- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to pay "Notice of Tax Return" in CA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

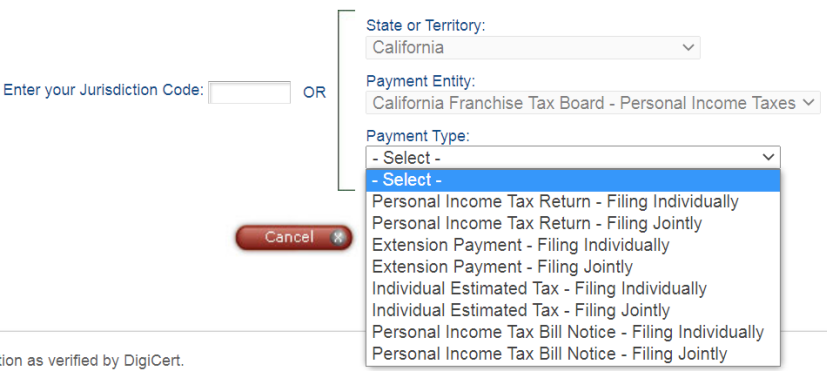

Hi just received a notice that I I still have a balanced, apparently its for Tax Penalty? Anyways, I'm trying pay for it online however I'm confused as to what I should chose: I think I narrow it down to either "personal income tax return" or "personal income tax bill notice". I'm assuming is the latter but I just wanted to make sure. Thanks!

A

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

Hi, I have the same question. I've received a "State Income Tax Balance Due Notice" that I I still have a balance. I'm trying to pay for it online with credit card. Which Payment Type should I select?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

HI I talked to a tax advisor and she says that it is Bill Notice, for either joint or single filing. I did this and seem to work. Fingers cross.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

Well you had only 4 choices ...

1) paying on an original tax return balance due

2) a payment with an extension

3) an estimated tax payment

OR

4) a payment in response to a BILL ... you have the bill in your hand so that is the only logical choice to make.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

Thanks a lot!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay "Notice of Tax Return" in CA?

thanks; you are correct; for me it was kinda scary to not know exactly 100%.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alexsuncn

New Member

mlynn88

New Member

mlynn88

New Member

4tparrish

New Member

4tparrish

New Member

Want a Full Service expert to do your taxes?