- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What is this CHECK for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is this CHECK for?

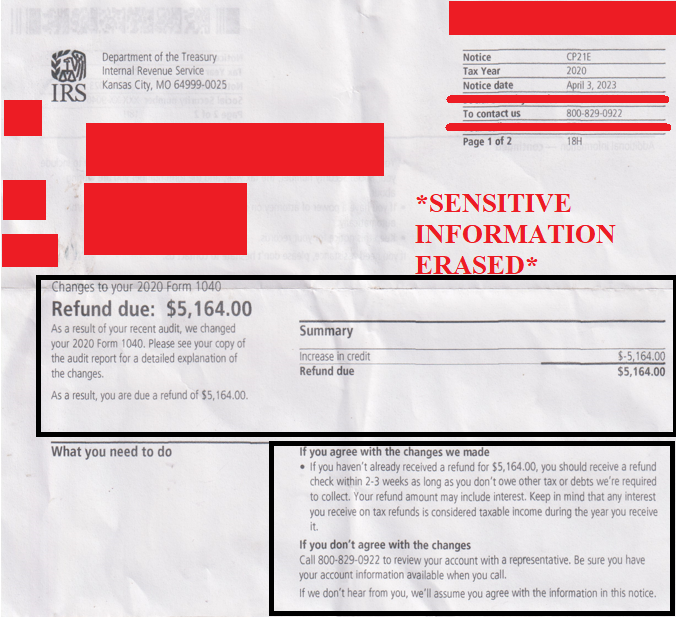

I received this letter along with a check for the above amount today, from what I have researched CP21E means I owe taxes, but if that is the case how do we explain this letter and a check for that amount?

I also been researching a little, and, because of covid, I was on unemployment in 2020, but had a job and got taxes back (Including Child Tax Credits) in 2019, there was a rule called the "Lookback Rule" which they would automatically apply all the credits I received the prior year (2019) for my 2020 return, is that what I'm looking at here?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is this CHECK for?

Yes, in most cases when you receive a CP21E notice, it means that you owe taxes, but not always. This letter is issued when the IRS has audited your tax return and changed it.

In addition to the beginning of the letter that you posted, there should be a section that specifically explains what changes were made. Often this will be on the back of the first page.

Based on what you said about your situation, my best guess would be that you filed your 2020 tax return early before the rules were changed about taxing unemployment. I would need to see the rest of the letter to be certain, but please don't post it here.

If you still have questions about what was changed on your 2020 tax return, please use the Audit Support Center to contact us for a more detailed analysis. Click here for contact information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dept19ffemt

New Member

tomjmu

New Member

Tristin1

New Member

ddranalli

Level 1

bobbypris

New Member