- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to amend China treaty $5000 on Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

Hello,

I am eligible for the US-China treaty $5000 exemption. I already filed tax return on Turbotax, but I forgot to add the treaty. I found this answer regarding to amendment:https://ttlc.intuit.com/community/tax-credits-deductions/discussion/form-1042s-on-income-tax-treaty-...

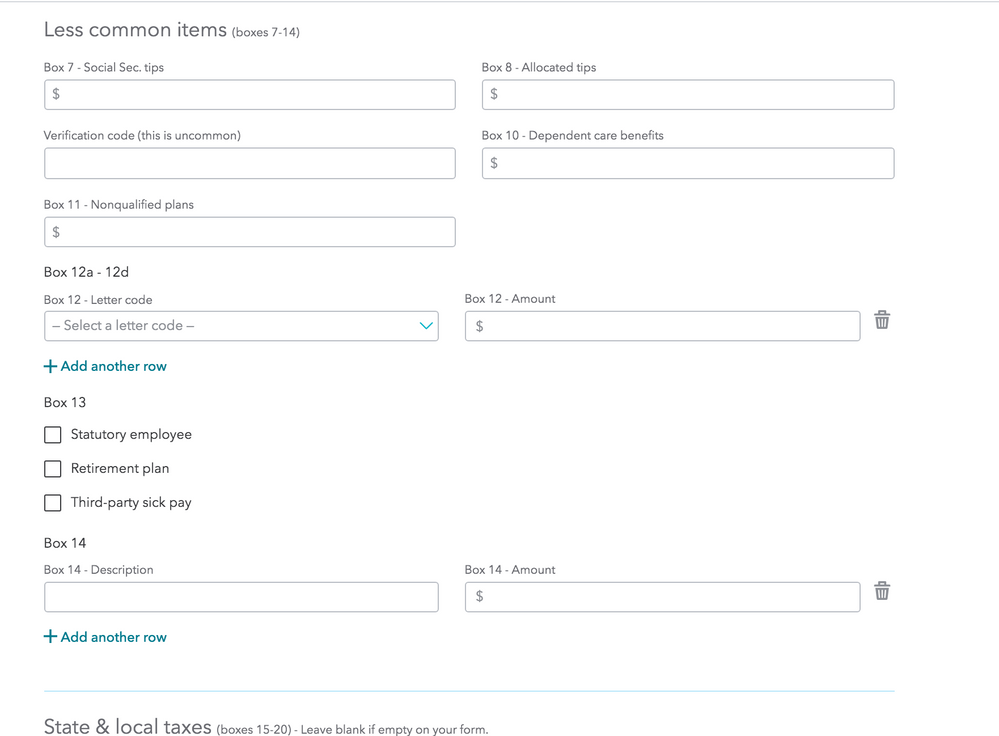

When I tried to amend on TurboTax, I edited the W-2 form, under "Less Common Income" I did not find "Miscellaneous Income". I tried to add a row under Box 14, but could not enter the negative number (-$5000). Please advise how can I amend the 2019 tax return for the treaty exemption!

Thank you!!

Kate

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

The edit is not in the W-2 section of TurboTax.

Open your return:

- Click on Wages & Income at the top of the screen

- Scroll down to All Income and click on it if needed to open

- Scroll all the way down to the bottom of the screen

- Click on Less Common Income

- Scroll all the way down to Miscellaneous Income, click start

- Scroll all the way down to Other Reportable Income

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

To enter the negative amount in the Miscellaneous Income Line 21, you would:

- Under the Income & Expenses find the Less Common Income - Select Show more

- Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable income

- On the next screen Select Yes

- Enter the negative number with the description of Form 8333

You will need to complete Form 8333 and mail it in with your return showing your Treaty-Based Return Position Disclosure

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

Thank you for the reply. But i guess the form was changed this year. I did not see "Miscellaneous Income" under "Less Common Income", neither the "show more" selection. Please see the screenshot.

Please advise. thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

The edit is not in the W-2 section of TurboTax.

Open your return:

