- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Worthless Stocks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worthless Stocks

I still own some of the stock which became worthless as the company filed the bankruptcy in 2024 (I didn't receive the 1099-B, as I still own the stocks, but I know this stock is not going to go up so I have to tax the Tax advantage this year by declaring them as worthless). I'm not seeing an option to enter worthless stock in Turbo Tax 2024. May I know where to enter the worthless.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worthless Stocks

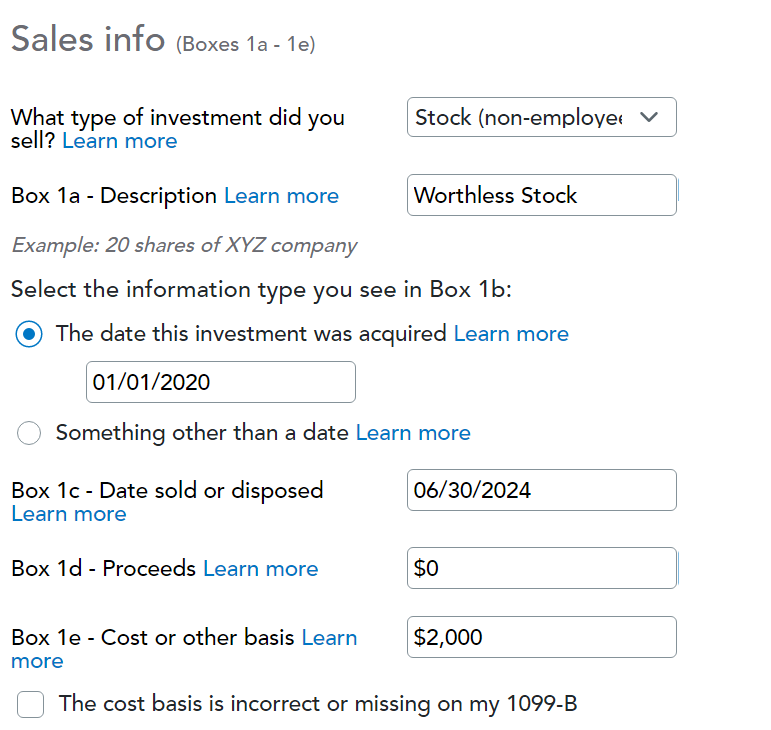

You enter an investment sale in TurboTax to account for the worthless stock. You list the proceeds of the sale as $0 and the cost equal to what you paid for the shares.

Follow these steps to enter the sale in TurboTax:

1. Navigate to Investment Income in the Wages and Income section of TurboTax

2. Choose the Stocks, Cryptocurrency, ... option

3. Skip the Import option

4. Choose the Stocks, Bonds, Mutual Funds option for investment type

5. Work through that section to find the Form 1099-B entry where you will enter the pertinent information to report the loss on sale of stock. You can enter "NA" for the name of the broker since you won't have one:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rskipton

New Member

dov-sugarman

New Member

6616jm

New Member

HOTMORA80

New Member

Uncle_Solo

Returning Member