- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is Form 8582 not being generated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

Every year of my rental property, TurboTax generated Form 8582. This year, I sold the property, but Form 8582 was not generated. A number from Form 8582 is showing up Schedule E line 22, but I need to see the calculations and besides I think the IRS requires this Form 8582 be attached. Where is it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

If you have an overall loss when you combine the income and losses, don’t use the worksheets or Form 8582 for the activity. All losses (including prior year unallowed losses) are allowed in full. Report the income and losses on the forms and schedules normally used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

I did not sell my rental and this form is not being generated?

Also schedule E is not generated and line 22 missing information.

Looking for total losses allowed from 8582 to use on Schedule E

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (PAL) for the current tax year and to report the application of prior year unallowed PALs.

An exception to filing the Form 8582 is if the rental properties are identified as non-passive income. Please review to determine is the responses to the questions are answered as intended.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

Hi All!

I am also having the similar issue.

Situation:

1. Current year, I have losses on Schedule E for both of my property.

2. I added carry over for last year.

Problem:

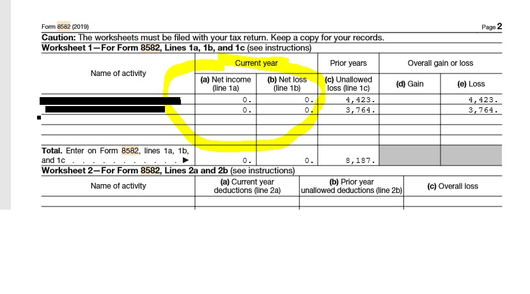

Here is what I see in TurboTax when it generates forms...

Can anyone guide on how to have the CURRENT YEAR losses appear here that are shown in Schedule E? Which question needs to be updated in TurboTax? I am using TurboTax Home&Business 2019 version. Perhaps this is a bug?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

I am having this same issue. My travel and other expenses on my rental property are not pulling into my totals. Do we need to open a 8582 form on our own?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

A passive carryover loss will show on your prior year return. These losses are created from any passive activity found on Schedule E, such as rental income. They will appear on your Schedule E Worksheets - Carryforward, which is a TurboTax worksheet and not an IRS form.

You can also find details regarding passive carryover losses on Form 8582, on page 2, Worksheet 5. If you used TurboTax in the prior tax year, these carryover losses will automatically transfer in. If not, use your tax documents from the prior year to make sure they are entered for the current tax year.

Do you happen to also use the rental for personal purposes, as well?

If the residence is rented for 15 days or more and is used for personal purposes for more than 14 days or 10 percent of the days rented, whichever is greater, allocable rental expenses are allowed only to the extent of rental income. Allocable rental expenses are deducted in three separate steps:

- The interest and taxes are deducted

- Utilities and maintenance expenses are deducted

- Depreciation expense is deducted

For utilities, maintenance, and depreciation expenses to be deductible, there must be positive income following the deduction of items in the preceding steps. In addition, the expenses, other than interest and taxes, are only deductible to the extent of that positive income.

Expenses are allocated between the rental and personal days before the limits are applied. The IRS requires that the allocation be on the basis of the total days of rental use or personal use divided by the total days of use.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Form 8582 not being generated?

I have Forms K-1 from two Public Limited Partnerships. I enter the info into the K-1s port, but the information does not flow to Form 8582 as it should.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17692275922

New Member

katherinehill022

New Member

akrice99

New Member

katiedobbinsmusic

New Member

zhuxi722

New Member