in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where to enter Airbnb income and expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter Airbnb income and expenses?

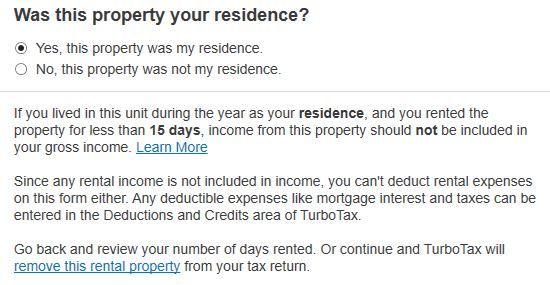

In 2020 I only rented out my Airbnb guest suite for 5 days (out of 365). I tried to enter my info under... Wages & Income > Rental Properties & Royalties > Days rented = 5. That's when Turbo Tax tells me to enter it SOMEWHERE under the "Deductions and Credits" area. Well, I can't figure out which sub-category to enter this info. I have $659 of income and $357 in expenses (supplies, repairs, misc expenses, property tax deduction, insurance deduction) to enter.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter Airbnb income and expenses?

Since you only rented out your guest suite for 5 days you don't have to report the income. Please see NancyG's explanaion: How to report airbnb income - TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter Airbnb income and expenses?

Since you only rented out your guest suite for 5 days you don't have to report the income. Please see NancyG's explanaion: How to report airbnb income - TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter Airbnb income and expenses?

No income taxes. Now that's music to my ears!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

currib

New Member

anil

New Member

bgoodreau01

Returning Member

RE-Semi-pro

New Member