- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What does federal adjusted gross income mean

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does federal adjusted gross income mean

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does federal adjusted gross income mean

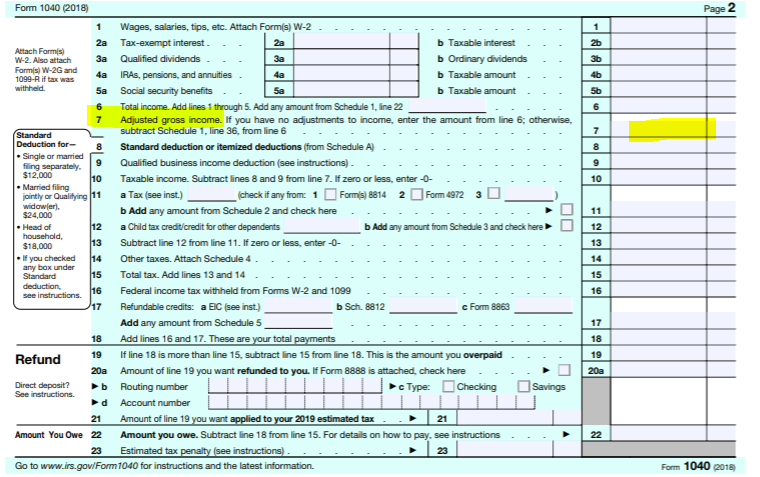

Adjusted gross income (AGI) is your gross income which includes wages, dividends, alimony, capital gains, business income, retirement distributions and other income, minus certain payments you’ve made during the year, such as student loan interest or contributions to a traditional individual retirement account or a health savings account.

You will need your 2018 AGI (Adjusted Gross Income) as the IRS now requires it for security verification. You can find your AGI

If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

If you have a copy of your 2018 tax return, your AGI is located on line 7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

reneesmith1969

New Member

Lukas1994

Level 2

ir63

Level 2

matto1

Level 2

Stephendsmith377

New Member