- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Amendment return disappeared

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

Hi,

About 8 months ago I filed a 1040X.

After 3-4 months, it appeared into the tool "Where's My Amended Return", and I decided just to wait, being a pandemic going on.

Today, after several weeks I was not checking, I went into the tool "Where's My Amended Return", and now it says that there is nothing pending for me.

What's going on? Did they just drop my adjustment?

I tried to call the IRS, but I had no way to speak with an actual person.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

It is not unusual when the return goes from department to department for the WMAR? tool will not show any progress report so don't panic. Amended returns are taking 6 months or more to process this year.

You can try calling to check the status of your refund at the IRS website.

800-829-1040

First choose your language.

Then 2

Then 1

Then 3

Then 2

When asked for SSN do nothing it will ask twice

Then 2

Then 4

You should then be transferred to an agent, but there is likely to be a long wait.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

Thanks for the answer.

I'm not concerned about the timing, but about the fact that for some months I saw something, and now I don't see it anymore

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

Again not unusual ... in fact the tool may have no info for days or even weeks even after you got the refund. The tool is often not correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

I have some updates on this.

After months, it looks like something changed on the website, but I'm quite puzzled:

The website now says that everything has been completed (In January) and:

"We processed your amended return on January 15, 2021. The adjustment on your account resulted in a refund. You should have received your refund and/or a notice if your refund was adjusted to cover past due obligations."

I never received a refund nor a letter....

I don't understand. Any suggestion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

Hello I’m going through the same thing, I was able to see my amended taxes online and now it’s saying no information found in records. I saw you said they updated it saying it was sent out but u didn’t receive it?!? Did you ever get this issue resolved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

This is the number to call about amended returns

800 :: 829 :: 0922

You should have a copy of your 1040-X when you call.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

In my case, it disappeared because they actually sent the check, but to my old address.

Once I let them know, they resent after a couple of weeks the check to my new address and everything worked out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

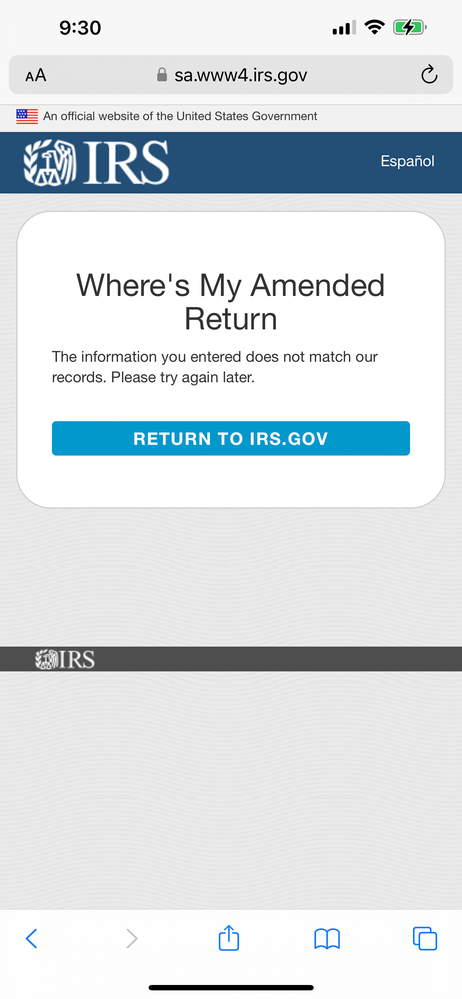

Ok I was seeing my refund was saying processing at first but now when I search nothing pops up and it says this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

This happens from time to time for various reasons ... the IRS system could be in a maintenace cycle or your return is inbetween departments in the processing system or you are checking too often and got "locked out". Don't worry and check again in a few days. Also be aware that amended returns are taking more than 6 months on average to process so just check once a week.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

Same here mine disappeared after being up for a week. Call the number says can't find. But it was excepted by the irs. Please any ideas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

As already mentioned ... as returns go thru processing they may not show up on the WMR? tool and this is normal. The amended return will probably take 4 months or much longer to process AFTER the original return has been fully processed and there is nothing you can do to speed it up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amendment return disappeared

Thank you for the trick! It worked for me to get connected with a IRS representative.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jasonrissa

New Member

hammer15026

New Member

vmojica256

New Member

user17724059922

New Member

wja

Level 3