- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How do I add my overtime

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my overtime

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my overtime

If your overtime income is included in box 1 of the W-2 or is shown in box 14, then after you complete entry of the W-2, on the following screen check the Overtime box and continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my overtime

The OBBA has introduced a new deduction for overtime pay from tax year 2025. You may deduct up to $12,500 of qualified overtime premium on your Federal tax return (up to $25,000 for MFJ). The deduction is gradually phased out if your MAGI exceeds $150,000 ($300,000 for MFJ). The deduction is for the overtime premium, which is the portion over your regular pay.

For tax year 2025, your employer may list non-taxable overtime in box 14 of form W-2 with a specific label like "FLSA OT Prem". You might also receive a separate year-end statement giving you the amount. Otherwise, you have to calculate the overtime premium to enter on your tax return.

In TurboTax Online, this is how you enter the qualified overtime premium:

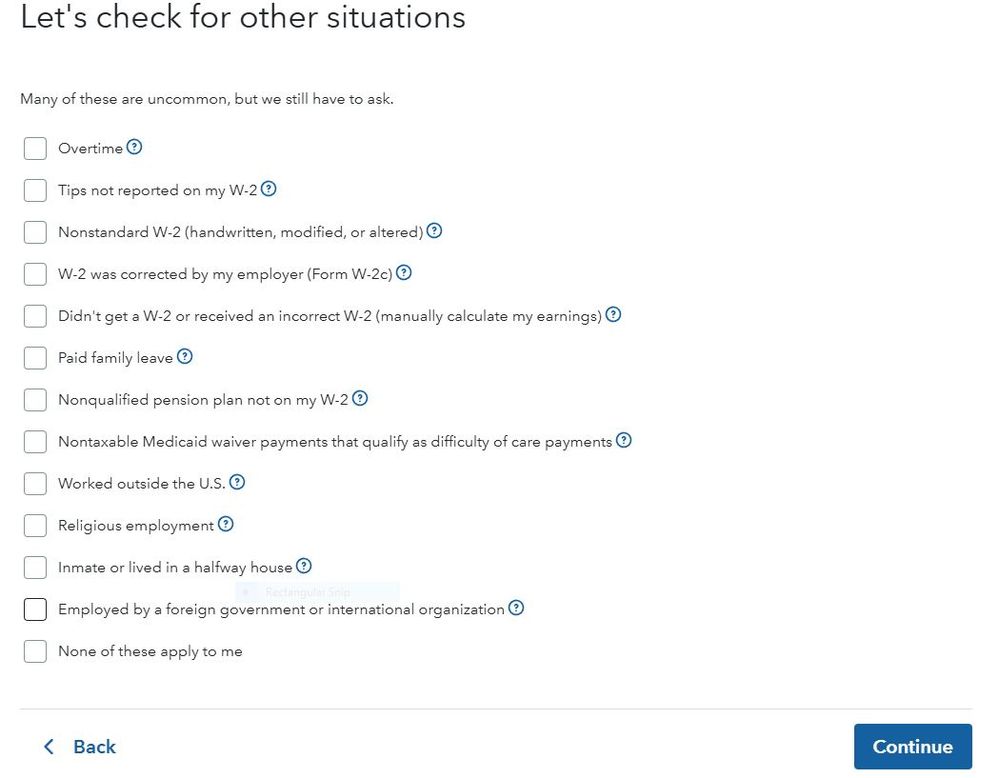

- After entering your form W-2, you'll see a screen titled Let's Check for Other Situations

- Put a checkmark on Overtime and click Continue

- Follow the TurboTax questionnaire to enter your qualified overtime premium

- This deduction will transfer to Schedule 1-A of your form 1040, with that amount flowing to line 13b of your form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

larryawilmoth

New Member

siplejustin

New Member

tom

New Member

c-franklin45

New Member

bleeriegler

New Member