- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Virginia Form VA760CG - Substraction for US Savings Bond Interest Wrong???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Form VA760CG - Substraction for US Savings Bond Interest Wrong???

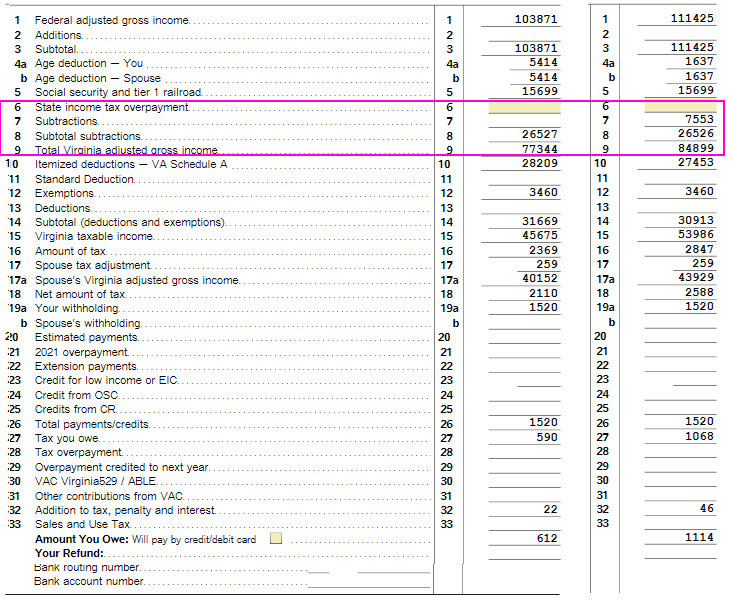

When I add $7553 interest of US Saving Bond interest I do not believe the program is adding the numbers right

I am attaching the columns from the form before and after adding in the Savings Bond interest

Virginia is suppose to be exempt from US Saving Bond interest yet Because my Federal Adjusted Income when up (because of the saving bond interest) my Virginia AGE deduction went down $7554 so even with line 7 being the subtraction of the $7553 my total Virginia adjusted gross income when up $7554 which means I am paying taxes on the US Saving Bonds.

Seems like these numbers are being added or reported to me. If interest on US Bonds isn't being taxes then why does my amt go up. It is costing me $500 in taxes at the bottom line????

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia Form VA760CG - Substraction for US Savings Bond Interest Wrong???

BobVal,

The issue is that your Federal AGI went up and the Age Deductions go down dollar for dollar at that level. So the result is that the amount added by the Savings Bond interest was offset by the same amount (to within $1) by the Age Deduction. (VA has a calculator at

https://www.individual.tax.virginia.gov/tools/#/calculators/ageDeduction

you can use to check this.)

Yes, it s**ks. Nothing you can do about it for 2022, but do contact your state legislature about getting this changed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tah0476

Returning Member

danielkbalzer

Level 1

raj2008agrawal

New Member

TomInVA

Level 2

TomInVA

Level 2