- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

The Review error sounds like you withdrew too many units of a cryptocurrency.

As an example, you purchased 10 units of crypto A. Then you disposed of 20 units of crypto A.

Did you download a .csv file from Coinbase? You may be able to review the transactions in the .csv file to see whether the entries have been coded correctly.

Join us for our Community Crypt event. Sign up here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

Please some details from turbo tax and sample csv file.

Error msg :

We need all of your transactions from all of your accounts to accurately calculate your cost basis.

Important:How to fix it: Go back and make sure you’ve added all of your exchanges or wallets. The most common reason for this error is when we’re missing a source.

See the specific errors that happened

What if I’ve already added every source?

Sample ADA entries from csv (I was not able to upload the file here).

| portfolio | type | time | amount | balance | amount/balance unit | transfer id | trade id | order id |

| default | match | 2022-03-07T02:11:07.046Z | -1476.34 | 2522.75 | ADA | 49 | xxx-0a26335413c3 | |

| default | match | 2022-03-07T02:11:07.060Z | -1200 | 1322.75 | ADA | 50 | xxx-0a26335413c3 | |

| default | match | 2022-03-07T02:11:07.080Z | -1046.41 | 276.34 | ADA | 51 | xxx0a26335413c3 | |

| default | match | 2022-03-07T02:11:07.089Z | -15.24 | 261.1 | ADA | 52 | xxx-0a26335413c3 | |

| default | match | 2022-03-07T02:11:07.103Z | -261.1 | 0 | ADA | 53 | xxx-0a26335413c3 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

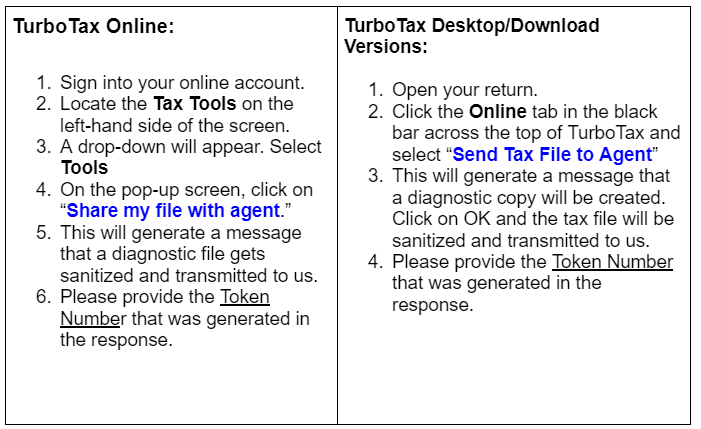

I would like to take a deeper look at this. However, I would need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

Thank you

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

@JamesG1 I gave you details and example below. Why don't analysis those ? Are you using auto replies? Have you gone though details ? About csv, I already said I could not find option to do and that's why I gave you those same transaction to analysis. I hope, now you can previous response and provide me details.

this is very frustrating support :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

XXX amount withdrawn is greater than what’s available from Coinbase Pro YYY -> These issues/validation errors are popping up even I continue for next step in crypto txns

If we enter the data provided on a "dummy" return, we likely will not get the same error message. Looking at a scrubbed version of your return allows us to see exactly what you are seeing minus your personal data.

Many times it takes a single box being clicked that shouldn't have been clicked to cause an error. We cannot duplicate that box clicked if we don't know it was clicked. If it is not an error that is a common error, we would not have a pinpointed solution without being able to see it first hand or duplicate it. This is why the request for a token number was made.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jcrouser

New Member

Perplexed in Los Angeles

Level 2

smiklakhani

Level 2

macey.karr

New Member

keenerbp

New Member