- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to Amend 2020 CA State Tax along? (NOT federal tax)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

Hello, I just submitted my 2020 federal and California Tax return on Turbo Tax Home and Business. And the status of both are "Accepted" already. I suddenly found I forget to include a minus mark on on of the CA numbers, which is different from the federal number, in one of my K1 form that I need to manually entry during the CA State filing process. This negligence of a minus sign caused my CA income completely wrong. How can I amend and resubmit my 2020 tax retunr to CA again on Turbo Tax? I can't find it? Please help!!

FYI, there is no change on my federal tax return for my situation as the numbers on my Fed return is correct. Please instruct the correct step. Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

Yes, you can amend just your state return. The steps are identical to filing a federal amended return initially. To do this in TurboTax, see: I need to amend my state return which provides the steps for both TurboTax Online and TurboTax CD/Download.

The directions for TurboTax Online from the above link:

- Sign in to your TurboTax account if you're not already signed in.

- Under Your tax returns & documents (you may need to scroll down or select Tax Home first), select Show to open a list of options.

- Select 2020 and select Amend (change) return, then Amend using TurboTax Online.

- Select the reason you’re amending and continue.

- Answer the questions about your federal return, even if they don't apply. You'll eventually get to the screen Let's get started on your state taxes.

- Keep going and we'll present you with the option to amend. In some states, this appears right at the beginning; in others, it appears towards the end of the state interview.

- When finished, we'll provide printing and filing instructions for the amendment. Your state may take several months to process it.

Once the amendment is triggered, and the correction has been completed, follow the prompts for how to submit it to the state. California requires amended returns to be mailed in. TurboTax will provide you all necessary instructions to file including the address for the mailing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

Yes, you can amend just your state return. The steps are identical to filing a federal amended return initially. To do this in TurboTax, see: I need to amend my state return which provides the steps for both TurboTax Online and TurboTax CD/Download.

The directions for TurboTax Online from the above link:

- Sign in to your TurboTax account if you're not already signed in.

- Under Your tax returns & documents (you may need to scroll down or select Tax Home first), select Show to open a list of options.

- Select 2020 and select Amend (change) return, then Amend using TurboTax Online.

- Select the reason you’re amending and continue.

- Answer the questions about your federal return, even if they don't apply. You'll eventually get to the screen Let's get started on your state taxes.

- Keep going and we'll present you with the option to amend. In some states, this appears right at the beginning; in others, it appears towards the end of the state interview.

- When finished, we'll provide printing and filing instructions for the amendment. Your state may take several months to process it.

Once the amendment is triggered, and the correction has been completed, follow the prompts for how to submit it to the state. California requires amended returns to be mailed in. TurboTax will provide you all necessary instructions to file including the address for the mailing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

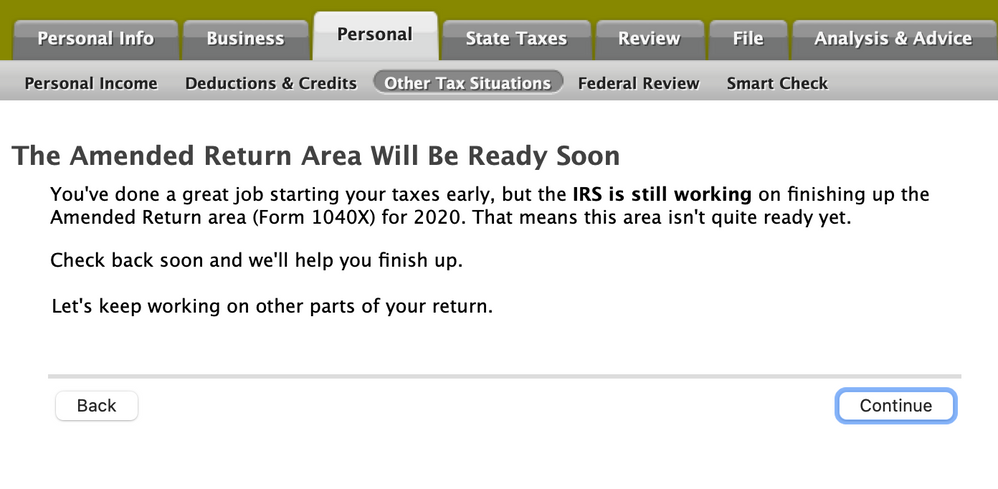

After I did the following and it's showing me the amend form is not ready yet. Please see the attachment. Do you know when am I allowed to amend the CA state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

The online version of TurboTax shows the Explanation page for the CA amended return is available now.

For information on the expected availability of state TurboTax forms please refer to the following link and select the version of the software you are using:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

I don't understand your reply.

"The online version of TurboTax shows the Explanation page for the CA amended return is available now."-- I'm using Turbo Tax Home and Business for Mac. And I already provided my screenshot in the previous reply, which shows is not available. Where can I amend?

"For information on the expected availability of state TurboTax forms please refer to the following link and select the version of the software you are using: TurboTax Expected Availability Dates for state forms "-- I clicked your link, it's a plain page. Nowhere to select the version of the software. It just shows a lot of forms name which is not helpful. I'm not amending a single form. If a change a number on CA K-1, a lot of numbers on other forms will change. I need to guidance on what should I do, where should i click, when can I amend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

2020 Amend is not yet available in TurboTax. We expect it to be available in late March. When amend is available you will walk through the amend interview and make any changes needed. Do not attempt to make any changes until the amend function is working.

You generally must file an amended return within three years of the date you filed the original return or within two years after the date you paid the tax, whichever is later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

Thanks for your clarification. The previous person's answer said Amend is available now. So I spent so much time finding it and it makes me confusing. I will check again in late March in this way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Amend 2020 CA State Tax along? (NOT federal tax)

By going through the entire federal process, does it give you an option to ignore amending the Federal portion? Or does data get saved as if the Federal has been amended? I don't want to alter anything but credits on my CA state return. I don't recall TurboTax prompting me for the CA EITC which I qualify for, and could allow me to qualify for the CA Golden Stimulus.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

madelkat

New Member

jbilltbill

New Member

danielle

New Member

bk1999

Level 1

weafrique

Level 2