- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why does Turbotax say the standard deduction is zero?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

My wife and I are married filing separately. She is itemizing, so I must also. Each of us, working on separate returns, eventually came to a screen on the Federal section that said "Your itemized deductions of $xxxx are less than the standard deduction of zero dollars." Of course the standard deduction is $12,000, not zero. This matters because for both of us the itemized deductions turned out to be less than $12,000, so we probably will switch to both taking that. But why does Turbotax give us that crazy message?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

If one of you are itemizing you both must itemize otherwise the standard deduction for the person not itemizing is $0.

You both must either itemize or take the standard deduction. If you are both taking the standard deduction be sure to uncheck the box that says "My spouse is itemizing"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

If you file MFS (Married Filing Separately) keep in mind that there are several limitations to MFS. Married filing Jointly is usually the better way to file.

A few of those limitations are: (see IRS Pub 17 for the full list

<a rel="nofollow" target="_blank" href="https://www.irs.gov/pub/irs-pdf/p17.pdf">https://www.irs.gov/pub/irs-pdf/p17.pdf</a> page 21

1. Your tax rate generally is higher than on a joint return.

2. Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return.

3. You cannot take the credit for child and dependent care expenses in most cases, and the amount you can exclude from income under an employer's dependent care assistance you are legally separated or living apart from your spouse, you may be able to file a separate return and still take the credit. For more information about these expenses, the credit, and the exclusion, see chapter 32.

4. You cannot take the earned income credit.

5. You cannot take the exclusion or credit for adoption expenses in most cases.

6. You cannot take the education credits (the American opportunity credit and lifetime learning credit) or the deduction for student loan interest.

7. You cannot exclude any interest income from qualified U.S. savings bonds you used for higher education expenses.

8. If you lived with your spouse at any time during the tax year:

a. You cannot claim the credit for the elderly or the disabled, and

b. You must include in income a greater percentage (up to 85%) of any social security or equivalent railroad retirement benefits you received.

9. The following credits and deductions are reduced at income levels half those for a joint return:

a. The child tax credit,

b. The retirement savings contributions credit,

10. Your capital loss deduction limit is $1,500 (instead of $3,000 on a joint return).

11. If your spouse itemizes deductions, you cannot claim the standard deduction. If you can claim the standard deduction, your basic standard deduction is half the amount allowed on a joint return.

- If you live in a community property state you must allocate community income between both spouses..

-

- Community property states. If you live in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin and file separately, your income may be considered separate income or community income for income tax purposes. See Publication 555. <a rel="nofollow" target="_blank" href="http://www.irs.gov/publications/p555/index.html">http://www.irs.gov/publications/p555/index.html</a>

See this TurboTax article for help with this.

<a rel="nofollow" target="_blank" href="https://ttlc.intuit.com/questions/1894449-married-filing-jointly-vs-married-filing-separately">https...>

<a rel="nofollow" target="_blank" href="https://ttlc.intuit.com/questions/1901162-married-filing-separately-in-community-property-states">ht...>

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

In the Turbotax software, on the page titled Standard Deduction or Itemized Deductions, I received this message (I've substituted a fake dollar figure for privacy's sake):

"Based on what you've told us, your federal itemized deductions of $2550 are your best option because they will save you more money than the standard deduction of zero."

This TurboTax message is confusing. As far as I know, the IRS does not use the expression of a "standard deduction of zero" if your spouse itemizes. Instead the IRS says (in Publication 17, for example) "If your spouse itemizes deductions, you can’t claim the standard deduction." In other words, in this case the standard deduction is NOT "zero" - the standard deduction simply isn't an option.

The TurboTax message would be more clear, and less confusing, if it reflected the IRS language and said something like:

"Based on what you've told us, you must take your federal itemized deductions of $2550. Although the standard deduction would be higher ($12,000), the standard deduction is not available to you because your spouse is itemizing deductions and, therefore, tax regulations require that you also itemize. You and your spouse may wish to calculate your taxes based on both taking the standard deduction, or filing jointly, to see which results in the lowest tax paid."

By the way, in my experience couples should not assume that married filing jointly is usually the best option. Whenever we've compared, we find filing separately results in less tax paid overall. Indeed, IRS Publication 17 says "you should figure your tax both ways (on a joint return and on separate returns). This way you can make sure you are using the filing status that results in the lowest combined tax."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

Thank you for your explanation - Turbo Tax's answer of the Standard Deduction is 0 is definitely confusing!

Question: Where is the check box you mentioned that says "My spouse is itemizing"?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

@cdf121 wrote:

Thank you for your explanation - Turbo Tax's answer of the Standard Deduction is 0 is definitely confusing!

Question: Where is the check box you mentioned that says "My spouse is itemizing"?

Thank you.

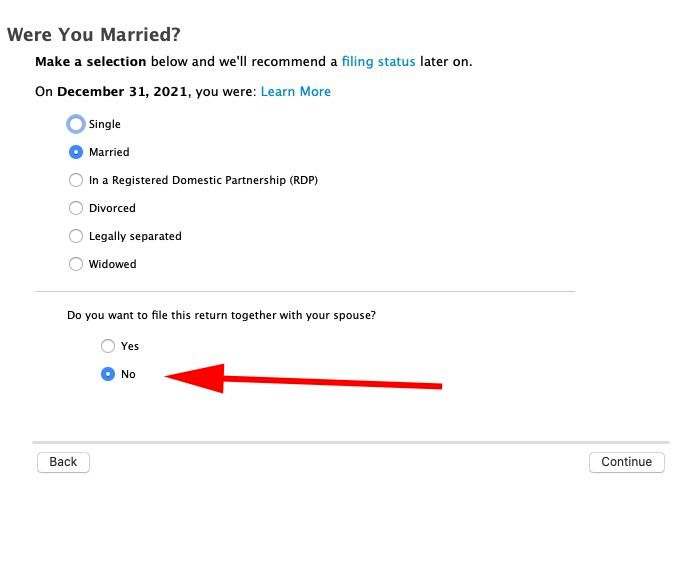

When you enter your personal information then is asks if you are marred, then it askd you you want to file jointly - say no and it will be separate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

Thank you - I did that, but thought there was a check box that said "My spouse is itemizing." When I got to the end of the section Turbo Tax did fill in the correct Standard Deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax say the standard deduction is zero?

@cdf121 wrote:

Thank you - I did that, but thought there was a check box that said "My spouse is itemizing." When I got to the end of the section Turbo Tax did fill in the correct Standard Deduction.

The next screen (after my screenshot) covers that.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rapptim

New Member

user17700787501

New Member

DPTice

New Member

youssef-eddajibi

New Member

user17700666027

New Member