- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

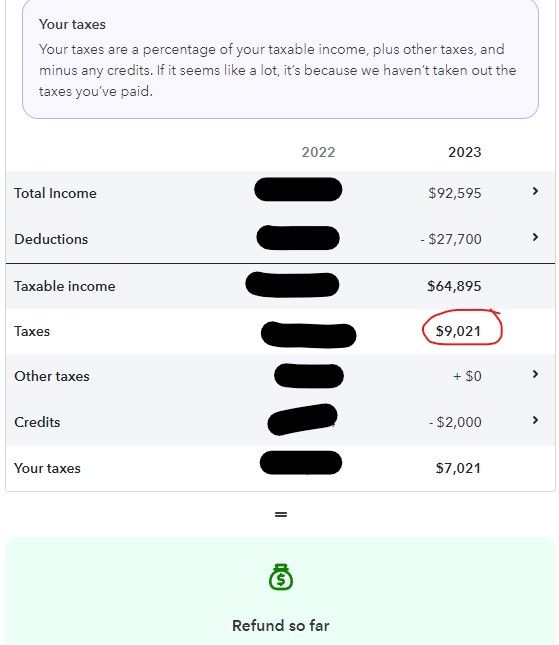

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

TT says

AGI $92,596

Taxable Income: $64,895

But the tax calculated by TT for married filing jointly is: $9021

When I look at the tax tables on IRS 1040, I see $7345

I do not have capital gains or losses.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

Usually it's the other way around, Turbo Tax is lower.

There are like 7 different ways to calculate the tax.

It depends what kind of income you have. Even though the full amount shows up in the total income on the 1040 line 7, if you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from Schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all the worksheets to see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

Thank you for your reply - I tried to edit my question to add more details

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

What line is the $9,021 on? The tax should be on line 16. Then you might have some other taxes on lines 17-23. Like the 10% Early Withdrawal Penalty on IRA & 401k etc. or self employment tax or something else. Check all the lines on your return. Which don't you understand? Do the credits, withholdings and payments look right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

I haven't paid for it yet, so it will not show me the entire 1040 form. I am using the Deluxe online version.

When I click on "Explain my Taxes" at the top, it brings up a section on the right of the screen and here is what it shows:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

Yeah you really need to look at your tax return, not a summary or review screen. You should be able to see enough of your return doing a preview

Before filing you can preview the 1040 or print the whole return

https://ttlc.intuit.com/community/accessing/help/how-do-i-preview-my-turbotax-online-return-before-f...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

No, that is not true. When I follow your linked instructions and go to Print Center and click on Preview, I see

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

You can view your Form 1040 plus Schedules 1, 2 and 3 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

Thank you! I see now that it says

Line 16: $7345

Line 17:

Amount from Schedule 2, line 3: $1676

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the IRS tax table show a lower amount as tax, than what Turbo tax calculated?

The excess doesn't come from the adding of the columns. Instead, it relates to how much of the net premium tax credit exceeds the allowed amount based on your income and family size.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

1099erGirl

Level 3

KaitlinSimone93

New Member

faith4302

New Member

ZayMimiEli3

New Member

CharlesANorris

New Member