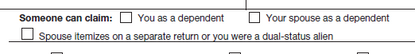

But you do not have that option. you have to answer on your tax return that you CAN be claimed which is a different statement than I WAS claimed (or WASN'T claimed). see the difference? your answer that you CAN be claimed is the same whether or not your parents actually claim you.

Look at your tax return - about a 1/4 of the way down the 1st page. Is the "you as a dependent" box checked?

if yes, all is good and you are not eligible for the stimulus

if no, you will probably receive it but are not entitled to it. Would strongly suggest returning it as there may be penalties and fines for keeping it, even though the tax return was inadvertently filled out incorrectly.

does that help ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

I’m sorry but this is false. You can be 24, in college, AND still receive the stimulus as long as you were not claimed. To show you are Independent, you will need to pay more than half your bills that year. Keep in mind that people older than 24 can also be dependent. Marking that box automatically exempts us from receiving the check.

IRS has also stated that the money doesn’t need to be returned if accidentally provided.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

My question is

There is talks about a second a stimulus of 2000 a month. Are we going to qualify for the second stimulus? Does anybody know ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Read an article about that, looks like the hypothetical act would include dependents. Though, doubt the federal government would remotely consider funding it. Fed would prob just say open your state back up and go back to work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Hello just read this whole thread. Im still kinda confused on everything so bare with me. Im in this thread now because I have made the same mistake as everyone else. Im 18 years old. Im pretty sure ive never filed any taxes before. I just started working about 1-2 months ago. So my question is what do I do if I marked the box as someone can claim me as dependent knowing im independent? I dont think I can do amend return because I havent filed taxes before. Should I just accept the fact that I played myself or should I wait. Also if Im working right now and pay taxes on every paycheck does that do anything? Will I receive anything next year. I dont know im new to all this **bleep** so please any information would help, thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Okay on turbotax i submitted my stimulas it told me a few days later that my submission is accepted .i filled in someone can claim me but underneath that it ask did that person claim that year i marked no so do still amend or am i good to go?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

It depends.

Part of the ineligibility occurs if you can be claimed as a dependent regardless of if you are or not.

Rules for claiming a dependent

Please see the link below to more details on who is eligible and who is not.

If you determine nobody else could claim you as a dependent based upon the first link above, then you should amend your return and mark that you could not be claimed. Be careful attention to the support requirements. If you are not providing over half of your own support, you could still be considered a dependent.

I have attached a link for instructions on preparing an amended return should you determine you do need to amend your return.

The IRS is scheduled to issue stimulus payments through 2020. If your return does not get processed in time, please be aware that when you file your return in 2020, you will have the opportunity to report the amount of the stimulus check(s) you did receive, and if it was less than what you were entitled to, you will receive a credit on your tax return in 2020.

What does the stimulus package mean for you?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Hi Everyone! Just read through this thread. So like everyone else, i did accidentally say that I could be claimed in my 2018 return but I was not and am eligible or the full $1,200 based on what I made. I also have not filed my 2019 return yet because I made more than the max making me ineligible. I will not be making more than the max in 2020 making me eligible so do I amend my 2018 and still hold off on filing my 2019? Or should I just file my 2019 and look to get the tax credit when I file in 2020? Thanks in advance!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ltkeener

New Member

actuning7

Returning Member

trapezewdc

Level 4

Lord_Tasho

Returning Member

mle4

Level 2