- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

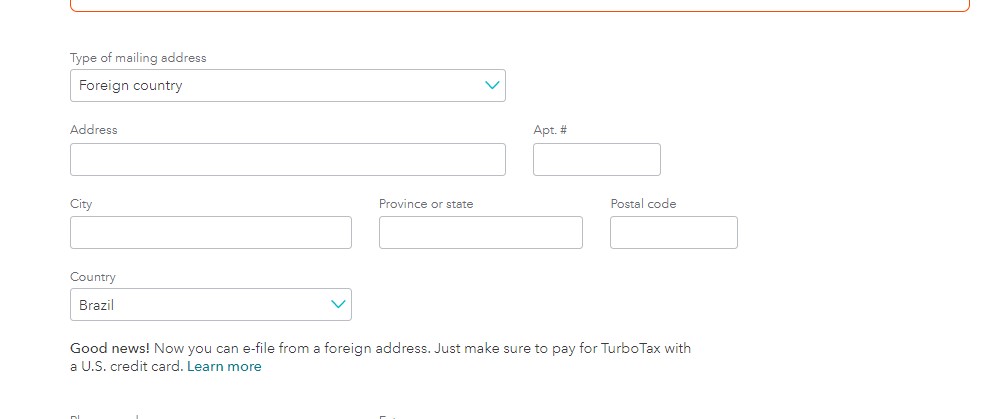

Just to verify you are trying to enter your foreign mailing address under "my Info" and it won't let you enter the foreign address in the fields?

- Login to your TurboTax Account

- Click "My Info" from the left side of your screen

- Please scroll down to “Mailing address” and click "Edit"

- Select "Foreign Country" as the "Type of mailing address"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

I was able to add a foreign address, however, when I try to e-file my taxes it keeps saying that Im missing the state and zip code. It wont let me file unless I type a US address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

Please try the following:

1) go back to the MY INFO section and change the address to the same one the US credit card is registered to

2) complete the FILE tab long enough to pay the TT fees

3) return to the address section of the MY INFO tab and put the actual foreign address back

4) complete the FILE tab again all the way until you can transmit the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

I paid the fees using a friends CC and his address without having to change the My info address. I can't e-file either for the above reason. It demands a State and ZIP code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why my mailing address is it not working? i follow all the steps for a foreign country and it's still not working

Yes, you can file federal (IRS) returns if you or your employer has a non-U.S. address. However, there are some restrictions regarding foreign-address returns:

- IRS regulations require a U.S. bank account to receive your tax refund, and you'll need a U.S. bank account (or credit/debit card with a U.S. billing address) if paying additional federal taxes owed.

- Like many stateside merchants, we require a U.S. billing address to pay for TurboTax if using a credit or debit card.

- If you're deducting fees from your refund with the optional Pay With My Refund service, you'll need a U.S. or APO/FPO/DPO address.

- Products like TurboTax Free Edition and TurboTax Easy Extension require a U.S. or APO/FPO/DPO address upon registration.

If your return is subject to any of these restrictions, then you won't be able to efile.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ridhamjoshi36

New Member

N7777

New Member

Jbrooksnw

New Member

jcrouser

New Member

ddm_25

Level 2