in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is my entire 2020 UI being applied to my 2020 AGI when I repaid several thousand dollars for prior years? Shouldn't that repayment come off the top?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my entire 2020 UI being applied to my 2020 AGI when I repaid several thousand dollars for prior years? Shouldn't that repayment come off the top?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my entire 2020 UI being applied to my 2020 AGI when I repaid several thousand dollars for prior years? Shouldn't that repayment come off the top?

You can deduct the payments if under $3,000 on your 2020 tax return as an itemized deduction, but that won't benefit you if don't itemize, which most people don't anymore.

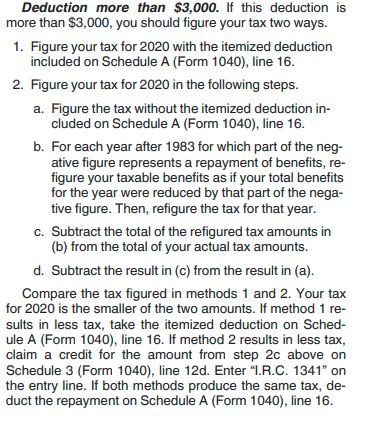

Your other option is to recalculate your tax in the year the UI applies to and enter the benefit on your 2020 tax return as a credit (reduction of tax). Here is an quote from IRS Publication 525 that explains how to do it:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gagan1208

Level 1

xiaochong2dai

Level 2

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

anonymouse1

Level 5

in Education

matto1

Level 2