- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where/How do I enter summary information for Form 8949 Box C and Box F?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How do I enter summary information for Form 8949 Box C and Box F?

For the last several years, I've been able to simply enter summary information for boxes C and F on Form 8949, then attach a statement to be mailed in via Form 8453. Easy.

For 2023, the interface has changed in TurboTax premier, and I cannot seem to find the right click path to generate this functionality. Any ideas?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How do I enter summary information for Form 8949 Box C and Box F?

Bumping for visibility and to report what I ultimately did to solve the issue...

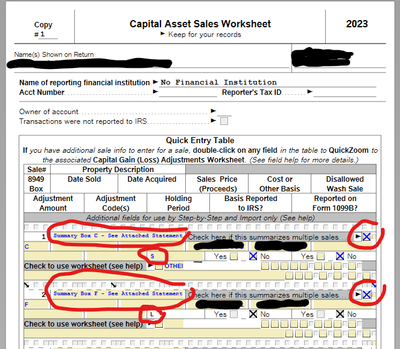

There is a bug in TurboTax's new 1099-B Step-by-step UI that will not ask if you want to enter summary information if you already have detail information elsewhere, even if it is for a different 8949 box (A through F). Under Forms view, I found the Capital Asset Sales Worksheet for my manually entered 1099-B and entered the following (circled). I also had to manually enter things that were automatic last year, such as including "see attached statement." Thankfully, Form 8453 generated correctly after making these changes.

Next year, I plan to do all my summaries for boxes C & F BEFORE I import any data from any financial institutions. This is based on several other related posts found here and elsewhere concerning this issue.

Needless the say, I would rather not have had to spend so much time fighting with the TT user interface to do something that should be very simple.

Don't get me started about "fixing" things that aren't broken, and/or now attempting to force me to categorize asset sales when that data is not reported to the IRS. I would much rather Intuit take the time and fix things that are broken, such as that ridiculously awful UI for entering individual transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How do I enter summary information for Form 8949 Box C and Box F?

Bumping for visibility and to report what I ultimately did to solve the issue...

There is a bug in TurboTax's new 1099-B Step-by-step UI that will not ask if you want to enter summary information if you already have detail information elsewhere, even if it is for a different 8949 box (A through F). Under Forms view, I found the Capital Asset Sales Worksheet for my manually entered 1099-B and entered the following (circled). I also had to manually enter things that were automatic last year, such as including "see attached statement." Thankfully, Form 8453 generated correctly after making these changes.

Next year, I plan to do all my summaries for boxes C & F BEFORE I import any data from any financial institutions. This is based on several other related posts found here and elsewhere concerning this issue.

Needless the say, I would rather not have had to spend so much time fighting with the TT user interface to do something that should be very simple.

Don't get me started about "fixing" things that aren't broken, and/or now attempting to force me to categorize asset sales when that data is not reported to the IRS. I would much rather Intuit take the time and fix things that are broken, such as that ridiculously awful UI for entering individual transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How do I enter summary information for Form 8949 Box C and Box F?

I have a similar issue. I am using Turbotax business (for a complex trust) and need to report a short term gain on Form 8949 Box C (Transaction not on the form 1099-B reported by the brokerage). I searched for the worksheet mentioned in the replies to this but do not find it in Turbotax business. So far I have overriden the entries in one part of an 8949 to report the gain, but of course it creates numerous errors in review. Is there a way to report Box C gain in the step by step without overriding? Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

ramster_2010

New Member

dack18

New Member

CRAM5

Level 2

fpho16

New Member