- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

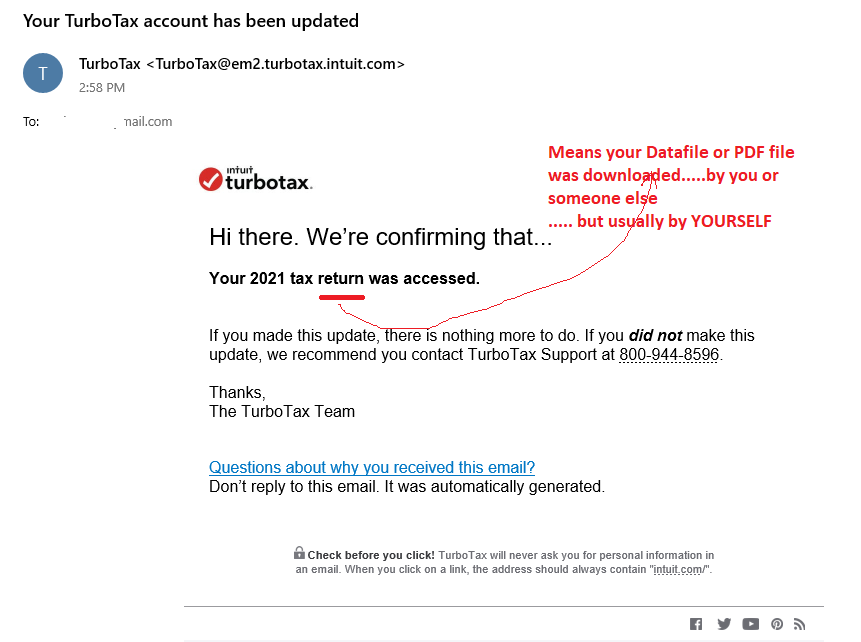

Did the email look like the following?

IF so, and if you recently downloaded one of your PDF or tax files to yorur computer...then that is the email they send out . Using proper tax "Terminology. A "Return" is your tax data that you prepare to send to the IRS. A "Refund" is what you might get back (if you don't owe).

Thus your tax "return" being accessed usually just means you recently downloaded a copy of your file to your computer (not your "refund")....if you didn't then contact TTX thru the 800 number provided......we can't do anything here.

____________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

In addition to your confusion over the terminology ("return" and "refund") it seems like you are saying that you moved after you filed your tax return and changed banks, and have not received your refund. If your refund went to the wrong (closed) bank account, it would have been sent back to the IRS. Then the IRS would mail a check to the address on your tax return. Does your tax return have the wrong (old) address? Did you change your address with the IRS so they can mail your check to the current address?

https://www.irs.gov/faqs/irs-procedures/address-changes/address-changes

And....did you choose to pay your TurboTax fees by having the fees deducted from your federal refund?

If you chose to have your fees deducted from your federal refund, but entered wrong or closed bank account information for your direct deposit, you are going to have an aggravating, frustrating situation. Your refund will go back to the third party bank. The third party bank might issue and mail you a check, or they might send your refund back to the IRS and then you will have to wait for the IRS to mail you a check.

If the third party bank mails the check, it will come in a plain envelope via first class mail so make sure you open all mail and do not assume anything is junk mail without opening it. While you are waiting, make sure that the address you entered on your tax return is correct, or your problem will be even worse.

When you choose “refund processing” your refund goes FIRST from the IRS to the third party bank. Then the bank takes your fees out of your refund and sends the rest of the refund to you.

How can I see my TurboTax fees?

https://ttlc.intuit.com/questions/2565973-how-do-i-review-my-fees-in-turbotax-online

What is Refund Processing Service?

Santa Barbara Tax Products Group, LLC (SBTPG) is the bank that handles the Refund Processing Service when you choose to have your TurboTax fees deducted from your refund. This option also has an additional charge from the bank that processes the transaction.

You can contact them SBTPG, toll-free, at 1-877-908-7228 or go to their secure website www.sbtpg.com

https://ttlc.intuit.com/questions/2580357-who-provides-the-refund-processing-service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

Did the email look like the following?

IF so, and if you recently downloaded one of your PDF or tax files to yorur computer...then that is the email they send out . Using proper tax "Terminology. A "Return" is your tax data that you prepare to send to the IRS. A "Refund" is what you might get back (if you don't owe).

Thus your tax "return" being accessed usually just means you recently downloaded a copy of your file to your computer (not your "refund")....if you didn't then contact TTX thru the 800 number provided......we can't do anything here.

____________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

In addition to your confusion over the terminology ("return" and "refund") it seems like you are saying that you moved after you filed your tax return and changed banks, and have not received your refund. If your refund went to the wrong (closed) bank account, it would have been sent back to the IRS. Then the IRS would mail a check to the address on your tax return. Does your tax return have the wrong (old) address? Did you change your address with the IRS so they can mail your check to the current address?

https://www.irs.gov/faqs/irs-procedures/address-changes/address-changes

And....did you choose to pay your TurboTax fees by having the fees deducted from your federal refund?

If you chose to have your fees deducted from your federal refund, but entered wrong or closed bank account information for your direct deposit, you are going to have an aggravating, frustrating situation. Your refund will go back to the third party bank. The third party bank might issue and mail you a check, or they might send your refund back to the IRS and then you will have to wait for the IRS to mail you a check.

If the third party bank mails the check, it will come in a plain envelope via first class mail so make sure you open all mail and do not assume anything is junk mail without opening it. While you are waiting, make sure that the address you entered on your tax return is correct, or your problem will be even worse.

When you choose “refund processing” your refund goes FIRST from the IRS to the third party bank. Then the bank takes your fees out of your refund and sends the rest of the refund to you.

How can I see my TurboTax fees?

https://ttlc.intuit.com/questions/2565973-how-do-i-review-my-fees-in-turbotax-online

What is Refund Processing Service?

Santa Barbara Tax Products Group, LLC (SBTPG) is the bank that handles the Refund Processing Service when you choose to have your TurboTax fees deducted from your refund. This option also has an additional charge from the bank that processes the transaction.

You can contact them SBTPG, toll-free, at 1-877-908-7228 or go to their secure website www.sbtpg.com

https://ttlc.intuit.com/questions/2580357-who-provides-the-refund-processing-service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I received a email saying they wanted to confirm I accessed my 2022 refund And no I didn’t receive it. So I’m assuming some else accessed my refund

Turbotax might send you an email about accessing your tax return (the information you send to the government about your income and deductions).

Turbotax will never send you an email about your tax refund (money back from the government) because that is paid directly from the IRS to the bank you used, and Turbotax doesn't have access to that information. In some cases, you might use a Turbotax partner bank, but you still have to talk to the bank, because the tax program side does not have access to your banking information.

If you can be more clear on what exactly you are trying to figure out, we may be able to provide better advice.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

J3rkym4n

New Member

dianecarey234

New Member

dcofran

New Member

Lisa-Stummeier

New Member

richhicklin

New Member