- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Accidentally efiled second federal; used wrong data

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

I have already efiled my 2022 federal taxes and have received a refund. I was just now using TurboTax to run various scenarios for charitable giving (using different entries than actual). However, after TurboTax updated there was a button to continue (I forget the exact prompt) at which point TurboTax said, "Congratulations. The IRS has accepted this return."

In the proposed TurboTax scenario I didn't indicate anywhere that this was an amended return. Is there some way to let the IRS know that this return was submitted in error? (I haven't yet received any response from the IRS. )

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

that should not be possible. a second e-filing with the same SSN as a previous filing while possible should result in you getting a rejection e-mail. look for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

"(I forget the exact prompt)"

It's pretty hard to e-File accidentally but somehow you managed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

Log back in ... scroll down ... click on ADD A STATE to let you back in ... then click on TOOLS ... then PRINT CENTER and save a PDF of the current return ... do you see a 1040X in the file ? If so you may have filed an incorrect amended return. If you did then wait for the IRS to process the incorrect amended return (could take a few months) and then amend the return again to undo the false changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

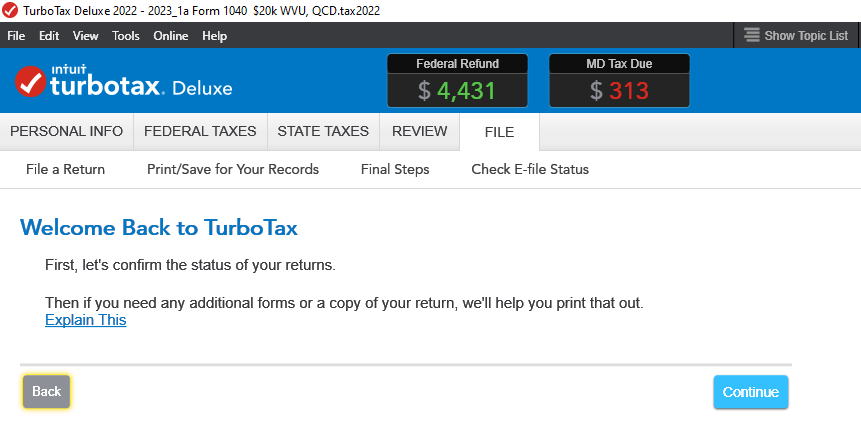

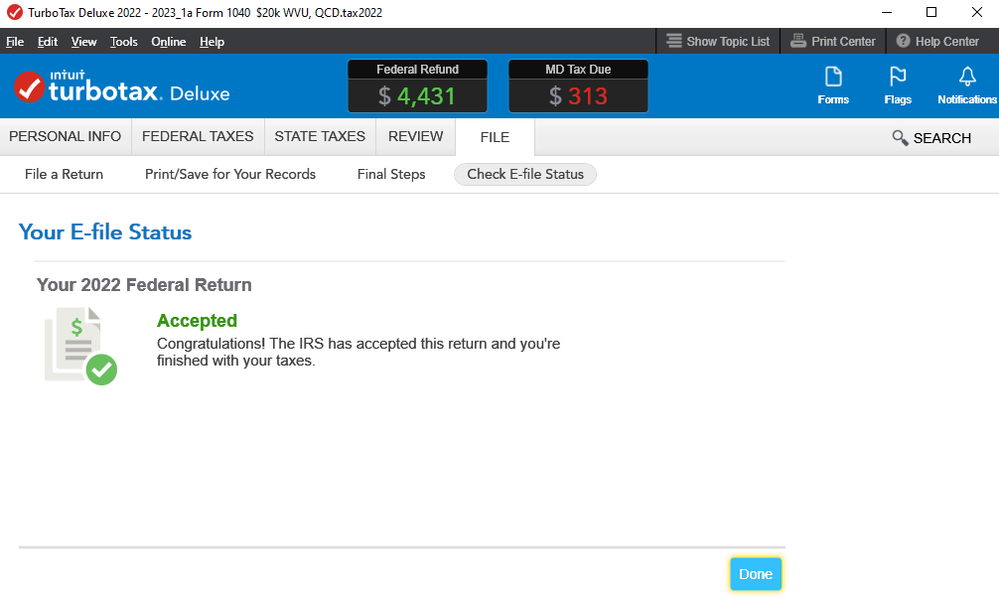

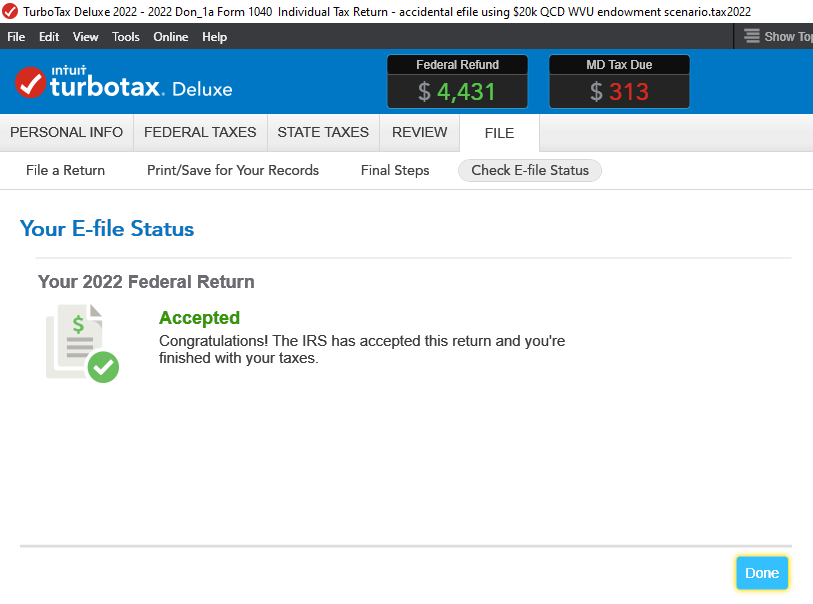

I'm reasonably sure that the following pic shows the prompt. (This occurs whenever I load one of my unfiled charity scenarios. Now I just click on \View\Forms to ignore the prompt.) When I clicked on "Continue" it efiled. (See second pic.) There was no warning prompt such as, "Are you sure you want to efile?" So perhaps it's really not so difficult to accidentally efile.

====================================================================

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

That seems normal. That is the status of your return. The first one was Accepted. It won't let you efile again unless it takes you though all the FILE steps and gives you the big SUBMIT button. Did it give you all 3 steps again?

