- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Hi. I have used TurboTax to report my MODEST YouTube "ad revenue" for multiple years and usually reported it as "Other Income" since it was hobby income. YouTube used to classify the income as 1099-MISC "Nonemployee compensation" in box 7. This apparently changed in 2021 and they now report it on a 1099-MISC in box 2 as "Royalties" and I was not aware of it until I got a notice about a 2022 tax form from them. I then saw there was one from 2021. Thus, I think I need to amend my 2021 return (if I need to use Sched E or C -- I don't think I need Sched C and see my reasoning below). And also, I will need to know how to report it on the 2022 taxes when I get around to doing them.

My YouTube is a hobby of mine. It is NOT my business . It has always been a hobby that was not for profit but some videos were monetized. Before, it always seemed to neatly fall under the category of "hobby income" and was reported as such but Google is now reporting it as ROYALTY income on a 1099-MISC.

My income is extremely modest nowadays.

In 2021 (the one I need to amend), the total "Royalties" on box 2 is $14.25.

For the new 2022 one, the amount is $41.10 ($30 of that being from just one month where one video was popular -- usually I make no more than a dollar a month from it!)

Previous years: 2020 approx $50

2019: unknown but very low.

I used to make more videos which made more revenue in 2018 and before:

2018: $143.91 Was reported on box 2 of a 1099-MISC as Nonemployee compensation

2017: approx $47

2016 (when I used to do it more) was approx $100~150 or so.

Anyway, since YouTube is reporting it NOW as box 2 Royalties, am I required to use Schedule E or Schedule C or can I continue reporting it as "Other Income" as I believe it to be a hobby?

(I've read the thing about 3/5 years posting a profit means you "might have a business" instead of a hobby, blah blah many times but always considered it to be a hobby since most of the videos I made would generate ZERO revenue due to YouTube's broken copyright system but that's a whole other story).

Just to me, it is a hobby. I do it for fun and not for money. If I get a few dollars, I take it.

I would prefer not to have to use Schedule C and make it "self employment income" as I really do not believe it to be that. I have a full-time job now (and in previous years was too or before that, I was a student doing it as a hobby in free-time).

I heard you can use Schedule E but most people don't see either way (E or C) fitting what YouTube is. The tax codes just don't have anything similar.

"Other Income" / hobby income is very close to what it is from when I used to research it online before this change on the 1099-MISC from Google.

(I also read the thing about if an author makes only one book and never publishes new editions or new books, his royalties are probably on Sched E and not a business. If he publishes many books, he probably has an "active business", and would report royalties on Sched C.)

However, I don't believe that YouTube/Google arbitrarily changing the way they report the income from nonemployee compensation to royalties should change the way I report the income (correct me if I am wrong). As the income is the EXACT SAME, just Google is reporting to to the IRS as royalties now (so they can make money on WORLDWIDE creator's revenue on ads served/watched in the United States instead of NEC.

Sorry for rambling but I want to know if I can continue reporting it as Other Income, or if I need to put it on Schedule E or C. (I really hope not to do Schedule C and make it a "business" that makes like a dollar or so a month nowadays). It really is my hobby. If anyone wants to see the channel it is www.youtube.com/@shanekpop

I only recently started making content frequently again in the form of YouTube Shorts (which were NOT ABLE TO MAKE MONEY until just the other day 2/1/2023 is when those became eligible for ad revenue)

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Since you are now receiving Forms 1099-MISC with Royalties in Box 2, you should report them on Schedule E unless the activity becomes a trade or business, such as with book writers as you noted.

See LenaH's response to this thread for further explanation. When you enter the 1099-MISC, enter your income into Box 2. On the next screen, choose Investment income from property as this income should be reported on Schedule E.

See here for additional IRS information on the topic, under Royalties.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Thank you. When I choose Investment income from property, it wants a description and a location for this "property". What do I put for the description and location as these are royalties that are coming from this YouTube video/Google 1099-MISC? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Yes, you can use a general description such as "Video" or "intellectual property". You should use your home address as the address. I am assuming your do this work from your home, since you say it is a hobby.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Thank you. Since I am amending a return, it asks me if I still receive mail at an old address (which was correct when I filed in April of 2022). Even though this is amending a 2021 return, and I have moved since then, do I still select "no" and enter the new address current as of today in 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Yes, you should answer "No" and enter your current address.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Thanks for all the help. I'm at the last step and have a new problem so I posted a new question but in case you might know, I'll post it here too (https://ttlc.intuit.com/community/taxes/discussion/amending-return-says-i-didn-t-e-file-through-turb...)

