- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where is Form 8283?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

I'm using TurboTax Home and Business 2023 for Mac and there is no Form 8283. There is no mention, flag, or error in app stating the unavailability of Form 8283. There is no mention of Form 8283 in the print cover letter for Alabama Tax Return. Alabama Schedule A Line 16 states "(You must attach Federal Form 8283 if over $500)". The amount on Line 16 is $13,015.00 Therefore I need Form 8283 but TurboTax is not providing it. How do I submit my taxes if Form 8283 is not available? Also Line 18 does not display the correct sum of Lines 15-17. Is this an issue of not having Form 8283?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

To document the resolution, I got with Derek in Customer Service. He had me temporarily modify my Federal return from Standard Deduction to Itemize, then Form 8283 became available for me to print. After printing Form 8283 I switch back to Standard Deduction. I will E-file Federal return but will have to paper file AL state return. Maybe TurboTax programmers will fix this issue for 2024 tax filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

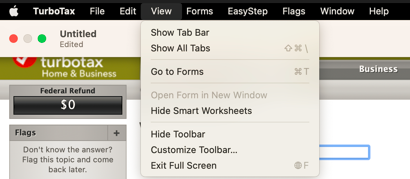

Switch over to Forms mode and open the 8283 for federal. Select View, click Go to Forms.

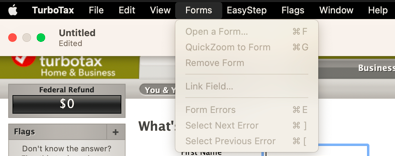

Select Forms, select Open a Form

This menu contains the following options:

- Open a Form

- QuickZoom to Form

- Remove Form

- Link Field

- Form Errors

- Select Next Error

- Select Previous Error

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

Hi AmyC, your reply didn't address my issue. When I print out my return for filing, Form 8283 is not included. AL Schedule A, Line 16 states I must submit Form 8283. But there is not a printable version of Form 8283 in TurboTax that I can find. I need a printable Form 8283 for my records. Also I need to be assured that when I submit my AL taxes electronically that the info contained in Form 8283 is transmitted with everything else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

@kjteitge wrote:

Hi AmyC, your reply didn't address my issue. When I print out my return for filing, Form 8283 is not included. AL Schedule A, Line 16 states I must submit Form 8283. But there is not a printable version of Form 8283 in TurboTax that I can find. I need a printable Form 8283 for my records. Also I need to be assured that when I submit my AL taxes electronically that the info contained in Form 8283 is transmitted with everything else.

Turbotax will only generate a form 8283 if your non-cash donations to charity are more than $500. Likewise, the Alabama instructions says that you must attach a copy of your federal form 8283 if your non-cash donations are more than $500. Non-cash donations are anything that is not money (cash, check, electronic transfer, credit card), such as personal property items like used clothing and household goods, stocks or other investments, and mileage driven to provide service to a charity.

Do you have more than $500 of donations that are not in cash or money?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

Yes donations are stock over $13k, but my total deductions are not over $27700 so Form 8283 is not required for Federal but my AL state return requires it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

@kjteitge wrote:

Yes donations are stock over $13k, but my total deductions are not over $27700 so Form 8283 is not required for Federal but my AL state return requires it.

You may need to contact customer support. If you are using Turbotax installed on your own computer (the desktop version), you can open form 8283 in Forms mode, and it should populate with whatever information is available even if it is not required for your federal return. You could print it, and attach it to your printed Alabama return and file by mail, but I don't know any way to force the Alabama return to attach it if the program doesn't recognize the need for it. And you can't access forms directly in Turbotax online. Customer support may be able to come up with something better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

Thanks for info. When I go to Form Mode I don't see Form 8283 in list available to print. I'll contact Customer Support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

To document the resolution, I got with Derek in Customer Service. He had me temporarily modify my Federal return from Standard Deduction to Itemize, then Form 8283 became available for me to print. After printing Form 8283 I switch back to Standard Deduction. I will E-file Federal return but will have to paper file AL state return. Maybe TurboTax programmers will fix this issue for 2024 tax filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is Form 8283?

FWIW - Intuit did not correct this error for tax year 2024. I live in California and need to file form 8283 with my state return. But there is no logic sequence that makes that form part of the state return if it is not used in the federal return. You have to go into FORM - FEDERAL RETURN, pull up 8283, print it and manually add it to the state return. This makes e-filing the state return not an option.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nystaxpayer12

Level 2

sallydolan60

Level 1

user17537389905

New Member

KevinP1

Level 3

LMadison

Level 1