- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Weird K-1 error in QBI passive loss column for an MLP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird K-1 error in QBI passive loss column for an MLP

Hi all,

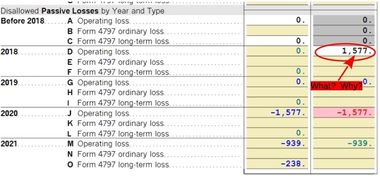

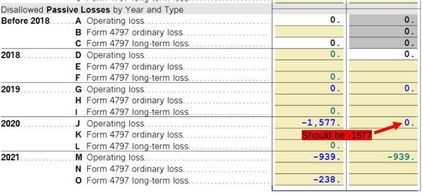

Just putting the finishing touches on my taxes, and I'm getting this strange error. The error check told me that an entry was needed for the QBI passive loss column. For some reason, it wasn't filling it in with the values I had entered. The left column (Regular Tax) was filled in with an operating loss of -1,577 for 2020. (Most midstream MLPs have operating losses most years due to depreciation, despite positive cash flow.) But the right column (QBI) was left blank, and this threw an error. This wasn't a problem in last year's taxes, or 2020's taxes. But it suddenly shows up now.

Yet when I fill in -1,577 manually, which is the correct value, it does the following. 1,577 suddenly appears on the line for 2018. This is obviously wrong, since I didn't even own this before 2019.

Apparently, the only value it will accept is zero. But that's wrong. It should be -1,577, which is the operating loss for 2020, just as -939 was the operating loss for 2021. What's causing this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird K-1 error in QBI passive loss column for an MLP

above that there and just below where the current WBI info is entered is a section that says "Qualified Business Income Carryforward"

then there's a line that says B QBI suspended losses - passive. the total of all QBI carryforwad must be entered in the 2022 column to match the year by year detail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird K-1 error in QBI passive loss column for an MLP

@Mike9241 thanks for your help with all my mlp questions in the past, including the one above. I'm still a little unclear on one point. Your method for entering PTP sales in Turbotax is:

1) Use interview for ordinary gain only

2) Adjusted 1099-B Basis = purchase price - basis adjustment + ordinary gain

Straightforward enough. What about passive activity loss carryforwards, though? Turbotax imports these along with last year's return. However, if the cumulative adjustment to basis shown on the sales schedule includes passive activity losses carried over from prior years, shouldn't I delete them from Turbotax so as to not double count them? Or, alternatively, subtract them from the adjusted basis I sub into the 1099-B?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird K-1 error in QBI passive loss column for an MLP

when you indicate final k-1, total disposition and enter the ordinary income recapture, if any, in the K-1 sales section, Turbotax shouldd allow as a deduction all its passive loss carryovers (each PTP stands on its own so only that PTP's suspended losses will be allowed. in addition, there are probably QBI loss carryforwards that will now flow to the QBI deduction form.

However, if the cumulative adjustment to basis shown on the sales schedule includes passive activity losses carried over from prior years, shouldn't I delete them from Turbotax so as to not double count them? Or, alternatively, subtract them from the adjusted basis I sub into the 1099-B?

no.

consider these examples

example 1

bought for $5000

suspended losses not deducted $3000 (cumulative adjustment to basis)

tax basis now $2000

you sell for $2000

thus no capital gain or loss

wouldn't you now want that $3000 deduction to reflect that you actually paid $5000 and now only have $2000

example 2

bought for $10000

received $2000 in distributions

suspended losses not deducted $7000

cumulative adjustments to basis $9000 (the $2K + the $7k)

tax basis now $1000

sell for $1000

wouldn't you now want that $7000 deduction to reflect you paid $10000 but received only $3000 (sales proceeds and distributions)

example 3

bought for $15000

received $3000 in distributions

suspended losses not deducted $7000

cumulative adjustments to basis $10000 (the $3K + the $7k)

tax basis before ordinary income recapture $5000

ordinary income recapture $1000

tax basis now $6000

sell for $6000

wouldn't you now want that $7000 deduction to reflect you paid $15000 received $9000 (sales proceeds and distributions) and have to report $1000 as ordinary income making the net for the year a $6000 loss

I should add that in the final example that ordinary income recapture is QBI income - report on the qbi line for other income/(loss) its not included in 20Z on the actual k-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird K-1 error in QBI passive loss column for an MLP

@Mike9241 Ah, that clarifies it. Thank you. So the adjustments as reported on the sales schedule don’t, in fact, include credit for the suspended losses. That's what I didn't know.

And entering the ordinary income recapture into the 20AB interview box in Turbotax causes it to be carried to Form 4797 and taxed as ordinary income, so I don’t need to enter this amount anywhere else, correct? So after that I just change the partnership basis on the 1099B "not reported" section to:

1099B basis = purchase price - cumulative adj. to basis + 751 ordinary gain recapture

Will keep this thread for future reference!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird K-1 error in QBI passive loss column for an MLP

"Ah, that clarifies it. Thank you. So the adjustments as reported on the sales schedule don’t, in fact, include credit for the suspended losses. That's what I didn't know."

No that's not correct. cumulative adjustments to basis include profit, loss and distributions.

Your tax basis for determining taxable gain is reduced for those losses on your k-1, but you have gotten no tax benefit out of them. until you deduct them which isn't allowed until either there are either profits or you dispose of the partnership.

And entering the ordinary income recapture into the 20AB interview box in Turbotax causes it to be carried to Form 4797 and taxed as ordinary income, so I don’t need to enter this amount anywhere else, correct? CORRECT. So after that I just change the partnership basis on the 1099B "not reported" section to:

1099B basis = purchase price - cumulative adj. to basis + 751 ordinary gain recapture CORRECT

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

statusquo

Level 3

ScottAHermann

Level 1

K1questions

New Member

vamsikvg

New Member

abarmot

Level 1