Amending return - says I didn't e-File through TurboTax but I did

I am trying to electronically amend a 2021 return. I e-filed through TurboTax (although I had to re-install the program due to some computer issues). TurboTax had no problem opening the return and going through with amending it. But it won't allow the amendment e-file as it says "It looks like your prepared a federal amended return form 1040X. It also looks like you haven't e-filed the 1040 through TurboTax. To e-file the 1040X through TurboTax, you must have filed the 1040 through TurboTax. What you can do is to print and file the 1040X by mail."

Is there any way to get around this error and e-file or must I file by mail? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Last thing (I will just file by mail).

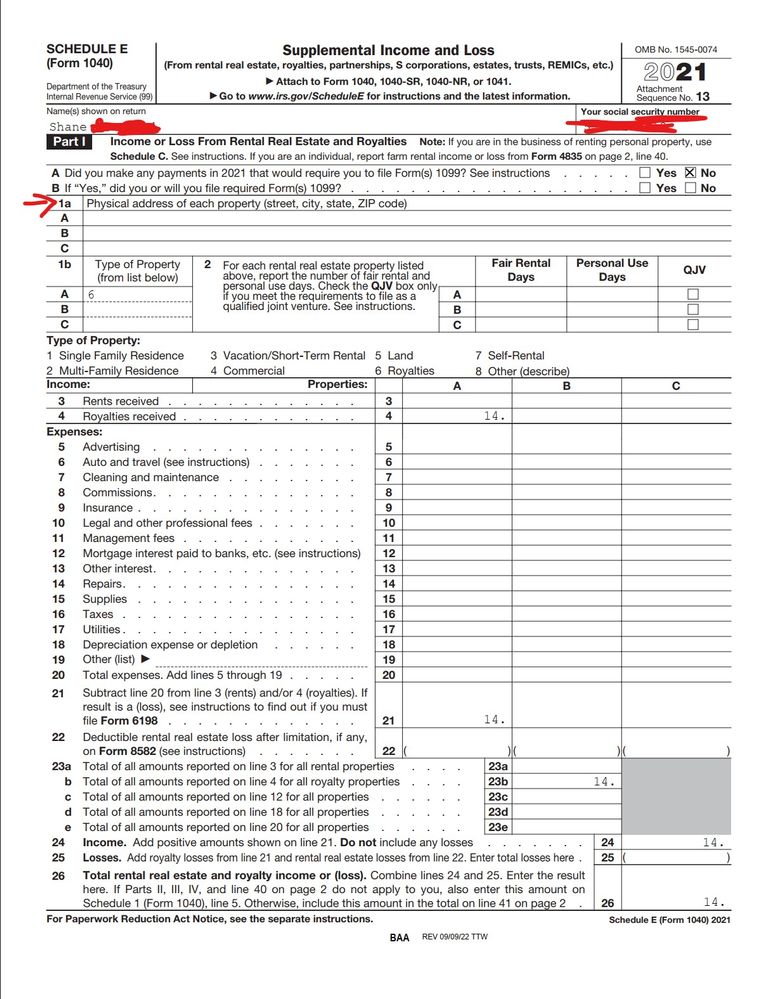

I put in intellectual property and my address, all that but I don't see it on any of the generated forms that TurboTax made for the amended return. Schedule E shows the amount of royalties ($14) but the "addresses" at the top are blank. I don't even see where the worksheets it had me filling out are. Is this wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Upon digging, I see the info that I typed for "description" and "location" in the Schedule E worksheet (to keep for records). But there are no addresses on Schedule E. Is it correct still? (see screenshot above). Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

There are a few reasons why your e-file submission may have some issues. Please see this TurboTax Help Article for assistance with solving those issues. More information on specific issues may be found here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

I appreciate the article but the program was reinstalled so it doesn't have any record of ever having e-filed my return. And I see no way to get those "records" back. I checked in the File menu and there are multiple selections for Electronic filing and the records show nothing there and there doesn't seem to be much it can do. The program is unaware that the return was filed. So, I think it needs to be filed by mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Again, the error reads as:

"It looks like your prepared a federal amended return form 1040X.

It also looks like you haven't e-filed the 1040 through TurboTax.

To e-file the 1040X through TurboTax, you must have filed the 1040 through TurboTax.

What you can do is to print and file the 1040X by mail."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

So we can take a closer look at your specific situation, please reach out to us directly using the Help Article here. This ensures you will get to the correct department as quickly as possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

YouTube/Google 1099 "Royalties" Sched E, C, or Other Income?

Rep on the phone said that 2021 e-filing ended October of 2022 for that tax season for all returns (incl. amended returns).

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

j-zee

New Member

bigmansax

New Member

air1erb

Returning Member

KaitlinSimone93

New Member

KarenL

Employee Tax Expert