- Click on Wages & Income at the top of the screen

- Scroll down to All Income and click on it if needed to open

- Scroll all the way down to the bottom of the screen

- Click on Less Common Income

- Scroll all the way down to Miscellaneous Income, click start

- Scroll all the way down to Other Reportable Income

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

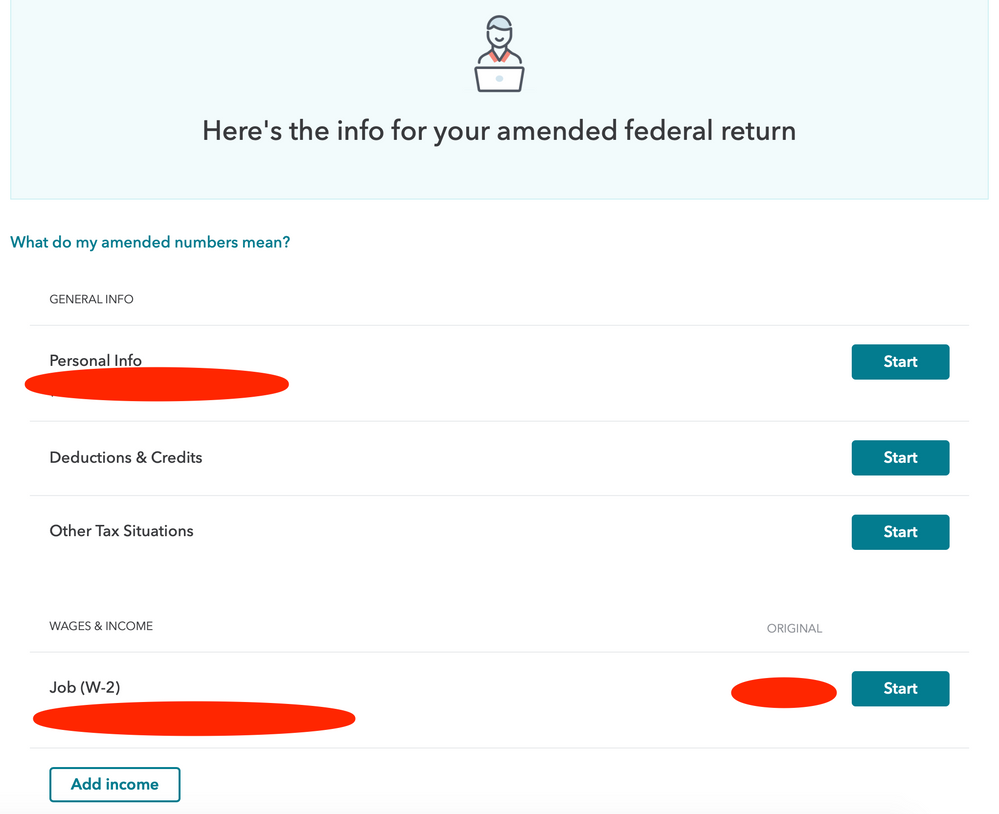

I could not find the Wage&Income at the top of the screen. If I click on Job(W-2), it will be the W2 form, still cannot find the "miscellaneous income"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

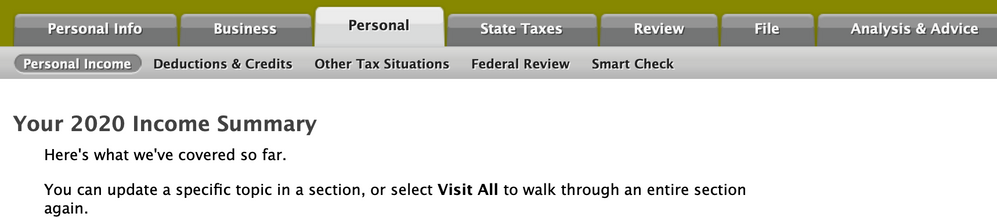

To enter the tax exempt amount in TurboTax online program, here are the instructions:

- Report your full income under the appropriate section. Then enter the treaty exempt amount as negative amount (e.g. -5000) under Federal Taxes / Less Common Income / Miscellaneous Income 1099A, 1099C / Other Reportable Income. See image below

- Download and fill in a Form 8833 from IRS to claim an exception. https://www.irs.gov/pub/irs-pdf/f8833.pdf

- You cannot e-file. You can still use the TurboTax program to prepare your tax forms, but you need to print them out and submit by mail along with the form 8833.

This amount should show on line 8 of Schedule 1 and Form 1040. Although it is an offset, the IRS requires you to show that on your return for reporting purposes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

Should it be Form 8833?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

Yes. to claim an exception, it's the Form 8833 https://www.irs.gov/pub/irs-pdf/f8833.pdf

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

I've already filed my return and it was accepted. Is it in the same place when I try to amend the return? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

To clarify, did you file using Turbo Tax online?

@sophy

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

yes!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

@sophy Then yes, it is in the same section on an amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

Thanks! But I could not find the Wage&Income at the top of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

In your case, under Personal Income.

@sophy

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to amend China treaty $5000 on Turbotax

Thanks for this detailed reply. However, in my case (University of Southern California), the federal wages has already been deducted 5000, e.g. state wage $15250 (box 16), but wages is $10250 (box 1). In this case, I dont need to enter the -5000, only need to attch 1042-S and form 8833, correct?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

gateranger164

Level 3

jsefler

New Member

frankfei

New Member

captmdismail

Returning Member