Have you checked the filing status here?. Open your return and go up to menu item

File > Electronic Filing > Check Electronic Filing Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

Critter-3 --

I am using the downloaded version, not the online, so I can just open the accidental efile.

After I save the pdf, where would I look for the 1040X? (The top of the form says "1040-SR".) Note that I never did anything to indicate that I was filing an amended form -- I just clicked the Continue button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

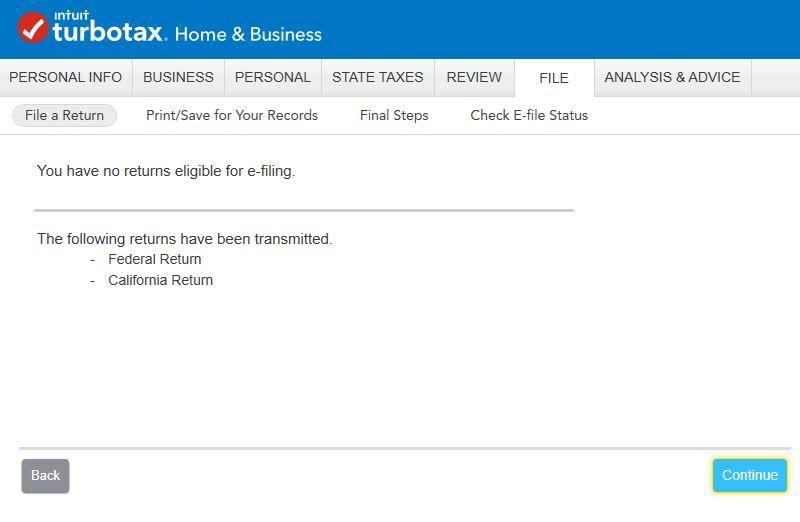

I opened my test return. It says the same thing. Try clicking on that first File a Return tab and keep going through and try to efile it again. At the end it should tell you it was already filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

VolvoGirl --

There was never a big SUBMIT button. TT just submitted after I pressed the Continue button (see pic in previous post).

When I check the filing status I get --

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

VolvoGirl --

The file that was accidentally efiled had a different name than the one that I officially filed. Is that possibly why TT might have allowed a second efile? (What criterion does TT use to determine whether a form has already been efiled?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

No you did not efile again. That's just the status of your actual filed return. Even in my test file with another name it shows that, because I'm in a copy of my actual return after I had filed. You can't efile a ssn a second time. Even if you put in a fake ssn the IRS would reject it. Go ahead and TRY to efile again, it won't let you Submit it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally efiled second federal; used wrong data

@dculp still suggest looking for the reject

it will reject if the SSN has already been used

it will reject if the SSN / last name combination doesn't match the IRS file.

That 'congratulations' message may simply be the message from the original efiling - it is permanent on the file.

unless you followed ALL the steps of the "file a return" tab, you did not efile again. (and if you did, it should reject)

I would do nothing more until you get an email of accept or reject (or texts).... but I bet you get nothing - because you didn't efile a 2nd time 🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amangano86

New Member

douglas_ramsey

New Member

MPMTCP

New Member

kevinsfour

New Member

LorindaJ

New Member