- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

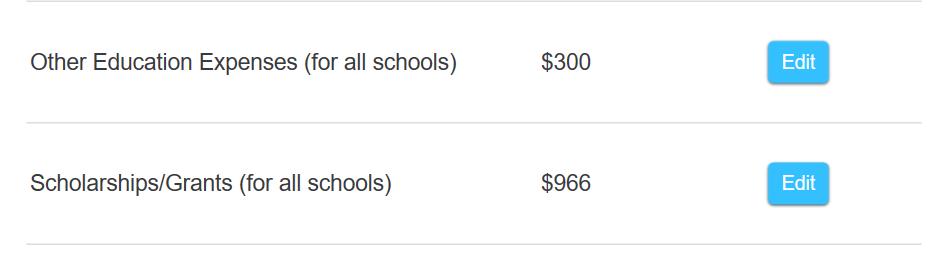

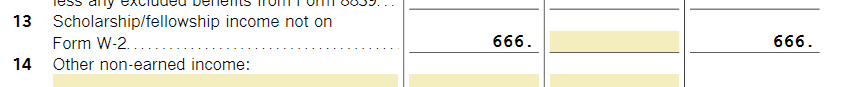

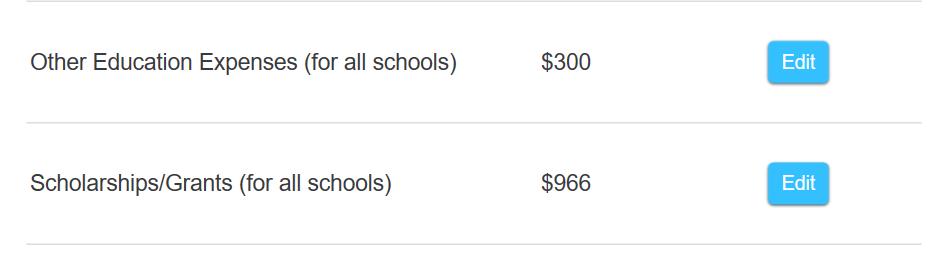

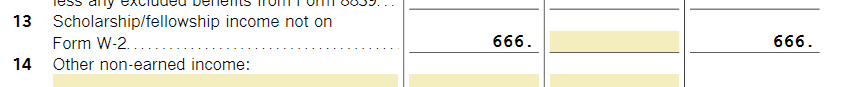

The $666 comes from your scholarship/grant in the amount of $966 less the $300 you entered for education expenses.

@seujai

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

Did you accidentally enter something in the W-2 field?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

I did not. There are only 2 items under "Your Income" which are Unemployment Income and Dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

Can you clarify where you are seeing the $666 in extra income on your return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

When clicking on "Federal Review" then "Why do I owe $x.xx?", it then gives me a breakdown of my total income. Underneath it says, "Your total income of $x.xx comes from adding up the $x.xx of ordinary dividends, your unemployment of $x.xx, and the $666 you earned at your jobs."

Again, I have not submitted any W-2 and I have even checked the W-2 section again to make sure. When adding up everything, my income is increased by the $666 that is stated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

If you are still getting an error, it would be helpful to have a TurboTax ".tax2021" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

The token number is 973221.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying that I have an extra $666 in income that I earned at my job? I only have 2 forms of income which are "Unemployment" and "Dividends.

The $666 comes from your scholarship/grant in the amount of $966 less the $300 you entered for education expenses.

@seujai

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkbrad

New Member

Idealsol

New Member

roybnikkih

New Member

gerald_hwang

New Member

ahkhan99

New Member