- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- You can enter the estimated taxes you paid by following t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

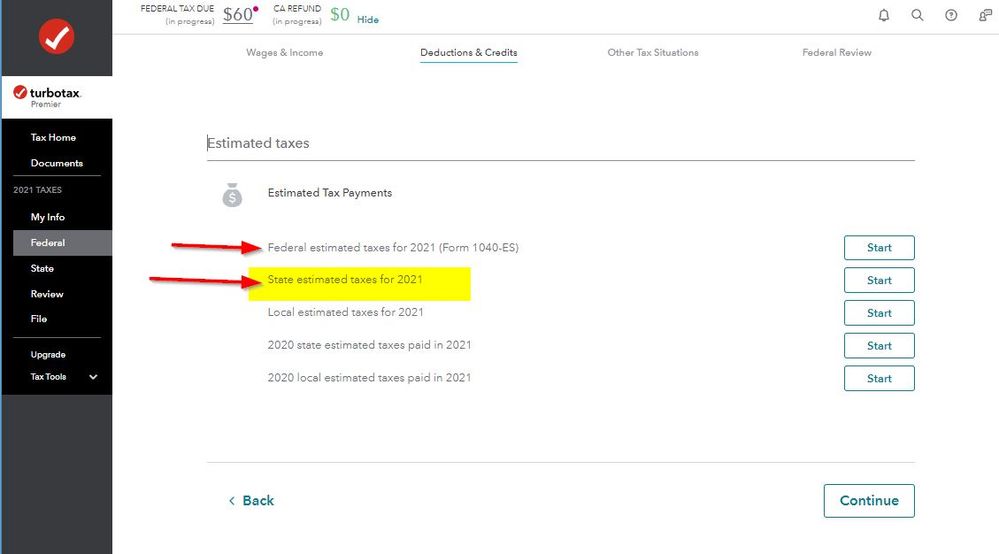

You can enter the estimated taxes you paid by following these steps:

- In TurboTax, open your tax return and click on Federal Taxes, then Deductions & Credits

- Under All tax breaks, locate the section named Estimates and Other Taxes Paid and click Show more

- Click on Start next to Estimates (see attached screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

or this screen shot from the online version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

This is a new forum layout. Some posts that have June 2019 dates are really older posts from the old forum that got moved over. So they might be for prior years and not current info. When they migrated over the dates got changed to June 2019. And the screen shots got deleted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

The original question was how to enter state estimated taxes ! The person answered for federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

You enter state estimated payments under the federal side (because they can be a federal itemized Deduction). THEN after you finish filling out the estimates under Federal you need to click on the State Tab at the top and start the state return over for it to update.

You have to pick the right state from the drop down box and enter the right payment dates.

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top (Personal for Home & Business)

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Estimated Taxes - click the start button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

Did you find it? I made a screen shot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter estimated state taxes paid?

Thanks

I now see where to enter the state estimated taxes paid

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michelle_corner

New Member

Rblot44

New Member

Chrissy-lee0515

New Member

jenny-cogswell

New Member

Cat_Sushi

Level 3