- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- A IRS letter says I owe $800. Turbo Tax said $400 REFUND? IRS web site my tax return said "Bal DUE/OVER Pymt using Computer Figures" $800. What does "per Computer" mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A IRS letter says I owe $800. Turbo Tax said $400 REFUND? IRS web site my tax return said "Bal DUE/OVER Pymt using Computer Figures" $800. What does "per Computer" mean?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A IRS letter says I owe $800. Turbo Tax said $400 REFUND? IRS web site my tax return said "Bal DUE/OVER Pymt using Computer Figures" $800. What does "per Computer" mean?

Don't know what that means. But a 400 refund to 800 tax due is a $1,200 difference.

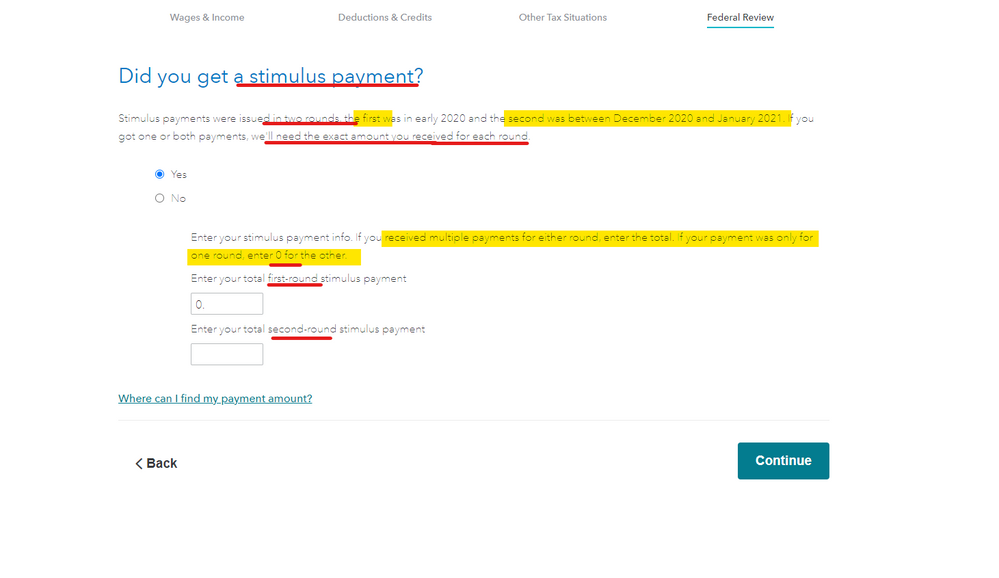

1200 sounds like the second Stimulus payment for married or Single with 1 dependent. Was 1200 on line 30?

A common adjustment is if you claimed the Recovery rebate credit on 1040 line 30 when you already got the Stimulus payment or got the second one after you filed. The IRS knows they already sent it to you. But you tried to claim it again on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A IRS letter says I owe $800. Turbo Tax said $400 REFUND? IRS web site my tax return said "Bal DUE/OVER Pymt using Computer Figures" $800. What does "per Computer" mean?

you e-filed, using your computer.

Per Computer is what you submitted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A IRS letter says I owe $800. Turbo Tax said $400 REFUND? IRS web site my tax return said "Bal DUE/OVER Pymt using Computer Figures" $800. What does "per Computer" mean?

"per computer" is the IRS's computer which they say is different from what you filed.

$1200 is defiantly the stimulus payment so did you make an error in entering how much stimulus you received in advance ? Did you get the second payment after you filed ? Did you accidentally put the first and second amount on the same line ?

If you want to check what you entered you can this way ... click on the REVIEW tab to get back to that section...

NOTE: When you open your return back up, do not make any changes in it if it's already been filed. If you later have to amend the return, it has to start off exactly as it was when it was originally filed.

- Log in and at the Tax Home or in the section "Your Tax Returns & Documents" for 2020, look for a link "Add a State."

- Click on "Add a State." (you don't really add one. That's just to open your return back up.)

- After the return is open, click in the left menu column on TAX TOOLS, then PRINT CENTER.

- Then choose "Print, save, view this year's return."

- The next screen should offer some options: "Just my tax returns", or "include government worksheets (optional)", or "include government and TurboTax worksheets (optional.)"

- See if one of those PDFs has what you need. The latter has the most pages.

NOTE: Remember all PDF tax documents and tax data files are very sensitive files, since they contain your personal ID info, financial data, and possibly bank account numbers, etc. Be sure to store them safely and securely to guard against computer theft, hacking, etc.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tbhemphill-comca

New Member

ohiogirl-cinci-r

New Member

AJ1017

New Member

melissa-chen66

New Member

Alar

New Member