- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where do I find Nondeductible Expenses from Prior Year for Rental Property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find Nondeductible Expenses from Prior Year for Rental Property?

We have a vacation home that we rent out and use ourselves. In filling out Schedule E, the TurboTax screen (see below) asks for Nondeductible Expenses from Prior Year. I don't remember ever filling out this screen in the past. Yes, we do take a loss every year but I thought TurboTax automatically does the calculations for me. Guess not. Now I'm confused. What do the four entries (Operating Expenses, Depreciation Expenses, AMT Operating Expenses, and AMT Depreciation Expenses) mean? And where would I find the information to add to this screen? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find Nondeductible Expenses from Prior Year for Rental Property?

Please clarify which version of TurboTax you are using - Online or Desktop. Windows or Mac? Deluxe, Premier, Premium, or Home and Business?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find Nondeductible Expenses from Prior Year for Rental Property?

I am using Home and Business (2023), Mac, Desktop.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find Nondeductible Expenses from Prior Year for Rental Property?

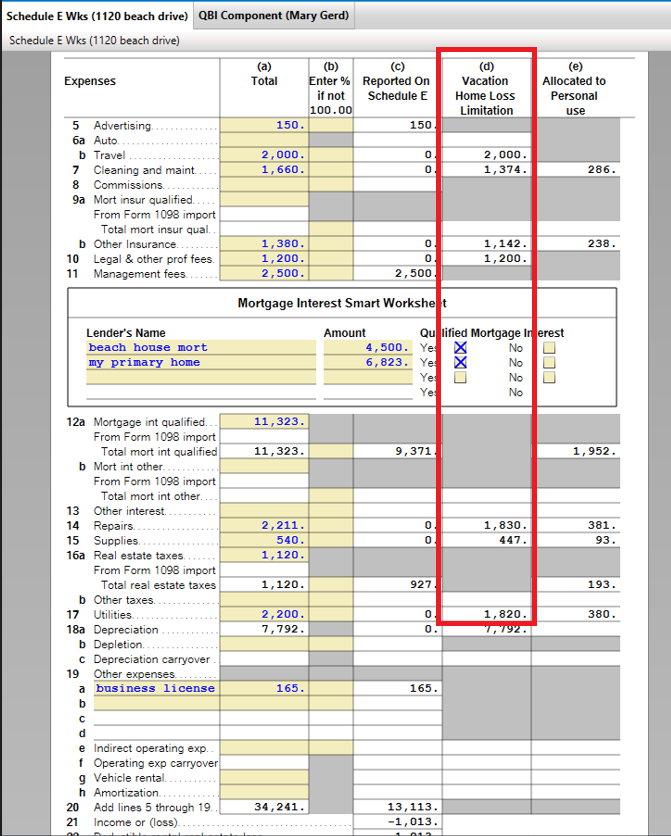

Check your prior year's Schedule E. If you have a property used for both Personal and Rental, your non-deductible expenses will show in a column titled 'Vacation Home Loss Limitation'. This is not a Mac version, but should be similar.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find Nondeductible Expenses from Prior Year for Rental Property?

Thank you for this answer. I am confused...I would have thought that column is the one you can deduct and the one under personal is the nondeductible...? Can you please coment?

Also would you please expand on the pert of prior ques tion that reads:

What do the four entries (Operating Expenses, Depreciation Expenses, AMT Operating Expenses, and AMT Depreciation Expenses) mean? And where would I find the information to add to this screen?

Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find Nondeductible Expenses from Prior Year for Rental Property?

You can look for form 8582 in your prior year's tax returns but it probably isn't there.

Deductions for rental homes are disallowed because you make too much money. That doesn't happen for most of us. If it hasn't ever happened to you then you can ignore this screen. If it has happened for you then you have a form 8582 in your tax return from last year that shows the amount of losses that you are carrying forward and have not been allowed to take over time. The numbers that you are looking for are there.

Operational expenses are the expenses to operate your rental home, depreciation expenses are expenses from depreciating your rental home and AMT is alternative minimum tax - a tax designed to stop high-income earners from avoiding taxes altogether with too many deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jawckey

Level 4

user17523314011

Returning Member

andredreed50

New Member

Jeff-W

Level 1

justine626

Level 1