- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Can I amend my federal return ONLY (not state) on TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

First amend the fed then simply skip the state section. In the FILE tab only choose to efile or mail in the fed amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

If there is no change to the state tax return then there is no need to amend the state return. After you have completed the federal amended return go to the File section of the program and e-file the 2021 amended federal tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

I can't seem to find the FILE tab for the life of me. Based on my Google search, it sounds like I'm not the only one having this issue. Could you please help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

@tpines wrote:

I can't seem to find the FILE tab for the life of me. Based on my Google search, it sounds like I'm not the only one having this issue. Could you please help?

Using the TurboTax online editions, Click on File on the left side of the online program screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

We must have different versions of TurboTax... I cannot get "file" to pop up on the left.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

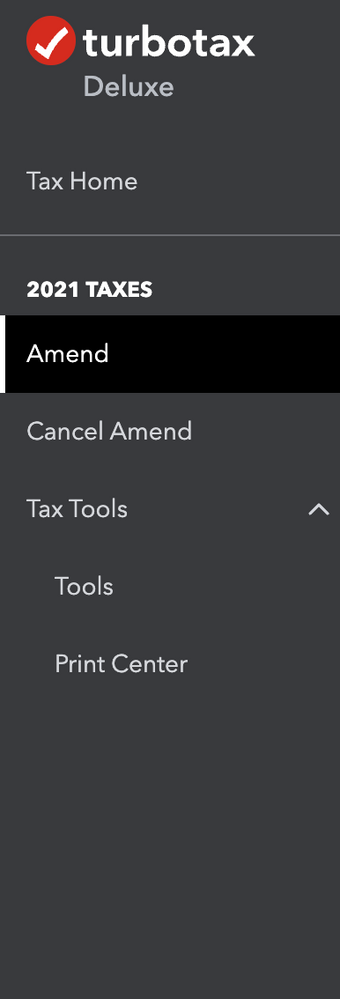

Ok ... you are not IN the return ... to get back in click on the amend option. Once in the return you will see the other menu will be available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

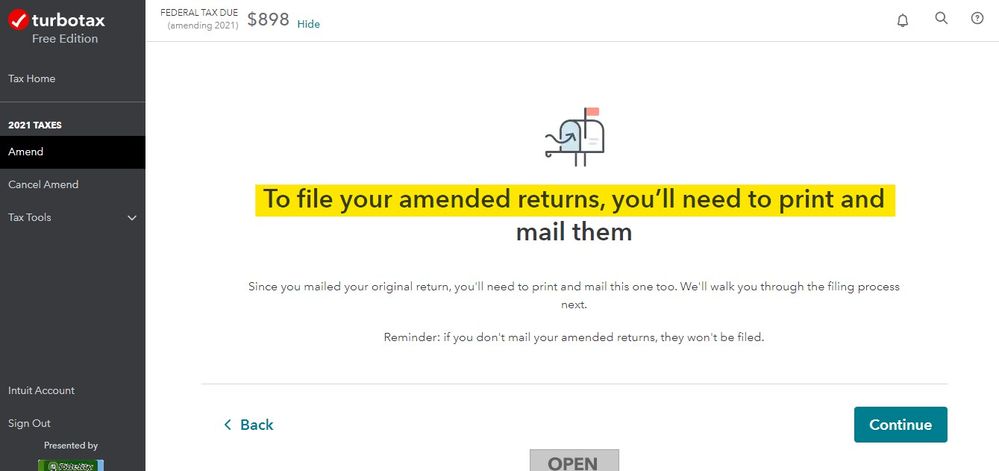

Ok ... did you efile the original return using this TT account ? If you did not then you can only mail in the amended return. Once you have completed the amendment interview and there are no more issues to correct the option to print the return for mailing will be presented :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

Thanks for the response! This is the menu I get when in the return (I hit the amend option and have been filling in the information). And yes, I did file the original return on TurboTax. I'm not sure why I'm not getting all of the menu options on the left.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

You will not ... they have changed the amendment system recently it seems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

@Critter-3 is the online different than the desktop? since much of the data for state returns comes from the federal inputs wouldn't certain federal changes for the amended carry to the state? I realize for amended you can choose to e-file the federal but not state and certain federal changes will only affect the federal. but is there a way to stop federal changes that would also change the state from doing so?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

you stated I do not need to amend my state return if there is no change to the state. I amended Fed because I found a "hidden" treasury direct 1099-int after I filed (they sure do not communicate well). This interest is not taxable by the state although it appears as a "subtraction" from the federal taxable income on the state tax form. So the fact that I sent in an amended 1040 won't matter to the state because it doesn't change my state taxable income? Just checking.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I amend my federal return ONLY (not state) on TurboTax?

It depends. Can you clarify what state return you are filing? Depending on your state, you may need to file an amended return simply because you filed an amended federal return. Also, if your return starts off with your federal adjusted gross income and subtracts out this interest, those amounts on your original state return would not be accurate after you file your 1040-X.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

moumourocks

New Member

krzysio

New Member

tazeen-m-ali

New Member

mbell3711

New Member

mbell3711

New Member