- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Work Comp + SSDI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

Where do I report Work Comp when it has made my ssdi taxable?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

Workman's Compensation is not entered on a tax return. If you entered it somewhere on the tax return remove it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

These types of income are not taxable and are not reported on your tax return.

Both Workmen's compensation and SSDI are not considered when you prepare your tax return. If you receive an injury at work or suffer an occupational disease, the benefits you receive under the these plans are not taxed under federal law. I am not aware of any state that taxes them either.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

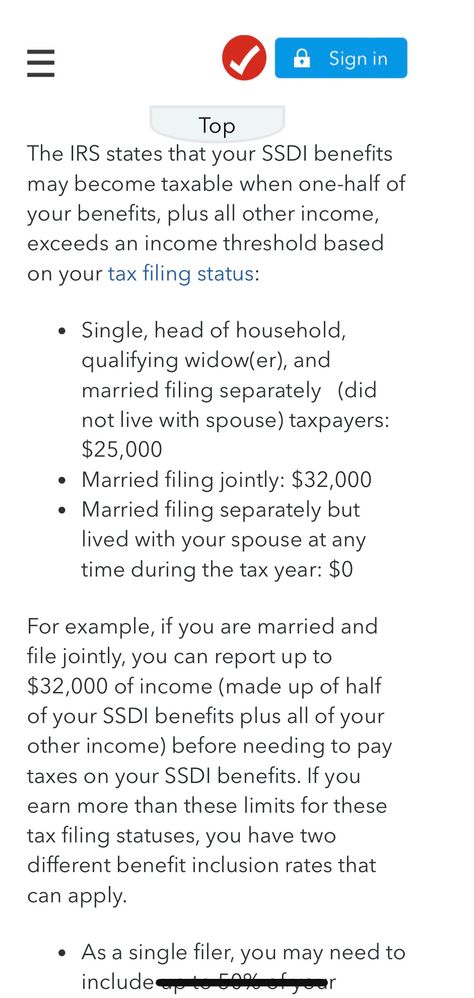

My WC puts my SSDI over the threshold and makes my SSDI partially taxable.

up to 25,000 not taxed

25,000 to 34,000 taxed on 50%

Over 34,000 taxed on 85%

I need to know where to put the WC. And get to the correct worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

@pennla wrote:

My WC puts my SSDI over the threshold and makes my SSDI partially taxable.

up to 25,000 not taxed25,000 to 34,000 taxed on 50%

Over 34,000 taxed on 85%I need to know where to put the WC. And get to the correct worksheet.

As already been stated not, twice. You do not enter anywhere on a tax return the income you received from Workmen's Compensation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work Comp + SSDI

That's only for other taxable income you need to enter on a tax return. WC doesn't count. It is not reported or taxable. There are lots of kinds of income you don't need to report like Child Support, Gifts you receive, cash inheritance.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarisabella

Level 1

julio89117

New Member

loomis3

New Member

bubbleychic04

New Member

bubbleychic04

New Member