- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to amend for a 1099-G (State refund) received in 2018, described as a 2017 1099-G, for tax year 2016?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend for a 1099-G (State refund) received in 2018, described as a 2017 1099-G, for tax year 2016?

How to amend for a 1099-G (State refund) received in 2018, described as a 2017 1099-G, for tax year 2016?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend for a 1099-G (State refund) received in 2018, described as a 2017 1099-G, for tax year 2016?

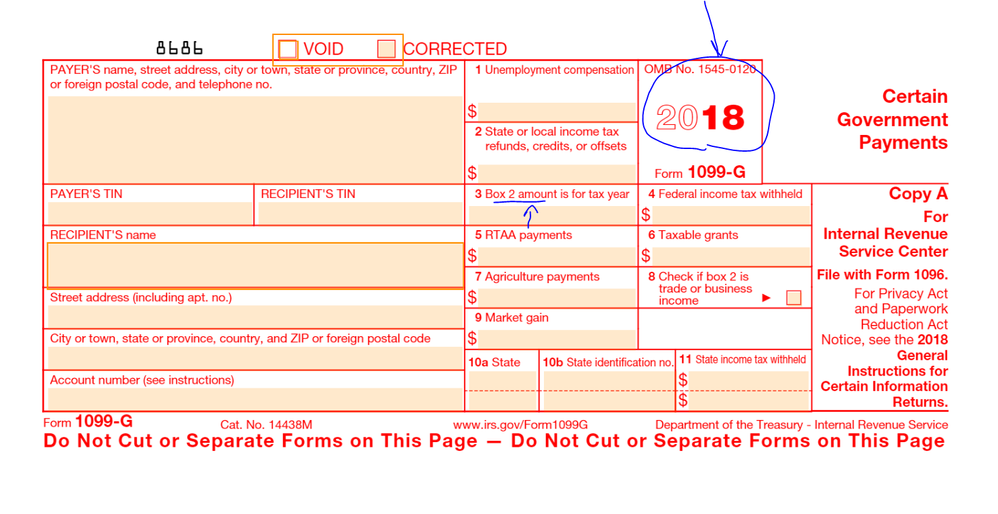

Look at the form carefully ... what tax year is in the big box ? And in box 3 ?

If the big box says 2017 then it goes on the 2017 return not the 2018 return.

If the refund was issued in 2017 but you did not get or cash it until 2018 it still belongs on the 2017 return. If you put it on the wrong tax year you could have issues.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend for a 1099-G (State refund) received in 2018, described as a 2017 1099-G, for tax year 2016?

Hi Critter,

Thank you. A picture does say a thousand words.

Yes, The big box does say 2017.

The notice date is 02-Jan-2018

The Box 3 shows, "Box 2 amount is for tax year: 2016"

The amount was paid and deposited in 2017.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend for a 1099-G (State refund) received in 2018, described as a 2017 1099-G, for tax year 2016?

When did you get the 1099G? If you got it in 2018 why didn't you enter it on your 2017 return?

But you might not need to enter it. Or if you did it might not be taxable.

A State Tax Refund is taxable if you itemized deductions on that prior year's 2016 federal return and took a deduction for state income taxes instead of the sale tax. You got a deduction benefit for it so now you have to include it as income. If you took the standard deduction or filed a 1040EZ or 1040A for 2016 it is not taxable and you don't need to report it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Newby1116

New Member

pv3677

Level 2

michaelaustin768

New Member

wado-sanchez2014

New Member

az148

Level 3